Cryptocurrencies have become popular lately, with lots of people wanting to invest in them. But to make good decisions, you need good information and reliable data about the market.

One place people often check for this info is CoinMarketCap.com. However, some people wonder if the figures on this website are trustworthy. In this blog, we’ll look into that question. We’ll talk about how CoinMarketCap gets its statistics, how things changed when Binance bought it, how reliable the data is, how exchanges play a role, and why it might not be a good idea to rely on one source only.

Let’s take a closer look and see if CoinMarketCap is a reliable source of information for cryptocurrency investors.

Understanding CoinMarketCap (CMC)

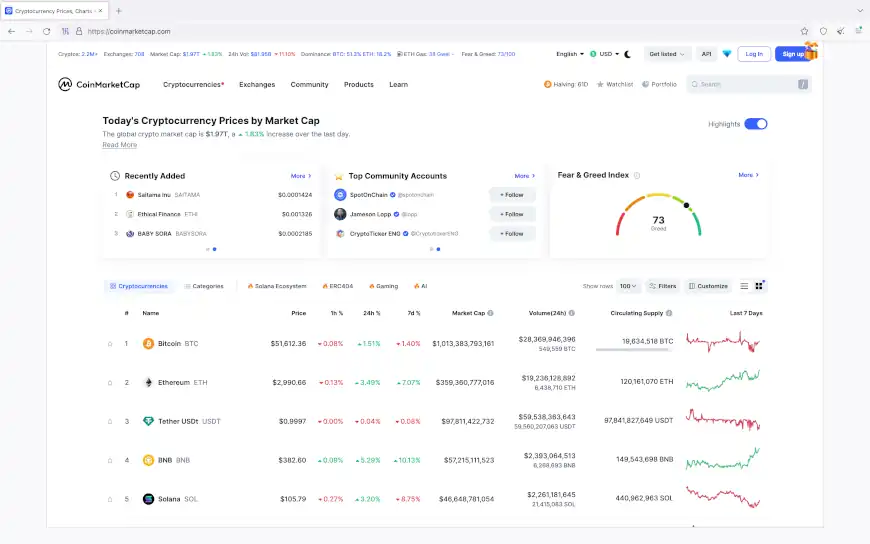

CoinMarketCap (in short CMC) is the leading source of cryptocurrency information. The website gets 19.3m organic visitors per month and ranks as #577 on all global websites. It has lots of details for people who are interested in crypto. You can find prices and how well different cryptocurrencies are doing in the market. CMC’s website is easy to use, so you can look around and learn about almost 9000 different cryptocurrencies. With data from CoinMarketCap, people should be able to make smart choices when dealing with crypto.

Share this Image on Your Site:

What is CoinMarketCap?

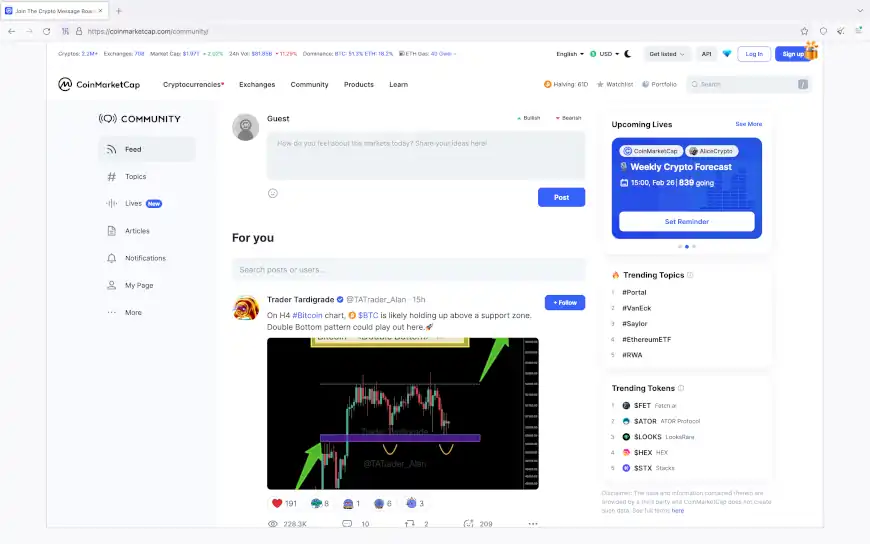

CoinMarketCap is a big website in the world of cryptocurrency that’s helpful for people who want to invest in the best crypto or just really like learning about it. It’s like a huge library full of information about thousands of different cryptocurrencies. You can find out how much they cost, how popular they are, and even how much people are trading them. CMC makes it easy to keep an eye on how well different cryptocurrencies are doing so they can make smart choices.

One cool thing about CoinMarketCap is that it throws this big party every year called the CMC Crypto Awards, also known as the “Oscars of Crypto”. It’s an entertaining way for the whole industry to come together and celebrate the awesome people and projects that are making a difference. This year, the event is all online, happening from February 21st to March 6th. They’re revealing nominees every day starting February 22nd, and the winners will be announced on March 3rd.

