Cryptocurrency is like a new kind of money that works online. But it can go up and down in value a lot, which makes it hard for people to use it like regular money. That’s where stablecoins come in. They’re special kinds of digital money that don’t change in value so much. In this blog, we’re going to talk all about stablecoin crypto.

We’ll learn what they’re for, the different kinds you can find, and what’s good and bad about them. We’ll also talk about why more people are starting to use them, what rules they follow, and what might happen with them in the future.

Come with us as we explore everything about stablecoins, so you can know more about them and decide if you want to use them too.

- 1. Understanding the Basics of Stablecoin?

- 2. History of Stablecoins

- 3. Why are Stablecoins so Important?

- 4. What Kinds of Stablecoins Are There?

- 5. Pros and Cons of a Cryptocurrency Stablecoin

- 6. Risks Associated with Stablecoin Usage

- 7. Why are Stablecoin Tokens Popular?

- 8. Stablecoin Regulations

- 9. Failed and Abandoned Stablecoin Projects: 100 Cents or?

- 10. The Future of Stablecoins in Crypto

- 11. Which Is the Best Stablecoin?

- 12. Conclusion

- 13. FAQ

Understanding the Basics of Stablecoin?

Cryptocurrencies are super exciting, but their prices jump up and down a lot, which makes some people nervous about using them like regular money. That’s where stablecoins come in – they’re a special kind of digital money that doesn’t bounce around in value so much. They do this by being tied to things we already know and use, like regular dollars (fiat currencies), gold, or even houses (real estate).

Share this Image on Your Site:

Stablecoins have a few cool jobs in the world of digital money: they can be used to buy and sell things (medium of exchange), they can keep their value over time so you can save (store of value), and they help us agree on what things are worth (unit of account). To keep everything open and safe, they use blockchain (the same tech behind Bitcoin) and smart contracts (kind of like automatic rules).

Why are stablecoins a big deal? Well, they help calm down the wild rides in the cryptocurrency market. This is really good for people who want to trade without worrying about huge price drops. They also make it easier to send money all over the world.

When you hear about stuff like Tether Gold, Paxos Gold, Ethereum, Bitcoin, Binance, and Coinbase, these are all big names in the crypto world that use or deal with stablecoins.

There are different kinds of stablecoins too – some are backed by money in the bank (fiat-collateralized), others by different cryptocurrencies (crypto-backed), some by valuable stuff like gold (commodity-backed), and there are even some that manage their value with computer algorithms (algorithmic) or don’t use backing at all (non-collateralized).

If you want more details about a stablecoin example then we’ve got you covered too. But for now, let’s continue with our guide on “stable coins crypto”.

The Purpose of Stable Coin Cryptocurrency

Stablecoins are like the steady hands in the fast-moving world of digital money. They’re special kinds of cryptocurrencies designed to keep their value steady, unlike Bitcoin (BTC) or Ethereum which can jump up and down in price a lot. This steadiness is super helpful for people who want to trade in cryptocurrencies without the crazy ups and downs or who need to send money around the world quickly and cheaply.

Think of stablecoins as a sort of digital dollar that doesn’t get tossed around by the waves of the crypto market. They’re perfect for traders who need to switch from one cryptocurrency to another without going back to regular money (like dollars or euros) and for people who want to send money across borders without the hassle or high fees.

Stablecoins come in different flavors. Some, like Tether Gold (XAUT) and Paxos Gold (PAXG), are backed by real gold sitting in a vault somewhere. Others, like Terra (LUNA) and Binance USD (BUSD), are tied to regular money that companies hold in bank accounts. This backing is what keeps their value stable.

More and more, big investors and companies are getting into stablecoins because they can count on their stable value. As the world of cryptocurrencies grows, these stable tokens will be super important in helping people feel safe and making it easier to use digital money in everyday life. With them, we can look forward to a future where trading, saving, and spending in cryptocurrencies is as easy as using the money in our wallets, with stablecoin issuers being regulated similarly to banks to ensure their safety and stability.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWThe Stability Token: Reducing Volatility

Stablecoins are a special kind of digital money in the world of cryptocurrencies that don’t change in value as much as other types like Bitcoin. Imagine you’re playing a game where the points you earn can suddenly be worth a lot one day and much less the next. That would make it hard to know what your points can get you, right? Stable cryptos try to fix that by staying more constant, just like the dollars in your piggy bank.

They do this by matching their value to things we know and use every day, like the money in your wallet (dollars, euros, etc.) or using smart rules in their programming. This means that if you have a stablecoin, it should have the same buying power today as it will tomorrow.

Because of this, people who trade cryptocurrencies like using stablecoins. It’s like having a calm port in a stormy sea of ups and downs in the market. These coins let people take a break from the wild price moves and can make it easier for more people to get into trading crypto. By making trading smoother and less scary, they help everyone feel more confident about using digital money.

