Have you ever asked this generic question, what is an ICO, an Initial Coin Offering? A lot of people continually ask this question. The boom of 2017/2018 took the financial world by storm. This piece takes a closer look at what is an ICO. Then we will explain to you the available types. Also other key considerations for investors amongst others.

In this article, we will have a look at the meaning. We will explain to you, how an ICO works. Furthermore, we will give you the insides of crypto tokens available today. Are you ready? Then let’s begin with our definition!

A brief history of Initial Coin Offerings

Before we start explaining what is an ICO, we have to take a look at the history of initial coin offerings. The very first ICO was conceived in 2012 by J.R. Willett. He published a white paper named ‘The Second Bitcoin White Paper’. He launched Mastercoin (now called Omni), and raised $500,000 worth of bitcoin.

Ethereum’s ICO in 2014 is an early, prominent example of an initial coin offering. They raised $18 million over a period of 42 days. In 2015, a two-phase ICO began for a company called Antshares, which was later rebranded as Neo. The first phase ended in October 2015, and the second continued until September 2016. During this time, Neo generated about $4.5 million. In another example, during a one-month ICO ending in March 2018, Dragon Coin raised about $320 million.

ICO activity began to decrease dramatically in 2019, partly because of the legal gray area that ICOs inhabit. In March 2020, the U.S. District Court for the Southern District of New York issued a preliminary injunction. In June 2020, Telegram was ordered to return $1.2 billion to investors and pay a civil penalty of $18.5 million. The sale of ‘Grams’ was determined to be securities.

To understand these developments, we now explain in detail what is an ICO.

What is an Initial Coin Offering? Our ICO Definition

ICO means Initial Coin Offering. Which of course begs the question “What is an initial coin offering?”. It is a way for new digital or cryptocurrency projects to raise money. It’s a bit like a company selling shares to raise funds but in the world of cryptocurrencies. Let’s break it down:

- Digital Tokens: In an ICO, a project creates its own digital tokens or coins. These are like the digital money you use online, but they’re specific to that project.

- Fundraising: The project then offers these tokens to the public for sale. People who are interested in the project can buy these tokens using more established cryptocurrencies like Bitcoin or Ethereum or sometimes even with regular money.

- Investment: When people buy these tokens, they’re essentially investing in the project. They hope that as the project grows and becomes more successful, the value of these tokens will also increase.

- Ownership and Use: Owning these tokens might give you certain rights within the project’s ecosystem, like voting on decisions or using the project’s services. But this can vary from project to project.

- Risks: However, investing in ICOs is risky. Not all projects succeed, and there have been cases of scams where people lose their money. Unlike traditional investments, there is a lack of regulation.

So, in simple terms, an ICO is like a digital fundraising event where a new cryptocurrency project sells its own tokens to raise money, and people who buy these tokens hope they’ll become more valuable in the future. But it’s important to be cautious because it can be a risky way to invest your money. Even with a clear roadmap, and many iterations of what is an ICO, scams are rising. This situation is continually drawing the attention of regulators like the Securities and Exchange Commission (SEC). You should always check if there is a red flag.

More will be discussed about it but first, let us consider the major types of Initial Coin Offerings there are.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWThe 2 Types of Initial Coin Offerings

After answering what is an ICO we need to understand the different types of Initial Coin Offerings. There are two major types. In general, we distinguish Private and Public fundraising events. Typically, both options are complementary and are often embraced by the startup following a time-bound succession.

1. Private ICOs

Private ICOs are public sale events in which coin issuers sell the cryptos directly to private investors. The sale is often conducted with huge venture capitalists and high-net-worth investors. This class of investors often backs the project by issuing the tokens at a very early stage, and the funds raised help in powering the project development.

Investors who back a startup at the private ICO stage are often in it for the long term. The project defines the tenor in which they can hold the coins even after it has started trading on an exchange.

2. Public ICOs

This is the ICO that is typically opened to the members of the public. The basic goal of every crypto project is to create a product that can be adopted by the public. The extension of a new cryptocurrency offering to the public is to get an initial crop of mass supporters for the project. People who invest their money in a project are likely to test out whatever product will be introduced later on.

