What lies ahead for Bitcoin in the future? Is there a sustainable future for it in the crypto market, and what can we anticipate in terms of its value, not only for 2023 or 2024 but beyond? Certainly, traders in cryptocurrency investments and digital asset holders are consistently seeking insights into investment advice.

Just recently, we discussed the present state of blockchain technology. Today, we aim to delve deeply into Bitcoin price prediction, the heavyweight of the financial crypto landscape. Many are still engaged in conjecture regarding the destiny of this cryptocurrency, which has caused ripples in the world of Fiat financial markets controlled by the US Dollar and central banks.

- 1. Today’s Bitcoin Price (USD)

- 2. Bitcoin Price Prediction for 10 Years

- 3. 10 Experts on the Future of Bitcoin

- 4. Bitcoin Future Price

- 5. Other BTC price predictions

- 6. Bitcoin is the future, are you investing?

- 7. Bitcoin Prognosis – 2023 Analysis and Relative Strength Index (RSI)

- 8. Final Thoughts and Disclaimer

- 9. FAQs

For absolute beginners, we recommend reading our article “What is Bitcoin” before you dig deeper into today’s subject. First, let’s start with the price of BTC today and the latest cryptocurrency news around this virtual currency. Then we can move on to what we can learn from these for the Bitcoin price prediction.

Today’s Bitcoin Price (USD)

Bitcoin price prediction always starts with a current look at Today’s price in US Dollars. This BTC price chart provides the current value and trading volume of the world’s leading cryptocurrency in real time.

By the way, Cryptocompare provides real-time, accurate technical indicators, and unbiased technical analysis about BTC and other cryptocurrencies. You should always do your own research, check the fundamentals of new projects, and evaluate the safest exchanges to trade by using their proprietary Trust Score algorithm.

As we can see, the Bitcoin price chart is still a bit volatile in 2023. There is no real price action and the bear market seems far. The financial market for cryptocurrencies works a bit differently than any other. It’s September, and the end of the year is close. Before we look into the crypto winter, let’s look back!

The Cold September, October, November, and December for Cryptocurrencies

The price chart shows us continuous growth of over $10,300, and in 2021, the price attained the highest peak of $67,500 per coin. In 2022 and until March, we first had a more or less stable market. Finally, in November 2022 we saw the bottom of a mini-crash. Inflation and rising interest rates put pressure on all markets. Multiple threats of further regulation contributed to Bitcoin’s collapse. FTX went bust and Celsius Network froze withdrawals.

The downward slide stopped at $16,441. Still, we don’t know where the Federal Reserve and monetary policy are taking us. The price rally pushed the BTC back to $30,466. But since this summer, investors have been waiting for good news. As long as interest rates continue to rise and no new positive news arrives, we will have to be patient for a moving average price of Bitcoin.

Enough talking about the history and current situation. Now, more important, let’s have a look at the Wheel of Fortune! What will happen to Bitcoin in 2024? What price will we see in 2030? We have asked 14 experts to give us their Bitcoin price predictions.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWBitcoin Price Prediction for 10 Years

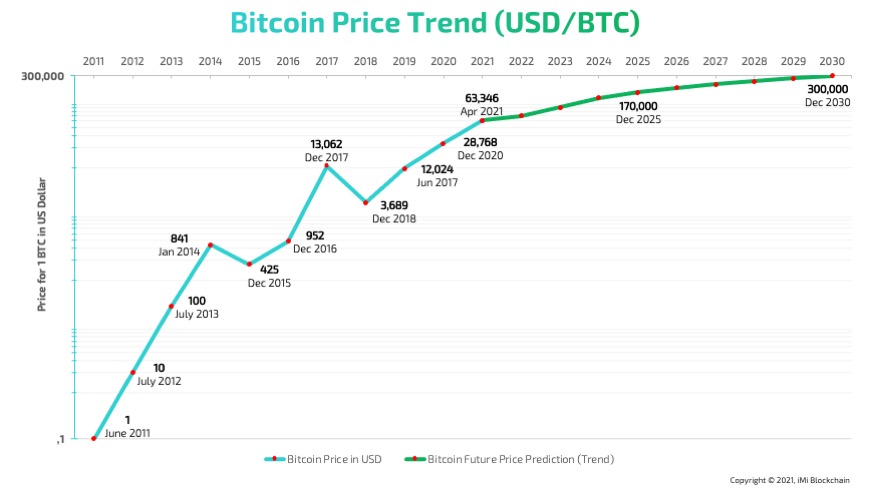

Analyzing the Bitcoin price prediction on the wheel of fortune is tough. However, there is a slight tendency among crypto experts to predict a positive growth trend. The main reason why BTC on the Wheel of Fortune looks great is based on the following fact:

THE MARKET CAP OF $512B SHOWS THE DOMINANCE AND THE CONSUMERS TRUST IN BTC AND OTHER CRYPTOCURRENCIES!