History of Stablecoins

Stablecoins are like the “steady” stable coins in cryptocurrency. The very first one to show up was called BitUSD. It was special because it didn’t jump up and down in value like other cryptocurrencies. Then came Tether (USDT), which a lot of people started to trust. It was kind of like having a digital version of gold. Another one called USD Coin (USDC) kept its value steady by sticking close to the US dollar’s value.

Share this Image on Your Site:

TrueUSD came along too, and it was cool because it let people see how it worked and made sure everything was on the up and up. Since those early days, there’s been a lot of new stuff happening with stablecoins. Big names in the digital money world like Ethereum, Bitcoin, Terra, Binance, Coinbase, and Paxos have all helped them grow a lot.

Now there are even more types, like UST, LUNA, ETH, GUSD, and BUSD. These are like different “flavors” of stablecoins, each with its own special features. From the start, when stablecoins were just getting going, they’ve come a long way and are now a big deal in how people use and think about digital money.

The First Stablecoin: BitUSD

Stablecoins are like a calm friend in the often wild world of digital money. Think of them as a “steady” type of cryptocurrency that doesn’t jump around in value like many others do. One of the first of these steady coins was called BitUSD.

BitUSD is special because it has a smart way of keeping its value even. This coin is tied to the value of the US dollar, so one BitUSD is meant to be worth the same as one real US dollar. This is a big deal because it means that even when other digital coins are going up and down in price a lot, BitUSD stays more predictable.

This predictability is what made a lot of people pay attention to BitUSD. People who are into trading digital money liked it because it didn’t have the wild price swings that other coins had. This makes it easier for more people to get involved in trading digital money without worrying so much about sudden changes in prices.

To wrap it up, BitUSD was a trendsetter. It introduced a smart way to keep its value steady, which is important for making the digital money world more user-friendly. As we keep learning about stablecoins, we’ll see just how much they help people feel more comfortable with using digital money.

The Rise of Tether (USDT)

Tether, also known by its code USDT, is a kind of digital money called a stablecoin that has become really popular for being steady in the ups and downs of the crypto world. But not everyone agrees on how good it is, and it has had its share of drama. Even with the issues, Tether keeps its value pretty even because it’s supposed to be backed up by real money, like dollars in a bank, and not conjured out of thin air.

Think of Tether like a “promise note” where each digital coin is like a promise that there’s a real dollar sitting somewhere for it. This makes people feel safer when they’re dealing with cryptocurrencies, which can jump up and down in value a lot. Tether is like a calm spot in the middle of a stormy sea for those who want to make sure their digital money doesn’t lose value suddenly.

Looking at how much Tether is out there compared to other stablecoins, we can see it’s a big deal—it’s way ahead of many others. Lots of people use Tether when they’re trading in crypto because it’s like a bridge between the wild world of crypto and the steady world of real money. And because big trading places on the internet, called exchanges, like Binance and Coinbase, use Tether a lot, it’s kind of like a popular kid in school that everybody knows.

In short, Tether’s story is all about being a steady hand in the wild crypto market. Even with some bumps in the road, it’s shown that people really want a stable coin they can rely on as they buy and sell digital currencies.

USD Coin (USDC), the Next in the Dollar line

USD Coin (USDC) is a kind of digital money that’s really steady, unlike other types of cryptocurrencies that go up and down in value a lot. It’s a stablecoin, which means it’s designed to not change in value too much. It’s super reliable for buying things or saving. The special tech behind USDC is called blockchain, which is like a digital ledger that keeps all the transactions safe and clear for everyone to see, so nobody can mess with it.

More and more people are using USDC because they trust it. It’s becoming a big deal in the stablecoin market, which is just a fancy way of saying the world where stable digital money is used and traded. When you look at USDC and compare it with other stablecoins like Tether and TrueUSD, a lot of folks think USDC is one of the best because you can count on it to stay steady in value.

In short, USD Coin (USDC) gives people who like digital money a really secure and dependable option that doesn’t go on a rollercoaster ride with its value. This is super important for anyone who wants to use digital money in their daily life or to keep it as savings.

TrueUSD

TrueUSD is like a steady ship in the choppy sea of digital money called cryptocurrencies. It’s made to not go up and down in value too much, which is a big deal when you’re dealing with virtual money that can sometimes feel like a rollercoaster. Think of TrueUSD as the “steady Eddie” of crypto coins.

To make sure everyone knows it’s playing fair, TrueUSD has people check its homework. These checks are called “audits,” and they help prove that TrueUSD is trustworthy. It’s kind of like getting a report card that shows it’s not hiding anything sneaky.

Imagine you’re in an arcade, and you need tokens to play the games. TrueUSD is like those tokens but for buying and selling things in the world of digital money. It’s a safe bet, kind of like keeping your game tokens in a secure pouch so they don’t get lost while you’re having fun.

