iMi Blockchain Experts

Comprehensive Blockchain Services

Join iMi, the Swiss experts in blockchain process architecture and digital transformation. We provide customer-savvy consultancy for businesses, practical training for everyone, and on top, we code your blocks.

Talk to the Experts01 INTRODUCTION

SAY HELLO TO BLOCKCHAIN TECHNOLOGY!

And say goodbye to insecure and expensive cloud computing. We provide the best blockchain and cryptocurrency services worldwide.

YOUR ORGANIZATION DESERVES THE BEST BLOCKCHAIN TECHNOLOGY SERVICES.

iMi makes sure you get it!

Watch this video to see how our blockchain experts use our secret recipe to provide streamlined enterprise blockchain technology services for all our clients.

We enter the room with an open mind and work WITH you to provide the blockchain services that are a perfect fit for YOUR organization.

Our blockchain consultants will ensure a frictionless implementation and deployment of distributed ledger technology at your organization, we leverage carefully integrated solutions from various parts of the ecosystem.

Blockchain at work

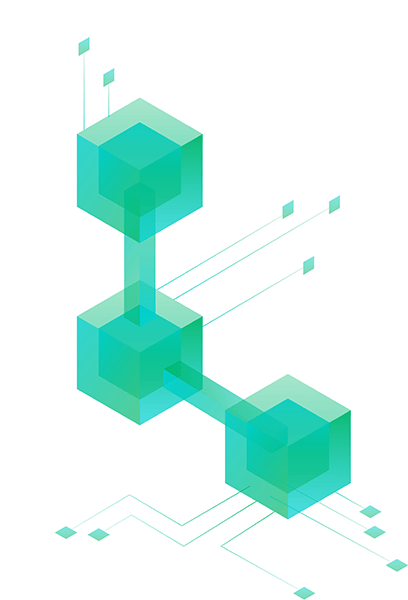

These blocks are linked together with the help of some cryptography magic, and data can be stored in real-time on these blocks. The best use of this data in today’s world has been in transactional data- where all processes are executed in the form of transactions. This explains why the finance and fintech sector is the most influenced by distributed ledger technology – because anything involving money has an inherent transactional nature attached to it.

Blocks in a Chain

Multiple participants (nodes) can be invited to a peer-to-peer network. Similar to the Bitcoin network. Each node will get a copy of our DLT database or blockchain-based application. As we put unlimited blocks (the previous block with pieces of information) in a chain, each participant can see the transferred data points. Therefore, transparency is granted, without the need for every node to see the details of a single data point.

Hence, it’s a myth that distributed ledger technology is only used for digital assets, digital currency, or money laundering, and other criminal activities. Much more it’s a much safer technology to protect intellectual property or sensitive data, f.e. in the financial services industry, from credit cards while sending over the internet.

02 Basics

BLOCKCHAIN – CATALYST FOR INDUSTRY REVOLUTION 4.0

Blockchain solutions – touted as a prime catalyst for the next industrial revolution, is phenomenal.

A good POC (Proof of Concept) and a scalable solution are all you need to leverage this technology and drive growth for your organization.

If you’ve heard the term block chain somewhere in an article, or from your friends, and cannot for the life of you figure out what this means, well, then you can learn about blockchain and implement it in your business processes right here! Read on and find out what this wondrous tech is all about.

Blockchain explained

Simply speaking, it is a ledger that is transparent and controlled by a decentralized network. Each node holds a private key. So for instance, a set of data released by a centralized organization can be tampered with as per convenience. With this distributed ledger technology at work, this won’t be the case.

Why Blockchain?

Because it embodies one very important function – decentralization. Blockchain applications do allow individuals or entities to make transactions without the middleman, for example, the bank. First introduced by Satoshi Nakamoto in 2008, Bitcoin disrupted the financial institutions, while Ethereum did the same with lawyers and notaries. This solution offers complete security, anonymity, and verifications of transactions, in addition to the basic features that centralized transaction networks offer.

This technology is still emerging. All of its use cases haven’t been established as commercial solutions to problems, but businesses and firms have already started harnessing its power.

iMi is here to help you! Reach out to us and

Learn more on our Blog03 Technology

DISTRIBUTED LEDGER TECHNOLOGY IN DETAIL

Distributed ledgers have existed for as long as transactions have existed in the world, which probably spans thousands of years. Ledgers were traditionally kept in paper form, and as the world moved towards scientifically advanced solutions, computerized ledgers took over. Although, computerized ledgers work in the same way paper ledgers do. So, where’s the benefit?

DLT in a Nutshell

Faster, safer, and more secure data transactions through DLT. What’s more, is that scalability gives it a significant boost. You can spread your data throughout the globe quickly. The decentralized distribution of your data is what makes it safe. Thanks to DLT!