Ethereum (ETH) is one of the biggest blockchain and crypto today. The firm conducted it in 2014 for the eventual launch of its open-source blockchain in 2015. With a price of US$0.3 according to ICO Rating, the growth of Ethereum to a price over $2,500 today showcases the massive returns on investment to investors.

Ethereum, as well as the majority of the genuine ICOs in the past years, comes with a usable product helping to advance the adoption of blockchain technology. While many investors focus on the rate of return, the utility tokens and the technology behind the startups are the selling points for both private and public ICOs respectively.

How does an ICO work?

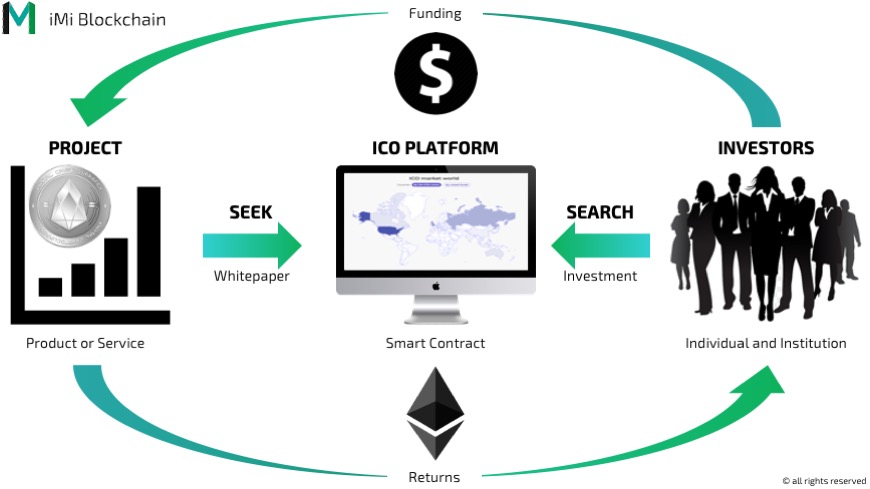

The question, “How does an ICO work?”, is a broad inquiry. Same as the question before, what is an ICO, it may be sought by many. Especially those new to the space. Think of a crowdfunding campaign for a new digital project or company, but instead of traditional money, people invest using cryptocurrencies like Bitcoin or Ethereum.

Share this Image on Your Site:

Here’s how it works step by step:

- Project Idea: A group of developers or entrepreneurs comes up with an idea for a new digital project, like a blockchain-based app or platform. They need funding to turn their idea into reality.

- White paper: They create a document called a “whitepaper” that explains their project in detail. It includes what the project does, how it will work, the problems it solves, and why it’s valuable.

- Token Creation: To raise funds, they create a new cryptocurrency token specifically for their project. These tokens often have a name related to the project.

- ICO Announcement: The project team announces the ICO and sets a date for it to start. They also determine how much money they want to raise.

- Investment Period: During the ICO period, people who are interested can buy these newly created tokens using established cryptocurrencies like Bitcoin or Ethereum. They send their cryptocurrency to a specific address provided by the project.

- Token Distribution: After the ICO ends, the project team distributes the new tokens to the investors’ cryptocurrency wallets. The number of tokens each investor gets is typically based on how much they invested relative to the total amount raised.

- Listing on Exchanges: Once the ICO is over, the new tokens can be traded on cryptocurrency exchanges. This allows investors to buy and sell them with other cryptocurrencies.

- Project Development: The project team uses the funds raised during the ICO to develop their project as outlined in the whitepaper. This could involve building software, hiring staff, or marketing.

- Project Launch: When the project is ready, it is launched to the public. The success of the project and the value of the tokens often depend on how well the team executes their plans and how useful the project is.

- Investor Returns: If the project becomes successful, the value of the tokens can increase, allowing early investors to make a profit by selling their tokens on exchanges. However, if the project fails or doesn’t meet expectations, investors may lose their money.

It’s essential to remember that ICOs can be risky investments because the projects are often in their early stages and may not have a proven track record. It’s crucial to do thorough research and understand the project, team, and terms of the ICO before investing.

Also, keep in mind that regulations around ICOs vary from country to country, and some countries have banned them due to concerns about fraud and investor protection. Always check your local regulations before participating.