When you hear about TrueUSD’s “market cap,” think of it as a score that shows how many people are using those tokens and think they’re as good as real money. Even as other shiny coins, like tether gold and Paxos gold, are getting attention, TrueUSD is like the quiet kid who gets all As because it’s got a good head on its shoulders, mainly because it’s super open about how it works.

For those who are into crypto trading, TrueUSD is like a savings jar that doesn’t break. It’s dependable, which is really appealing for investors who want to keep their virtual money safe.

In the world of cryptocurrency, names like Ethereum, Bitcoin, Binance, and others are kind of like different rides at the amusement park. By playing well with these big names, TrueUSD makes sure it stays relevant and strong in the eyes of those looking for a stable choice in an unpredictable market.

So, if you’re looking to invest in digital money and don’t want too much drama, you might want to keep TrueUSD on your list. It’s the calm buddy in the exciting but sometimes wild world of cryptocurrencies.

Maker DAI

Let’s break down Maker DAI for you – it’s like a special kind of digital money, or “cryptocurrency,” that doesn’t jump up and down in value like most others. Imagine it’s tied to a regular dollar, so one DAI aims to be worth about one US dollar most of the time. This is cool because it uses special computer programs, called “smart contracts,” to keep its value steady. This makes it a good choice for people who want to buy, sell, or trade without worrying too much about sudden price drops or jumps.

So, unlike other cryptocurrencies that can change prices super fast (which can be pretty nerve-wracking!), Maker DAI is more like a steady ship in a stormy sea. It’s backed by some assets that act like a promise, making sure there’s something of value holding it up. This is one reason why people are starting to like it more – it’s dependable.

In simple terms, Maker DAI gives traders the chance to avoid those wild price swings in the crypto world, which can be a big relief. With Maker DAI, investors can feel more secure, knowing their digital money will have a stable value for when they need it. This is why it’s becoming a strong player in the game of stablecoins.

Why are Stablecoins so Important?

Stablecoins are a big deal in the world of digital money – think of them like the steady eddies in the often choppy sea of cryptocurrency. These special coins are important because they don’t bounce up and down in value like other cryptocurrencies, which makes them really useful for buying things every day. They help make sure that the digital money market is smooth and that more people can join in and use it without worrying too much. They are all about making the digital cash world more stable, quick, and easy for everyone to get into.

Share this Image on Your Site:

Little to no volatility

Stablecoins are like anchors in the stormy sea of cryptocurrency. They help keep prices from going up and down too much. This means when you use them, you can expect to buy or sell things without worrying about the price changing quickly. These coins are tied to regular money (like dollars or euros), so even if other digital money goes on a roller-coaster ride, the stable coin in crypto stays calm.

Picture it like this: If normal cryptocurrency is like a bouncy ball bouncing all over the place, stablecoins are like a yo-yo that you hold tightly in your hand. It may move a little, but it’s mostly steady because you’re keeping it under control.

When you’re looking to trade, like on websites such as Binance or Coinbase, a stablecoin token is a smart choice. Coins like Tether Gold (XAUT), Paxos Gold (PAXG), or TerraUSD (UST) won’t let you down. They keep your digital money’s value from bouncing around, which is a big relief. So, with stablecoins, you can feel more secure when you step into the exciting world of crypto!

Global Blockchain Payment and Remittance

Stablecoins are like digital piggy banks that don’t bounce around in value like other types of internet money, which is super helpful for people who want to send money across the world without the hassle and high fees of regular financial institutions. Imagine being able to zap money to your friend in another country instantly and cheaply. That’s what they can do!

These special coins use something called blockchain technology, which is a super secure way of recording information so that it’s really hard to cheat or make changes once it’s been saved. This technology helps keep costs down and makes sure that rules are followed, especially when working with official money places like banks.

Stablecoins are really important for people who don’t have easy access to banks or who live in places where the money situation isn’t that stable. They can use these digital coins to buy things or send and receive money from far away without worrying about the value of their money going up and down like a roller coaster.

Some of the popular stablecoins that people are using include Tether Gold, Paxos Gold, and Terra USD. These coins are changing the game by making it easier for everyone to do business and support their families, no matter where they are in the world. So, if you want to pay your pen pal in another country or buy something from a place far away, they make it as simple as sending a text message!

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWProtecting Cryptocurrency Traders

Stablecoins are like the steady friends in the wild world of digital money. They don’t go up and down in value like other cryptocurrencies. This makes them super helpful for people trading in cryptocurrencies because they can use stablecoins to avoid losing money when prices suddenly change.

Think of it this way: if cryptocurrencies were a rollercoaster, stablecoins would be the smooth track that doesn’t have all those crazy ups and downs. When traders use them, they don’t have to worry as much about prices changing fast and can make smarter choices.