The main reason behind the development of the blockchain was to help humans regain financial freedom, privacy, and security. With that said: The human race will never allow cryptocurrencies to disappear again based on the exposure to their capability in recent years in making many people billionaires.

Share this Image on Your Site:

Man strives for freedom. If a system tries to exclude or discriminate against certain people, then people always create ways around such systems. That’s why new technologies like Blockchain make it easy for us. But now, let’s hear what experts saying about their Bitcoin price predictions as it relates to its price and projected valuations.

10 Experts on the Future of Bitcoin

Given that BTC is the most popular cryptocurrency, it is advisable to learn a thing or two about it. It was created in 2009 by a man who goes by the identity of Satoshi Nakamoto. Unlike fiat currency like the United States Dollar, there is no assigned value behind the cryptocurrency. Transactions can be done instantly and without any intermediary. Before reading our reliable price prediction, you should get some BTC first.

Getting cryptos can be done in many ways. You can either purchase it from trusted cryptocurrency exchanges, or you can mine it directly. The latter is very expensive to do, but you can subscribe to cloud mining providers if you so wish.

Have you acquired BTC yourself, then you can follow our top 10 crypto industry experts and their Bitcoin price predictions for 2023 to 2030.

Bitcoin Price Prediction 2023

According to Marshall Beard, CSO at Gemini, BTC/USD will reach $100,000 by 2023. The respected expert is the chief strategy officer at Gemini, a huge crypto exchange platform.

Tethers’ chief technology officer, Paolo Ardoino, is also positive about the future of Bitcoin. The crypto giant projects $69,000 for BTC by the end of 2023.

Daria Morgen, an analyst blogger at Changelly says the Bitcoin price prediction is stable. They see the highest level by the end of 2023 at $32,268.

Bitcoin Price Prediction 2024

Philip Swift believes that Bitcoin’s price will be between $92,000 and $137,000 in October 2024. However, he argues that given that it’s an early asset, there’s a higher number of risks that make it hard to predict. He says that if the previous cycles continue to play out in the future, this is the exact period when BTC/USD will hit that level.

According to our own analysis of prices in previous years, we assume that in 2024, the price average might be $48,800.

Bitcoin Price Prediction 2030

Ben Ritchie is the managing director of Digital Capital Management. His short-term Bitcoin price prediction is set at $48,000 and a future potential of $350,000.

Yves Renno also predicted that the value of BTC will reach $40,000 by 2030. He is head of trading at Wirex.

According to the renowned Crypto Research Report, the price of one is on track to hit $397,000 by 2030. At this valuation, it will arguably be one of the most valuable assets in the world.

John Pfeffer is a partner at Pfeffer Capital. He always backs up his predictions with mathematics. John’s statement was straightforward: “It becomes the dominant non-sovereign store of value. The new gold or new reserve currency.” At its peak, John believes it will surge to $700,000 per coin by the year 2030.

Cameron and Tyler Winklevoss are the twin stars in the cryptocurrency market. As one of the earliest Bitcoin investors, together, they have gained more than $1 billion in net wealth by BTC. Both twins who are the founders of the Gemini cryptocurrency exchange believe it will break the $500 price mark in no time.

Bitcoin Future Price

Furthermore, we have also asked our market experts to give us their bitcoin price predictions. On top of that, they will answer some of the hottest questions related to the BTC price in the long term.

Does BTC have a future at all? Bitcoin stock forecast

Citi Group noted that institutional investors driving more interest in crypto. The acceptance is increasing and is about to be used by the mainstream.

David Schwartz, CTO of Ripple mentioned that such extensive media coverage will bring an explosion of low-cost and high-speed payment systems. This will transform value exchange just the same way the Internet transformed information technology.

We should be aware that BTC is the very first but not the only network, said Marcel Isler, CEO of iMi Blockchain. Hence, we see increased demand for newer and better solutions to exchange assets. It has a great brand value and helps to push other cryptocurrencies and new network solutions to mainstream applications.