With the advent of cryptography, the need for the central authority to verify what’s written in the ledgers has disappeared. The distributed ledger technology stores transactions and their information in multiple places at the same time.

No central authority

There is no central data store for DLTs, hence the name distributed. Blockchains are one of the most popular forms of distributed ledger technology, utilizing cryptography and advanced algorithms to store process, and validate transactions over a network, without the use of a central authority.

Revolutionary

Don’t worry if you feel intimidated by diving into the new technology such as distributed ledger technology. At iMi, we are ready to help you with whatever business needs you want to fulfill using the power of this technology. How do we do it? We harness the six main features:

Distributed

All network participants have a copy of the ledger, for full transparency and trust.

Anonymous

Participants can choose between pseudonymous or anonymous identity. Flexibility is guaranteed.

Stamped

For reliable tracking and tracing of records, a timestamp is registered with each block in the network.

Validated

All network participants agree to the validity of each record. Fraud is almost excluded.

Immutable

Validated records are irreversible and cannot be changed. Any attempted change would lead to a security alert!

Secure

Finally, all records are individually encrypted and 100% secure. It is very safe and reliable.

04 Expertise

EXPERTS IN DISTRIBUTED LEDGER TECHNOLOGY

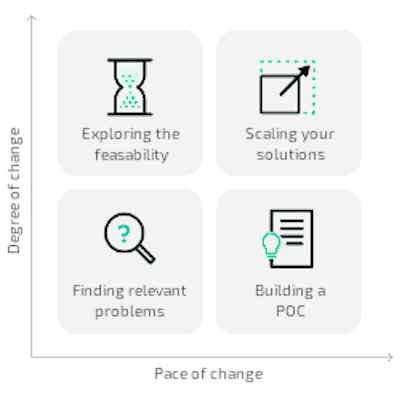

Finding a good product-market fit and impressive use cases will help your IT strategy to the runway.

But, our expert blockchain consulting and insights will help you to truly take off!

No matter where your organization’s DLT strategy is right now, iMi will join you and start making an impact from the word go!

Years of experience and our industry-leading expertise with DLTs will help you navigate quickly to a successful implementation of the blockchain network.

Talk with a DLT Expert Today

05 DLT Cases

BITCOIN BLOCKCHAIN AND OTHER USES

WHAT ARE THE MOST POWERFUL BLOCKCHAIN USES OTHERS THAN BITCOIN? WHY DO WE NEED DISTRIBUTED LEDGER TECHNOLOGY? WHERE CAN BLOCKS HELP US TO OVERPERFORM?

In particular, a distributed ledger is a database. Once the data is set in a block, it is consensually shared and synchronized across a network. Likewise on multiple sites, institutions, or geographies. Each transaction got public witnesses. Hence, a distributed ledger is difficult to hack. Nodes (network participants) can access the recordings. Therefore, each node can own an identical copy. Furthermore, only the owner can make changes. Any change is immediately copied to all participants. The most noteworthy applications of today are:

Finance

We have already revolutionized the financial sector. Above all, a Cryptocurrency like Bitcoin is traded peer-to-peer, held in your own crypto wallet, without the need of a bank (intermediary). Similarly to the Bitcoin, the Ethereum Network is the global platform for decentralized applications. This allows the financial industry to optimize processes. Sharing data efficiently and securely.

Contracts

Every type of contract can be executed or enforced without human interaction. No need for a notary due to automated escrow. Furthermore, Tokens and Initial Coin Offering (ICO) helps businesses going public to lower costs. Smart Contracts do replace lawyers.

Track & Trace

Business-class tracking is used for supply chain and logistics. Finally, we create permanent, public, and transparent ledger systems for proof of existence or proof of authenticity. Hence, Sales, Marketing & HR organizations become more effective.

06 intelligence

SMART BLOCKCHAINS

What is Artificial Intelligence (AI) and how can this technology be applied when it comes to DLT implementation? First of all, AI is the simulation of human intelligence that a computer system can process. Imagine a robot, acquiring information, and learning from it. Al system runs fully automated. Waymo, Google’s self-driving car, and Apple’s SIRI are only two examples of artificial intelligence (AI) applications. Google’s search algorithm or IBM’s Watson to autonomous weapons shows that this technology is improving very fast

Furthermore, scientists are already developing so-called Strong AI, better known as Artificial General Intelligence (AGI) a system with generalized human cognitive abilities.

Let's Implement Blockchain TogetherIf there is an unfamiliar task, a strong AGI system will find a solution itself. Hence, we can say that artificial intelligence systems will outperform a human being soon and nearly at every cognitive task you can imagine.