For example, if you’re trading with stablecoins, it’s a bit like having a shield against the big waves in the ocean of cryptocurrency prices. They give traders a way to keep their money’s worth more consistent, so they can trade without the fear of their digital money changing value like a yo-yo. This is especially important for protecting cryptocurrency traders who may be using various crypto assets in their trades.

So, all in all, stablecoins help traders stay calm and collected because they know they’ve got something in their wallet that won’t change the value from one minute to the next. This means they can focus on trading without fretting about the usual ups and downs of the cryptocurrency market.

What Kinds of Stablecoins Are There?

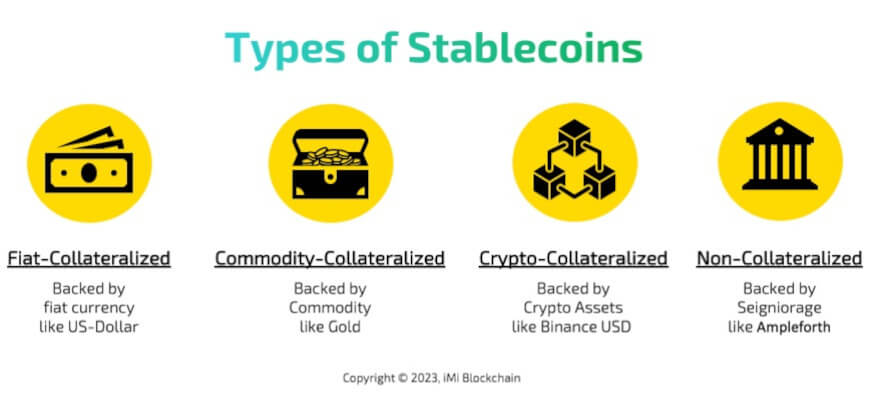

Fiat-Collateralized Stablecoins provide stability by pegging to fiat currencies like USD, backed by real assets. Crypto-Backed Stablecoins maintain value through collateralizing digital assets, using cryptocurrencies as collateral. Commodity-Backed Stablecoins derive stability from physical assets like precious metals. Algorithmic or Hybrid Stablecoins adjust supply based on market demand. Non-collateralized or Seigniorage-Style Stablecoins rely on market mechanisms for stability.

Share this Image on Your Site:

Stablecoins are like a safe version of regular cryptocurrencies. Imagine them as a digital piggy bank that doesn’t bounce around in value as much as other online coins like Bitcoin. Here’s a simple breakdown of the different kinds you might find:

Fiat-Collateralized Stablecoins (Collateral)

Stablecoins that are linked to actual money, like dollars or euros, are like the steady kids on the cryptocurrency playground. They don’t go up and down a lot in value because they have real money backing them up, dollar for dollar. Think of it like a video game where you can buy tokens that are worth the same as real money, so you always know how much you have.

These are super handy because they’re like a bridge between regular money and digital money, giving you the best of both worlds. You can swap them easily for real cash, and they don’t bounce around in value like other cryptocurrencies might.

But it’s not all perfect. You have to trust the company that makes the stablecoin to actually have the real money they say they do. Plus, governments could change rules that affect them, which is a bit like when a new rule in school changes how you do things.

Some of the big names in this stablecoin world are Tether (USDT), USD Coin (USDC), and TrueUSD. They’re like the popular kids in school because they’re reliable and have a good track record.

So, using these stablecoins can make you feel a bit more secure when you’re exploring the world of cryptocurrency because you know your digital money won’t suddenly drop in value if the market gets wild.

Crypto-Backed Stablecoins

Crypto-backed stablecoins are a special kind of digital money that aims to keep its value stable by using other cryptocurrencies as a safety net. These are different from others that use things like dollars or gold to maintain their value. Instead, crypto-backed stablecoins use computer programs called smart contracts on the blockchain to make sure their price doesn’t go up and down too much. This makes them really appealing to people who trade cryptocurrencies and want to avoid the big price swings that can happen.

For example, there’s a stablecoin called Tether Gold (XAUT), and it’s pretty neat because it’s actually backed by real gold. When you have XAUT, it’s like you own a little bit of physical gold. Then there’s Paxos Gold (PAXG), which is also backed by gold, and owning PAXG is like owning an ounce of physical gold.

There are other well-known crypto-backed stablecoins too. Terra (LUNA) is made on its own special blockchain called Terra, and Binance USD (BUSD) is created on what’s called the Binance Chain. People like these tokens because they’re thought to be stable and safe, making them a good choice for someone who wants to keep their money in crypto without worrying too much about sudden price drops in September 2022.