How high can Bitcoin go? BTC Value in 10 years

What will BTC be worth in 2030? We have asked more experts to give us their honest predictions. Is there a limit to growth? Let’s have a look.

Chamath Palihapitiya, co-owner of Golden State Warriors has predicted that the price will reach $1 million. If not in 2030 then 2037 latest. Like many other experts, Chamath mentioned that it has the potential to compare with the value of gold.

The founder and CEO of Xapo, Wences Casares, also believes that this crypto could hit one million dollars in the next 5 to 10 years.

What will Bitcoin be worth in 20 years? Crypto price prediction

What will Bitcoin be worth in 2040? That answer on Bitcoin price prediction might be impossible to answer. Still, we hear from crypto evangelists that the price is only one factor. Another important factor will be its market size. Therefore, let’s see what experts predict for its market cap in 20 years.

Andy Edstrom, wealth manager at WESCAP, made a prediction in February 2020 that it would reach an $8 trillion market cap. Edstrom believes it will become the global default currency.

Standpoint researcher Ronnie Moas projects a lower value in market capitalization. Ronnie believes that the market cap of all cryptocurrencies will reach $2 trillion within the next 10 to 20 years.

Unlock the Secrets of Crypto Trading

Join our Live Online Course today!

Live, interactive online sessions – 1-on-1 sessions from a seasoned crypto trading expert.

Personalized coaching – from a certified crypto expert.

Learning Material – comprehensive learning from basics to advanced strategy.

Flexible Scheduling – to fit your busy life.

ENROLL IN THE BEST CRYPTO TRADING COURSEWill the Bitcoin Token ever disappear?

BTC will never disappear! The network is here and as long as miners use it, Bitcoin cannot disappear. If all miners would stop using the network, then Bitcoin could disappear. In all likelihood, however, this will never happen. Miners have invested billions of dollars in infrastructure.

Marcel Isler explained it to us in very simple terms:

While the network will not disappear its value could always be zero. Even the US dollar can crash and become worthless. The value of any currency is linked to belief.

Other BTC price predictions

As we have heard, the estimated Bitcoin price prediction in 2030 and beyond will be high. Very high in fact. Now, we would like to take the opportunity to share our thoughts. So what will happen to Bitcoin in 2030? What the future of BTC and other cryptocurrencies will look like amid constant fluctuations?

One thing is for sure! Crypto technology will define our life in the future. We will be able to earn, save, spend, and engage in crypto trading as we like. Easy and simple. New application developments are already being implemented.

ING Bank says Bitcoin interest to double

UBS, the leading Swiss investment bank replaces Sergio Ermotti with Ralph Hamers as their new CEO. Ralph is well known as the former CEO of the Dutch ING bank. But Ralph is even better known as THE digital banker. Seems like the rather dusty Board of Directors at UBS has finally noticed in which direction blockchain technology is moving us. Lower costs and clients’ freedom to use BTC instead of over-regulated FIAT currencies leave traces everywhere.

Goldman Sachs is expecting huge institutional demand

Additionally, multinational banks including Goldman Sachs & Co, and Morgan Stanley to mention a few are also joining the ecosystem. They are notably seeking avenues to offer BTC and cryptocurrency services to their clients.

Also because institutional investors growing continuously, our prediction at iMi Blockchain of Bitcoin price prediction in 2030 is quite clear:

IT IS THE GAME CHANGER! YOU CAN TALK CRYPTOCURRENCIES DOWN AS YOU WANT. BUT THE FUTURE IS CRYPTO-LOGIC. BTC IS MORE LIKELY THE NEW GOLD THAN ANY OTHER RESOURCE ON THIS PLANET.

Bitcoin is the future, are you investing?

A lot has been said about Bitcoin price prediction in this article, but do other cryptocurrencies also have a future?

Generally, all cryptocurrencies rely heavily on the giant. If we look into price charts of Altcoins, such as Litecoin, Ether, or EOS, then we see similar price developments. If BTC goes up, the others go up too. If the giant drops, so do the others. However, some altcoins occasionally break away from this dominance effect.

The altcoin market is now very diversified with several tokens being launched every other week. There are about 7,000 cryptocurrencies today, and while many will fade out, those with good use cases will survive.

These use cases vary based on the market each token is designed to revolutionize.

In general, the future of cryptocurrencies is bright.