What is an ICO company?

The next question to answer is “What is an ICO company”. It is the firm backing the development of a particular project. This company is the outfit that develops the project per its core aims, visions, and target market. Take the case of Ethereum for example. The company is called Ethereum Foundation and it is not uncommon to find firms with varied names for their projects.

Cardano is one of the most iconic smart contract-based decentralized platforms of our time. While everyone knows Cardano, a good number of people are not aware of the company behind the project, Input-Output (IOHK). While the growing number of blockchain startups employs the decentralized model of governance, the company is often inseparable from probable advances in the ecosystem.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWWhat are ICO tokens?

After we’ve explored what is an ICO, we will gain a broad over of ICO tokens. We would need to explore them by the classification per regulatory provisions. Based on these, ICO tokens are primarily divided into two: utility and security tokens. But creative people came up with some “sub-categories” as well. Let’s have a look at what exists so far.

What are the types of ICO tokens?

If you ask yourself, what is an ICO, then you should understand the different types of tokens in today’s market. We distinguish the following 7 different types:

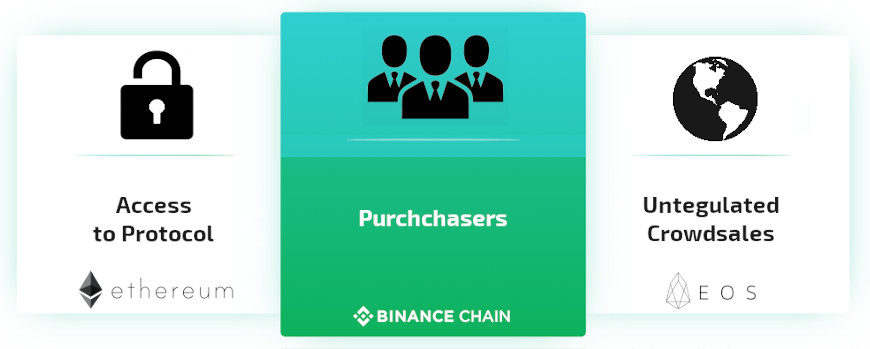

1. Utility Tokens – To Please the SEC

Utility tokens are often sold out to investors in exchange for gaining access to a project’s platform and offerings upon Mainnet launch. Ether and Gas coins are top. As in the case of Filecoin (FIL) in which a total of $257 million tokens were sold to give FIL holders access to the network’s data storage infrastructure.

Share this Image on Your Site:

Issuers of utility tokens are often less burdened by regulatory issues for their crowd-sale programs as these are not considered investment security. The bulk of the tokens issued, be it an ERC-20 or recently a BEP-20 is often sold as a utility token. Typically, these coins grant incentives to decentralized exchanges, exclusive access to launchpads, and a host of other use cases.

2. Security Tokens

Security tokens on the other hand are classified by monetary authorities as investment securities issued by a company. Per this classification, security tokens conform with securities laws and they represent a share in the issuing company. In reality, the issuance takes the tag of a Security Token Offering (STO). Holders may be entitled to share profits alongside the firm.

Share this Image on Your Site:

To issue Security tokens, the ICO company must receive authorization from such market regulators, in the United States from the US SEC. Startups must do their due diligence under federal securities laws before venturing to issue tokens which are known as high-risk assets. The improper classification of a token can attract regulatory clampdown, heavy fines, and eventual derailment of the cryptocurrency project.

3. Asset Tokens

Asset Tokens are similar to Utility tokens but it represents an asset. It can be a debt or equity claim on the issuer. These are analogous to equities, bonds, or derivates. Most regulators don’t consider an asset as a security token. They usually only require a Code of Obligations (OC).

4. Reward Tokens

Reward Tokens can be described as loyalty points. This type is BSV-based and distributed to users of a platform or service. There are many Reward Tokens out there. The SurfMoon for example, is a travel-based coin. BODA is a DeFi token that automatically rewards investors on Binance. Rewards (RWD) is the first reward coin that is interoperable and works across multiple blockchains.

5. Equity Tokens

Equity Tokens are a form of security tokens. Normally, it represents the equity in an underlying asset, typically the stock of a company. Similar to shares, an equity token entitles its holders to voting rights and or dividends.