Commodity-Backed Stablecoins

Commodity-backed stablecoins are like special types of digital money that stay stable because they are linked to real things like gold. Imagine you have a virtual coin that is worth the same as a tiny piece of gold. That’s what companies like Tether Gold and Paxos Gold do. They promise that for every digital coin out there, there is a little bit of real gold stored somewhere safe. This makes people feel more confident about their digital money because they know it’s not just made-up numbers but is actually worth something solid.

These stablecoins use a computer system called a blockchain, which is what also runs famous digital currencies like Bitcoin and Ethereum. Blockchains are super smart because they keep a clear record of every trade, making sure everything is fair and can be checked by anyone. This is why people trust blockchains to keep their digital money safe.

When you hear names like Tether tokens or UST (which is from digital money called Luna), they are types of gold-backed coins. Investors like them because they can trade with them, feeling sure that these coins are as good as gold – literally. As more people want to use these kinds of stablecoins, we see even more options popping up, like TerraUSD and Binance USD (BUSD).

In the wild ups and downs of the cryptocurrency world, these gold-backed coins are like anchors that keep your investments from drifting away. They give you the best of both worlds: the cool, futuristic feel of digital money and the old-school security of gold that people have valued for centuries.

Algorithmic or Hybrid Stablecoins

Algorithmic and hybrid stablecoins are like smart robots in the world of digital money. They use a mix of smart computer programs and a pile of other assets to keep their value steady. These cool digital dollars work to stay stable in price, even when the market price goes up and down like a roller coaster.

Imagine you have a toy car that runs on batteries. If the car goes too fast, the batteries slow it down. If it goes too slow, the batteries make it go faster. That’s kind of what algorithmic stablecoins do with their value. If the value goes too high, the smart program makes more coins to lower the price. If the value drops, it takes some coins away to raise the price back up.

For example, there’s a digital coin called Terra’s stablecoin. It’s like a digital piggy bank filled with different kinds of money from around the world, and it uses a smart computer program to keep its value as close as possible to one US dollar. Another one, called AMPL, changes the number of coins you have to keep its price the same.

Then there are hybrid stablecoins, which are like a superhero team-up of smart programs and a pile of other assets, like Ethereum. DAI is a famous one of these. It has a safety net made of extra crypto coins, and the smart program helps keep its value steady, too.

These smart digital coins are great because they give people a smooth ride in the crypto world. You don’t have to worry about wild price swings, and there’s no big bank in charge. It’s all about using technology to make sure everyone can have a steady and safe experience with digital money.

Non-Collateralized or Seigniorage-Style Stablecoins

Stablecoins are like special types of digital money designed to have a steady value. Imagine you have a dollar in digital form that stays worth a dollar, even when other digital coins go up and down in value a lot. That’s what they try to be. There are different ways to keep these coins stable, and one interesting way is what we call “seigniorage-style” stablecoins.

These seigniorage-style stablecoins don’t depend on actual stuff like gold or regular money to keep their value. Instead, they use smart computer programs to control how many coins there are. If lots of people want to buy the stablecoin, the program makes more coins. If not many people want them, it makes fewer coins. The idea is to keep the coin’s value from jumping around too much.

One example of this kind of stablecoin is called Terra’s UST. It uses smart tech to keep its value steady. Another one is Ampleforth (AMPL), which changes the number of tokens out there every day to keep its value stable.

But these cool-sounding tokens can be tricky. They work with complicated tech stuff that might be hard to get your head around. Plus, their value can still wiggle a bit because it’s all based on what’s happening in the market, which is always changing.

Even with those challenges, these seigniorage-style stablecoins are pretty exciting. They’re a new way to think about making digital money stable without needing actual objects or money to back them up. For people who are into digital money, this is a fresh option that adds to all the ways we can use and understand cryptocurrencies.

Pros and Cons of a Cryptocurrency Stablecoin

Stablecoins are like a bridge between regular money and cryptocurrency, and they’re becoming more popular because they don’t jump up and down in value as much as other cryptos like Bitcoin.

Advantages of Crypto Stablecoins

- Steady Value: Imagine if you had $10 today, but tomorrow it could only buy what $5 can buy today. That would be pretty bad, right? Well, stablecoins are great because they stay the same in value, which means $10 in stablecoin today will still be worth about $10 tomorrow.

- Useful for Buying and Sending Money: Because their value doesn’t change much, stablecoins are handy for sending money to people in other countries or buying things without worrying about the price changing quickly.

- Some stablecoins, like Tether Gold (XAUT) and Paxos Gold (PAXG), are special because they are like promises that for every digital coin there is real gold stored somewhere safe. This is like having a note that says you own a little piece of gold that you can trust will be there, which can make these coins more stable.

- Then there are stablecoins like Terra (LUNA) and some that work with Ethereum (like UST) and Binance USD (BUSD). These don’t use gold but have other clever ways to keep their value steady. They work hard to make sure that for every digital coin, there is something of value that matches it, like having a dollar in the bank for every digital dollar coin. Because they are good at keeping their value the same, especially compared to big currencies like the US dollar, people are starting to use them more and more.