Bitcoin Prognosis – 2023 Analysis and Relative Strength Index (RSI)

Bitcoin prognosis is omnipresent, fueled by a dynamic revolution that has just started. Hence, the revolutionary strides to lead the numerous digital currencies (altcoins) in a bid to usher in a new financial ecosystem always generate a lot of newsworthy activities.

The current push into the mainstream adoption cycle has not been unnoticed by mainstream media such as Forbes, and Bloomberg, and social media platforms like Twitter and Reddit among others.

As we have in the forex market a positive RSI, and like any other digital coin including Ethereum, Ripple has grown in utility globally and is now broadly exchanged or used to buy goods and services. The ticker symbol BTC, as well as its logo, is now found everywhere, in all news updates around the globe.

Let us review the latest Bitcoin price predictions in 2023, to see where the crypto giant is moving to:

Top 3 Factors Influencing Bitcoin Price

On May 17th, Gary Gensler was sworn in as the Chairman of the United States Securities and Exchange Commission (SEC). While Gensler will oversee the broader market, his ascension will affect the future of Bitcoin and cryptocurrencies, in general.

Gensler will lead the market regulator for 4 years until 2026. The cryptocurrency ecosystem is happy about Gensler coming into the scene. Many now look up to him to provide the right regulations to help crypto innovations thrive.

1. Bitcoin ETF: As the BTC price continued to soar, the asset became more attractive as a safeguard against inflation, and many wanted to gain exposure to the coin. As US laws are still unclear, many investors are pressing the SEC to approve its first Bitcoin ETF application. Currently, there are more than 9 ETF applications filed with the US SEC to date.

On the global scene, other countries including Canada, and Switzerland have already approved their first BTC ETF products. This reality is responsible for stirring the demand for similar approval from the American regulator.

2. Institutional Investors: Institutional or corporate investors are now taking more interest than before. While 2020 marked the point of entry into crypto for these classes of investors, a new standard was set in 2022.

Tesla has invested $1.5 billion in Bitcoin, and other firms including Chinese tech firm Meitu, and payment giant Square are also buying up. Today, more investors are rushing to buy crypto through hedge funds such as Grayscale. In all, the Coinbase exchange went public and began trading on the stock market, a move that is poised to draw in more institutional investors.

3. A New ATH Was Set: A feather to all the major positive news about Bitcoin price prediction is its growth in price. The cryptocurrency has recorded a new all-time high (ATH) price record above $64,000. All the accumulated interest and investor buyup of the cryptocurrency helped it attain this milestone.

Final Thoughts and Disclaimer

What are your thoughts about the future of BTC and your Bitcoin price prediction? Where do you see the future price of BTC? Do you doubt that cryptocurrency is the future? Or do you agree with our expert predictions? Let us know what you believe and please leave a comment below. We love to hear from you!

Finally, if you’re in need of expert crypto consulting, don’t hesitate to contact us. We’re offering comprehensive cryptocurrency training, and cryptocurrency webinars as well.

Learn Crypto!

Crypto Training in small Classes

Webinars about Crypto and Coding

Crypto Courses at University Level

Get free Crypto

News!

Get monthly news on Bitcoin and Altcoins.

On top, you’ll get our free blockchain beginners course right away to learn how this technology will change our lives.

FAQs

What will happen to Bitcoin in the future?

Bitcoin may become the new Gold. As most experts agree, the market capitalization of Bitcoin and other cryptocurrencies goes beyond old-fashioned investment options.

Why is Bitcoin the future of money?

Bitcoin like other cryptocurrencies is giving you the freedom of how you hold and send your assets. No bank account is needed anymore. Meaning, everyone all over the world can own a crypto account. Limitless freedom.

Is Bitcoin safe and legal?

Bitcoin is legal but never safe. As with any other currency, the value of Bitcoin is volatile. Actually, very volatile.

Can I trust Bitcoin Reddit Predictions?

According to a majority of Reddit users, Bitcoin will have a bright future. Most comments on Reddit shows, that consumers do trust cryptocurrencies more than any bank. But the Reddit community usually lacks expertise. Most users simply try to push what they have invested in.

How to read and predict Bitcoin price movements?

Use technical analytics with candlestick patterns to identify Bitcoins’ trend.

What influences the price of Bitcoin?

Even though Bitcoin is not a fiat currency, the same rules apply to all cryptocurrencies for investors: 1. The market demand; 2. Availability and supply; 3. Investor sentiment

Will the price of Bitcoin increase or decrease in the near future?

Our actual Bitcoin price forecast indicates a price increase between 5 to 8% and reach $33,000 by December 2023.