Now we know the effectiveness of AI. So how can this technology be applied together with block chain applications? By combining them we upgrade everything! Data collection, analysis, and distribution become fully automated. Just imagine the impact on food manufacturing, supply chain, and food logistics. Even more for healthcare record sharing or media royalties.

07 premium services

IMI BLOCKCHAIN EXPERT SERVICES

Are you looking for the services of blockchain experts you can put your trust in? We create blocks and put them on the chain for you. Certainly, we make the implementation of distributed ledger technology fast, secure, and reliable and our expertise is extremely comprehensive. In particular,

WE ARE EXPERTS IN THE TECHNOLOGY SECTOR, BUT ABOVE ALL, WE ENSURE CLIENT CENTRIC CONSULTING & SUPPORT. OUR CONSULTANTS HAVE IN-DEPTH KNOWLEDGE OF YOUR INDUSTRY.

From Financial Sectors, Healthcare, the Public Sector, Governments, Charities & NGOs, Real Estate, Industrial Businesses, and all the way down to Supply Chain & Logistics. Allocated and dedicated teams are built around your industry needs.

Our blockchain programming experts have top-notch experience in distributed ledger technologies, smart contracts, as well as for cryptocurrencies.

Contact the iMi Blockchain Experts

KEY FACTORS FOR SUCCESSFUL

BLOCKCHAIN & CRYPTO SERVICES

The key factors for the successful implementation of DLT, Blockchain, or Crypto services, are manyfold. As usual, the main key is a great team. You need a strong team that can cover all areas professionally. Then, you’ll need an industry-leading advisor. Ongoing learning on the job is crucial. Finally, you need top-notch experts when it comes to coding. Thus we summarize:

The 3 Pillars for Your Success

Consulting

We are customer-savvy Blockchain Process Architects, building practicable business solutions.

We AdviceLearning

We are the Bridge between our clients and technologists, transferring know-how that is simply understandable.

You LearnCoding

Ultimately, we code to enhance clients’ IT security, improve traceability, increase efficiency and reduce costs.

We Code08 learning

BLOCKCHAIN INFO – ALL YOU NEED TO KNOW

For the latest blogs and information, you came to the right place too. Our blog is full of interesting articles about cryptocurrencies, bitcoin news, proof-of-work, and future block chain trends.

Blockchain Info Explorer

For the latest bitcoin info, you can rely on our latest posts below. We inform you about transaction status, compare and review block chain wallets, and finally, you can download the latest app and the best wallet directly from our website.

Blockchain Wikipedia

To inform you about this revolutionary technology, you can always check our Wikipedia page. There you can review our blockchain development services as well as our cryptographic codes. Wikipedia is for us a great place to share our knowledge with everyone.

Furthermore, you should explore our online courses. In collaboration with leading universities worldwide, we have put together ultimate training sessions. Learn from the best within our community.

Blockchain Wiki How

From Princeton University professors, MIT lecturers, as well as from Oxford and the ETH in Zurich, we’ve collected the best educational programs. We offer training about block chain basics. Are you ready to become a Crypto pro? We provide feature-rich webinars for beginners and advanced nerds. Furthermore, our wiki how will teach you how to develop distributed ledger technology, smart contracts, or ICOs. Finally,

YOU CAN LEARN BITCOIN TRADING, CODING, PROGRAMMING, AND IMPLEMENTATION. GET READY FOR THE FUTURE! IT HAS JUST BEGAN.

LEARNING CRYPTO FOR BUSINESSES &

INDIVIDUALS

Aside from providing blockchain services, we love to help others learn blockchain in a variety of ways. We can get your team members on a live blockchain webinar or blockchain course to help them hone their knowledge base.

Latest Courses & Webinars

Learn HTML

Learn HTML and become a Certified HTML Developer. This Tutorial is the first step to become a Blockchain Programmer. …

Learn CSS

Learn CSS and become a Certified CSS Developer. This Tutorial is the first step to become a Blockchain Programmer. Le…

Learn JavaScript

Learn JavaScript and become a Certified JS Developer. This Tutorial is the first step to become a Blockchain Programm…

CLIENT TESTIMONIALS

09 partners

MEET OUR DLT PARTNERS

Meet our major partners. Above all, we only work with the best in class. In detail, we cooperate with the best technical universities. Furthermore, we partner with the most important associations. In addition, we attend all global summits when it comes to Block Chain Technology. As a result, we are proud to partner with the following companies:

ETH, the top-notch technical University of Zurich is offering ground-breaking research.

The University of Zurich is one of the leading research universities in Europe.

INATBA is the International Association for Trusted Applications.

The International Token Standardization Association for the global token economy.

We follow the Global Digital Finance Code of Conduct for the cryptoasset market.