Disadvantages of Stablecoins in Cryptocurrency

- Rules and Safety: The big bosses who make rules for money stuff don’t have many rules for stablecoins yet. This means there might be more chances for scams, and your money could be less safe.

- Transparency Issues: Sometimes it’s not super clear how stablecoins keep their value. It’s like if someone told you they had a magic trick to keep your money safe, but they wouldn’t show you how it worked.

- Risk of Losing Their Steady Value: Even though stablecoins are supposed to keep the same value, sometimes they can mess up and change in value when they’re not supposed to. It’s like if your $10 is suddenly worth $9 without any warning.

When you’re thinking about trading or using stablecoins, it’s like any other important decision – you’ve got to look at the good and the bad, and decide what’s best for you!

Risks Associated with Stablecoin Usage

Stablecoins are like anchors in the choppy seas of cryptocurrency, aiming to stay steady in value while other digital money can go up and down a lot. But even though they’re designed to be stable, they’re not without their own problems.

Think about stablecoins as a type of online money that’s supposed to keep the same value all the time. This is different from most cryptocurrencies, which can change in value very quickly and unpredictably. However, these coins have their own set of issues:

- Rules (or the lack thereof): Not all stablecoins have someone checking on them to make sure everything is done right. This can be risky because it might mean that people aren’t being totally upfront about how the stablecoin works.

- Honesty in Reports: When companies behind stablecoins tell us how much money they have, sometimes it’s not as clear as it could be. This makes people worry if the stablecoin is really as stable as it says it is.

- Sticking to Their Value: There’s a chance that stablecoins could suddenly not stick to their promised value. If that happens, it could shake up the market and cause trouble for anyone who owns them.

- Outside Influence: Governments and banks might decide to step in and change how stablecoins work, which can affect their value and how they operate.

- Market Tricks: Some people might try to mess with the price of stablecoins to make a profit, which can be unfair and harmful to the market.

- Tech Glitches: The computer programs that run stablecoins can sometimes have flaws, making them not work as expected, which can lead to losses for users.

It’s super important for anyone who’s thinking about buying or using stablecoins to do their homework. Learn about these risks so you can make smart choices and not be caught off guard by any surprises in the stablecoin market.

Lack of Regulation

Stablecoins are a kind of digital money that is supposed to not change much in value. They’re different from other cryptocurrencies that go up and down in price a lot, which makes some people unsure about using them to buy things. But there’s a problem with these coins: they don’t have many rules to follow. This can make people worry about whether stablecoins are safe to use and actually stable.

People are working on fixing this problem by making new rules for how stablecoins should work. These rules would help make sure that stablecoins are safe, that everybody can see how they work, and that the people who have them are treated fairly. To make these rules the best they can be, it’s important for governments, banks, and the folks who know a lot about blockchain (the technology behind cryptocurrencies) to work together and address the lack of regulation, especially in light of calls for tighter regulation in November 2021.

When we have good rules, using stablecoins could become safer and more people might start to use them, not just for trading other digital money but also for buying things in everyday life. If users feel confident about these coins, then these digital coins could become more popular and more kinds of stablecoins might be created. This could mean a big step forward for how we use money online.

The Transparency Issue

Stablecoins are a special kind of digital money that aims to keep their value steady, unlike other cryptocurrencies that can change in value a lot. It’s important for the companies that make stablecoins to let everyone see clearly how much money they have to back up the coins they create. If these companies don’t show this information openly, people might start to worry that the stablecoins aren’t really worth as much as they say.

Having clear reports about how many stablecoins are out there, how many new ones are made, and checking that the company’s money report is honest, helps everyone believe in these coins more. If we make sure that everything about stablecoins is open and clear, then more people and big companies might start using them. Making sure they are clear in how they work can stop problems before they start and help the whole digital money world stay steady.

As more and more people want to use stablecoins, being open about how they work is really important. It helps build a strong base for using them in the future. When we pay attention to how clear and honest everything is with stablecoins, we can make smarter choices and help make sure that the world of digital money is safe and steady for everyone.

Potential De-pegging Threats: Safeguarding

Stablecoins are becoming a big deal in the world of digital money, like Bitcoin. Imagine stablecoins as arcade tokens that are supposed to always be worth the same amount, like one token equals one dollar. Sometimes, though, what those tokens are worth can change, and that’s a problem called “de-pegging”.

De-pegging is like if you’re playing a game at the arcade, and suddenly, your tokens buy you fewer games. For stablecoins, this happens when their value starts to wiggle away from the dollar or whatever they’re supposed to stay equal to. This wiggle can make things a bit messy for everyone using them.