This annual event, known as the “Oscars of Crypto”, showcases the importance of CoinMarketCap in the whole industry and its dedication to keeping everyone connected. Rush Luton, the CEO of CoinMarketCap, said, “We’re super excited to host the CMC Crypto Awards again and give shoutouts to the amazing people and projects in the crypto world. It’s a sign of how much the industry has grown, and we can’t wait to see who the community picks as winners. You can catch the entertaining annual event, also known as the “Oscars of Crypto”, on Chainwire, which is a really popular place for crypto news. The event is hosted in partnership with BingX, showcasing the dedication of CoinMarketCap to the crypto community.

Unlock the Secrets of Crypto Trading

Join our Live Online Course today!

Live, interactive online sessions – 1-on-1 sessions from a seasoned crypto trading expert.

Personalized coaching – from a certified crypto expert.

Learning Material – comprehensive learning from basics to advanced strategy.

Flexible Scheduling – to fit your busy life.

ENROLL IN THE BEST CRYPTO TRADING COURSEWho runs CoinMarketCap and Who is the Owner?

Founded by Brandon Chez in May 2013, CMC has quickly grown. In March 2020, Binance Capital Mgmt bought CMC. Binance is a really big cryptocurrency exchange. This made a lot of people wonder if CoinMarketCap would still be fair and reliable. People who invest in cryptocurrency and those who watch the industry were worried about how the purchase might affect CMC’s honesty and openness. As the cryptocurrency community watched closely to see what would happen next, they talked a lot about making sure the information stayed accurate and honest, especially after the purchase.

Share this Image on Your Site:

How CoinMarketCap collect data?

To make sure the information is correct and dependable, CoinMarketCap uses different ways to collect data. They gather figures from many places, like cryptocurrency exchanges, to create a complete picture of the cryptocurrency market. These exchanges share data through APIs (Application Programming Interfaces). They use these APIs to get up-to-date details on cryptocurrency prices, how much trading is happening, and the total value of cryptocurrencies in the market, all of which are then converted to USD. Also, CMC looks at blockchain data to double-check that the information they’ve gathered is accurate. By using smart computer programs and careful checking processes, CoinMarketCap keeps the statistics it shows trustworthy, which helps build confidence in the cryptocurrency community.

How is data verified on CoinMarketCap?

CoinMarketCap uses strong verification methods to make sure the information about cryptocurrency on its website is correct. They have strict processes to check that the data is reliable. These clear methods make CMC’s figures quite trustworthy. Investors can count on this information to help them make good choices. CoinMarketCap shows it cares about accuracy by verifying data. This makes people trust CMC more when they’re looking for cryptocurrency information. It gives investors the confidence to understand the changing world of cryptocurrency.

How reliable is crypto market data on websites like coinmarketcap.com?

Crypto market data on websites like CoinMarketCap.com is generally not 100 % reliable for providing real-time information about cryptocurrency prices, market capitalizations, trading volumes, and other relevant metrics. Of course, it is one of the most popular and widely used cryptocurrency data aggregators, and it collects figures from various exchanges and sources. But, it’s essential to understand that while CoinMarketCap strives to provide accurate and up-to-date information, there can be occasional discrepancies or inaccuracies due to factors such as:

- Data Aggregation: They gather information from numerous exchanges, each with its own data reporting practices and potential for errors.

- Lack of Regulation: The cryptocurrency market is relatively young and less regulated compared to traditional financial markets. This lack of regulation can sometimes lead to data manipulation or inaccuracies in certain exchanges.

- Technical Issues: Like any online platform, they may experience technical glitches or downtime, affecting the accuracy and reliability of the data temporarily.

- Manipulation: The cryptocurrency market can be susceptible to manipulation, such as pump-and-dump schemes or wash trading, which can distort market figures.

- New and Illiquid Markets: Some cryptocurrencies or tokens may have low trading volumes or be traded on less reputable exchanges, making their market data less reliable.

- Price Volatility: Cryptocurrency prices can be highly volatile, leading to rapid price changes that may not always be accurately reflected in real-time data.

While CoinMarketCap and similar websites make efforts to verify and validate the data they display, users should exercise caution and cross-reference information from multiple sources when making trading or investment decisions. Additionally, using reputable exchanges and data sources can help mitigate the risk of relying on potentially inaccurate market statistics.

Share this Image on Your Site:

Can I trust CoinMarketCap’s Data?

Data aggregator tools like CoinMarketCap can be useful for gathering and organizing large volumes of data from various sources. However, there are several reasons why complete trust in data aggregators may not be advisable. Let’s dive into some problems we are facing in today’s world of data analytics:

Cryptocurrency Data: Bitcoin (BTC), Solana (SOL) & Co.

There are several potential issues when you try to make a Bitcoin price prediction for example. Wrong data, including market capitalization, current prices, and other related metrics will lead to an incorrect target price. Here are the main issues:

- Volatility: Prices are highly volatile, experiencing rapid fluctuations within short periods. This can make it challenging to accurately assess its value at any given moment.