6. Payment Tokens

Payment Tokens do replace sensitive debit or credit card payments. A unique identification code (called a token) is used during the payment transaction. Payment Tokens make online transactions more secure.

7. Non-Fungible Tokens (NFTs)

Non-fungible tokens can represent any asset in the digital world. NFTs have become very popular lately in the form of digital artwork and digital real estate. Such a digital asset is not a copy or a scan of an artwork. It is a unique, non-interchangeable unit of data stored on a blockchain.

How do ICOs work with an ICO wallet

Next, to understand what is an ICO, an ICO wallet plays a crucial role in the process by facilitating the purchase, storage, and management of these tokens. After project creation, the whitepaper comes out. Then the project announces its sale. Now, ICO wallets enter the game and this is how it works:

- ICO Wallet Creation: Investors interested in participating need to create a wallet. This is typically a cryptocurrency wallet that is compatible with the token standard used by the project (e.g., ERC-20 for Ethereum-based tokens). Popular wallets include MyEtherWallet, MetaMask, and Trust Wallet.

- Funding the ICO Wallet: Investors need to fund their wallets with the cryptocurrency (e.g., ETH) they intend to use to purchase the project’s tokens. This is done by sending the cryptocurrency to the wallet’s address.

Once it begins, investors can use their ICO wallets to participate by sending the required amount of cryptocurrency to the smart contract address. In return, they receive the project’s tokens at the specified conversion rate.

The ICO wallet becomes the storage and management tool for the newly acquired tokens. Investors can check their token balances, transfer tokens to other wallets, or hold them for potential future value appreciation.

ICO fundraising: How do ICOs make money?

In the beginning, we explained what is an ICO. Now we know it is kind of a fundraising model, similar to an Initial Public Offering (IPO). But, how do ICOs make money? Actually, they raise money in one prominent way; the sale of the new token. Potential investors back the project of their choice, after in-depth market research. In a diverse market, they contribute or make their purchases through Bitcoin (BTC), Ethereum (ETH), or Stablecoins like Tether (USDT). Some regulated platforms may permit investors to pay through fiat currency like the US Dollar.

Besides the direct receipt of investors’ funds, ICO fundraising becomes quite profitable for the project incubators with the growth of the token. As mentioned earlier, the growth in Ethereum has made a number of early investors rich. ICO backers and developers can also make a lot of money through similar growth.

The fees generated from the platform being marketed may also add a source of revenue to ICO builders upon launch. Typically, with advances in social media marketing, platforms like Telegram, LinkedIn, Reddit, and Twitter can be used to promote the general acceptance of the project toward productivity. In the long run, productivity benefits both the investors and the company behind it.

How to Setup an Initial Coin Offering – Cryptocurrency Roadmap

Setting up an Initial Coin Offering campaign may take a lot of time on the part of the project owners. ICO development requires a unique use case. To understand what is an ICO seems easy, but to launch an ICO successfully you should consider hiring experts to broaden your views. The logistics of selling and distributing the created tokens are usually assumed by third-party launchpads or exchanges. As a result, this burden is taken away from project teams.

However, distinguishing a project from fraudulent ICOs designed by scammers may require more effort on the part of developers. Building a functional and responsive community on social media handles is a key prerequisite. Putting up the public profile of key leaders or vision bearers of the project is also a good way to earn trust.

Setting up an Initial Coin Offering entails much more than just knowing what is an ICO. However, whatever option is being sought, adherence to local regulations should be taken into key consideration

Investing in ICO Coin Offerings vs. IPO investments

It is a key requirement for investors to understand how to buy initial coin offerings. Later we will show you how to participate in ICO.

The distributed ledger economy has a vibrant ascension of new projects that may be too numerous to follow. Unsuspecting investors may lose their funds easily to ICO fraud. Therefore, we must warn you of the great risks and immediately turn to the scam.

Investing in ICOs involves buying tokens in a new blockchain project with less regulation and potentially higher risks. On the other hand, investing in IPOs means purchasing shares in a company on the stock market. Your choice should align with your risk tolerance and investment goals.