If you’re using stablecoins, you should know about the wiggle risks. Different coins have different safety nets to stop too much wiggling, like having real money saved up or using special rules to keep their value. But these nets can have holes sometimes, especially if the market is going wild or if the people behind the stablecoins aren’t doing a great job.

To stay safe, you’ve got to keep an eye on how your stablecoins are doing. Think of it like checking the weather before you go out; you want to know if you need an umbrella (or if you should even go out at all). Also, don’t put all your arcade tokens in one basket. If you spread them out, a little wiggle in one won’t ruin your whole day at the arcade.

Knowing what’s up with stablecoins and being ready just in case means you can still enjoy the fun of this new digital money world without as many worries. Let’s learn about them, stay smart, and play the game right.

Other concerns: Stable Coin Trading

Stablecoins are a type of digital money that aims to keep their value the same, unlike other cryptocurrencies that can go up and down in price a lot. Think of stablecoins like a digital dollar that tries not to change in value even when things in the market go crazy. They are tied to something stable like regular money or gold, providing a sense of price stability in the volatile world of cryptocurrency.

But stablecoins have their own problems. For example, if the market goes on a roller coaster ride because of big news or a crisis, it can struggle to stay at its set value. Also, they use special computer programs called smart contracts to work, and sometimes these programs can have errors or break down, which can make the stablecoins not so stable.

Governments and big financial groups are paying more attention to stablecoins and making new rules that the people who create and trade them have to follow. This can make it harder to use these coins the way we’re used to.

Other things like how people feel about the market, what’s happening in the world economy, or the latest trends in the world of cryptocurrencies can also change the value of stablecoins.

If you’re thinking about using stablecoins, it’s a good idea to really think about these issues. If you’re not sure what to do, talking to a money expert can help you understand the risks and make smart choices. Knowing what’s up with stablecoins can help you use them wisely.

Why are Stablecoin Tokens Popular?

Stablecoins are like anchors in the choppy sea of cryptocurrency trading. They’re becoming really popular, especially for people who trade a lot, big companies, and even regular businesses. Why? Because the prices of regular cryptocurrencies like Bitcoin can jump up and down a lot, and that can be pretty risky if you want to use them like regular money. Stablecoins help make things less risky because their value doesn’t change as much.

Imagine you’re playing a video game, and the points you earn can suddenly be worth a lot or a little at any time – that would make planning how to spend them really hard, right? Stablecoins are like having points that stay the same, so you can actually use them to buy stuff without worrying about their value going all over the place.

They’re also really handy because they work all over the world, don’t cost a lot to send to someone else, and the transactions happen super fast. That’s why more and more people like using stablecoins – they make dealing with money in the digital world a bit easier and safer.

Stablecoin Regulations

Stablecoins are a kind of digital money that try to keep their value steady, unlike other cryptocurrencies that go up and down a lot in price. Governments and other organizations are working on rules to make sure stablecoins are safe for people to use and invest in for their financial decisions. These rules are important because they help keep the cryptocurrency market honest and protect people from losing their money or getting scammed.

One big thing that regulators focus on is making sure stablecoins really have enough money or other things of value behind them to support their worth. There are different kinds of stablecoins:

- Some stablecoins, like Tether (USDT) and USD Coin (USDC), are like IOUs backed by real dollars or other kinds of money that the company has in a bank.

- Others, like Maker DAI, are backed by other cryptocurrencies like Ethereum.

- And then there are those like Tether Gold (XAUT) and Paxos Gold (PAXG), which are supposed to be backed by actual gold.

The people who make the rules want to make sure that if a stablecoin says it’s worth something, it really is. This means that if a stablecoin is backed by dollars, there should be enough dollars in the bank to match.

Another important part of the rules is stopping illegal activities like money laundering. They want to make sure that people can’t use stablecoins to hide their money or do other bad things. This is why you often have to provide your personal information when you sign up for a cryptocurrency service.

As time goes on, these rules will probably get more detailed to make sure everything stays safe and reliable. This will help more people trust and use stablecoins in the future.

Failed and Abandoned Stablecoin Projects: 100 Cents or?

Stablecoins are a special kind of digital money that tries to stay the same value all the time, unlike other cryptocurrencies that can change a lot in price very quickly. But sometimes, these stablecoins don’t stay stable and end up failing. Let’s take a closer look at these not-so-stable coins to see what we can learn from them.

When a stablecoin can’t keep its value steady, it’s often because the prices in the market are going up and down too much. If we look at the stablecoins that didn’t work out, we can understand why people didn’t want to use them. For example, some stablecoins have failed due to their value fluctuating by a few cents multiple times in a short period of time, making them unreliable for users. It’s kind of like doing detective work to figure out why a science experiment didn’t go as planned.