How to identify ICO Scams and Crypto Fraud

Fraudulent ICOs are everywhere. Millions of people google the term what is an ICO. Of course, this attracts scammers. We have seen classic exit scams, dead/fake scams, compound scams, and even exchange scams in the last few years. But there are good ways to ensure that you don’t fall into potential scams. Before you invest, take note of these 4 key considerations:

1. Addressable market/use case

The project’s key use case must be known and carefully analyzed. Successful ICOs are those who have a unique product or service to offer. If you are promised to get returns at a later stage it might be a Ponzi scheme, a well-known scam in the financial sector.

2. Backing investors/launchpad

Who are the investors that invested in the project’s private sale, if any? The credibility of top venture capital in the crypto ecosystem can be used as a viable yardstick to profile a good project.

Also, the partnering launchpad where the token will be sold and distributed is also a core consideration to note. Top launchpads like CoinList and Binance Launchpad amongst others hardly back fraudulent projects.

In the well-regulated financial sector, you can relate to the Howey Test. It’s a qualification of an investment contract and a subject to U.S. securities laws. Most ICOs are not regulated. Hence, you must choose a known and trustworthy launchpad before investing.

3. Community responsiveness

Social media is increasingly becoming a tool to perpetrate scams. Good use of these messaging platforms can significantly showcase how credible an ICO project is.

A serious ICO is available on all platforms. Still, you have to ensure somehow that you don’t fall into market manipulation or pre-mines.

4. Team profile

Backing a project whose team profile is hidden may be a sign of fraud. While many project developers choose to stay anonymous like Bitcoin creator, Satoshi Nakamoto, investors must beware as today’s faceless inventors are scammers.

ICO Structure: How an ICO Crypto Fits with Blockchain

The ICO structure or process is quite similar across the various launchpads or blockchain ecosystems that sell out tokens. On a platform like CoinList for instance, a registration or opening of an account is required. This account opening grants access to new token sales, provided you do not reside in prohibited regions.

There are various models for allocating ICOs to eligible investors. But this may largely depend on a random allocation to guarantee equitable distribution. Other launchpads employ the whitelist option.

Depending on the project, some coins may be locked for some months before being released while others are made available to dedicated wallets immediately after the sale. Though timelines may vary, distributed tokens can then be traded on exchanges that list them for trading. Beyond this, investors can deploy the tokens for the exact utility they have been designed for.

ICO meaning, IRS, and key takeaways

The digital currency ecosystem has developed a fundraising model that mimics what is obtainable in the broader financial market. ICOs and their many alterations are ways in which startups raise funds to finance unique project developments in the crypto ecosystem. The process may or may not be regulated depending on the type of token (utility or security) being issued.

ICOs may be replete with fraud, however, key indicators like the real-world use case and the team behind a project can give investors the confidence they need to invest in a new token.

Finally, as we now know what is an ICO, let’s talk about taxation. In the United States (IRS), digital assets have to be taxed. Cryptocurrency taxation is a complex and rapidly evolving area. Consult with an expert who can provide guidance tailored to your situation and the laws in your country.

If you are planning an ICO, be sure to seek advice from an expert. Get to know the comprehensive iMi Blockchain services during a 30-minute initial consultation. In case you are an investor, then you should book our advanced cryptocurrency seminar. We will show you how to profitably maximize your crypto portfolio.

Learn All About ICO!

ICO Training in Small Classes

Webinars about DLT

DLT Courses at University Level

Free ICO Tips!

Get monthly tips on ICO investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQs

Are ICOs legal?

Yes, ICOs are legal, however, there may be some prohibitions on participation in some countries due to local laws. Provided the nature of the ICOs is well defined as either a utility or security token, regulators may have no issue with the offering.

Is an ICO currency, or something else?

ICOs are not currencies, rather they are tokens that have inherent usage or value to the issuing project’s ecosystem. Digital currencies as a whole may serve as a means of value transfer, they are not classified as fiat currencies in today’s monetary system.

Are ICOs dead?

ICOs are not dead in 2022. There is a growing alteration of the name to public sales, token sales, or IDOs amongst others. The central idea remains the same, raise funds through token issuance. A number of projects still explore this fundraising path to date.