Even though these stablecoins didn’t work, we can learn a lot from them. They remind us that it’s super important for people to trust the stablecoin, and the people running it need to be open about how things work and make good decisions. Every time a stablecoin doesn’t succeed, it’s a chance for the people who make stablecoins to do better next time.

In short, looking at the stablecoins that didn’t stay stable is like learning from a mistake. It’s not fun when it happens, but it teaches us how to do better in the future. So, by studying these fails, we can help build new stablecoins that are stronger and won’t let us down.

The Future of Stablecoins in Crypto

Stablecoins are a cool new type of digital money that helps make the prices in the cryptocurrency world less wild. Think of them as a middleman between the regular money we use every day, like dollars or euros, and the digital coins like Bitcoin which can jump up and down in value a lot.

More and more people are starting to pay attention to stablecoins because they can make buying things or sending money across countries easier and less risky. This is because stablecoins have something valuable, like gold or regular money, backing them up to keep their value steady.

Banks and other money experts are getting really interested in stablecoins. They see how these coins can move money around the world quickly and without the crazy price changes that other cryptocurrencies can have.

Since stablecoins are built on blockchain technology – the same stuff that powers all cryptocurrencies – they are expected to become even more important. People think they’ll help make buying, selling, and trading things online smoother, safer, and more honest if built on a stablecoin blockchain.

The big idea here is that stablecoins could help people and companies feel more comfortable using digital money because it offers the perks of being stable and secure. This could lead to everyone having an easier time getting into the world of digital currencies and enjoying the benefits of an online money system that’s solid and trustworthy.

Which Is the Best Stablecoin?

Let’s talk about the different kinds of stablecoins you can find in the world of digital money, which is pretty exciting! Stablecoins are like steady ships in the choppy sea of cryptocurrencies – they don’t go up and down in value as much. When you’re looking at stablecoins, think about how steady they are, how much they’re worth in total (that’s market capitalization), and how many are out there being used (circulation).

There are stablecoins that are like a promise, saying, “This coin is worth this much because it’s backed by real money (like dollars or euros)”, or even gold and silver! Others say, “We’ve got some other cryptocurrencies backing this up”. Choosing the right stablecoin is like picking the right tool for a job – it should match what you want to do with your money.

When you’re picking a stablecoin, think about what’s important to you. Do you want something as stable as your allowance money, or are you okay with a little bit of ups and downs? Look at different stablecoins, see how they’ve been doing, and choose the one that fits your money plans the best!

Conclusion

Stablecoins are like the steady ships in the choppy sea of cryptocurrency. They’re a kind of digital money that doesn’t bounce up and down in value as much as other cryptos like Bitcoin. People like them because they can send money all over the world or save their money without worrying about it suddenly being worth a lot less.

Just like any new thing, though, there are good and not-so-good sides to stablecoins. They’re not watched over by governments as closely as regular money, which can be risky. And sometimes, they can still lose their steady value.

Even with these bumps in the road, stablecoins are becoming more popular and getting better all the time. New versions are popping up, and the rules for how they should work are starting to catch up.

So, as stablecoins keep growing and changing, it’s really important to keep up with what’s happening. If you’re thinking about getting into stablecoins, make sure you learn as much as you can to make smart choices that are right for you.

Learn Cryptocurrency Investment!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

Is a bitcoin a stablecoin?

Bitcoin isn’t a stablecoin. Stablecoins have a set value tied to money or gold, staying steady. Bitcoin’s worth changes often, based on what people are willing to pay and how many are available, because it’s not tied to a single asset and works on a blockchain system.

What is the most popular stablecoin?

Tether (USDT) is a popular stablecoin that keeps its value equal to a U.S. dollar. It helps traders switch money fast in the crypto world. Other stablecoins like USD Coin (USDC) and DAI are also well-liked for similar uses.

Which coins are stablecoin?

Stablecoins, like Tether and USD Coin, are special digital money that stays at the same value, usually tied to a real-world thing like dollars. They aim to be steady for users, unlike other cryptos that can change prices a lot.

Is it good to invest in stablecoin?

Stablecoins might be a good choice for some investors who want less risk and like their value steady, tied to regular money like dollars. They’re good for diversifying crypto investments or for using them in trades. But, like any investment, they can have risks and need careful research before jumping in. Always check how solid the stablecoin is and think about your own money goals and how much risk you can handle.

What can you do with stablecoins?

Stablecoins are digital money tied to stable assets like dollars or gold. You can use them to buy things online, send money quickly without big fees, and trade in cryptocurrency markets without worrying about wild price swings. They’re handy for saving since their value doesn’t jump around like other cryptocurrencies.

How are stablecoins similar to cash?

Stablecoins are like digital cash because their value stays the same, usually equal to a dollar or another steady thing like gold. They’re different from regular cryptocurrencies, which can change in price a lot. This makes stablecoins a go-to for people wanting to keep their money in a form that doesn’t go up and down in value so much.