- Lack of Regulation: The cryptocurrency market, is relatively unregulated compared to traditional financial markets. This lack of oversight can lead to issues such as market manipulation, false reporting of trading volumes, and unreliable data from exchanges.

- Liquidity: Liquidity refers to the ease with which an asset can be bought or sold without affecting its price. Bitcoin’s liquidity can vary significantly depending on the exchange and market conditions, which can impact the accuracy of price details.

- Data Sources: There are numerous exchanges where cryptocurrencies is traded, and each may report slightly different prices due to factors such as trading volume, fees, and regional demand. Aggregating data from multiple sources can introduce discrepancies.

- Security Concerns: Exchanges and other platforms where crypto is traded are susceptible to hacking and security breaches. Instances of theft or manipulation can affect the integrity of the data reported by these platforms.

- Manipulation: The relatively small size of the cryptocurrency market compared to traditional financial markets makes it more susceptible to manipulation by large traders or “whales,” who can influence prices and market sentiment.

- Fragmented Market: The crypto market is global and operates 24/7, leading to fragmentation across different time zones and regions. This can result in disparities in pricing and market activity.

- Data Reporting Standards: There are no universally accepted standards for reporting crypto data, leading to inconsistencies in how metrics such as market capitalization and trading volume are calculated and reported.

The Role of Exchanges in CoinMarketCap’s Data Collection

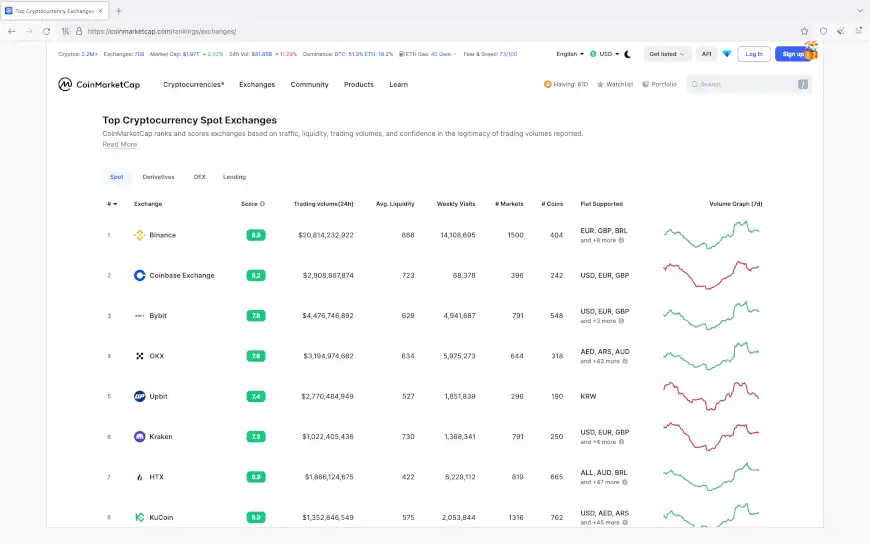

Cryptocurrency exchanges are really important for CoinMarketCap. They help gather all the information about different cryptocurrencies. They collect data from lots of these exchanges, like Binance, Coinbase, and Bitfinex. By getting information from over 230 exchanges, CMC can show users a complete picture of cryptocurrency prices, how much trading is happening, and the total value of the market. Having data from all these different places means CoinMarketCap can include lots of different cryptocurrencies in their information.

Share this Image on Your Site:

Does CoinMarketCap collect data from Coinbase?

CoinMarketCap brings together information from lots of different places where people trade cryptocurrencies, like Binance, Coinbase, Bitfinex, and more. This helps give a complete picture of what’s happening in the world of cryptocurrency. These places allow people to buy, sell, and trade different kinds of digital money, such as Chainlink (LINK), Dogecoin (DOGE), Shiba Inu Coin (SHIB), and Polkadot (DOT), as well as newer coins like TRON (TRX) and XRP.

By gathering data from many exchanges, including BTC and XRP, CoinMarketCap gives users up-to-date prices, trading volumes, and how much different cryptocurrencies are worth in the market. This includes the popular cryptocurrency BTC, which has a market cap of over $1 trillion and is traded on multiple exchanges, including TRON (TRX) and XRP, making CMC a reliable source for tracking the value of XRP and other cryptocurrencies.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWHow exchanges influence the data on CoinMarketCap

When different places where you can trade cryptocurrencies, called exchanges, get involved in the cryptocurrency market, it really affects the information you see on CoinMarketCap. You know, that’s the website where you can check out the prices of different cryptocurrencies.

So, when people trade cryptocurrencies on these exchanges, it directly changes the prices you see on CoinMarketCap. The exchanges where a lot of trading happens have a bigger impact on the overall market info you see. This means they kinda control a big part of what’s going on in the crypto world.

CoinMarketCap uses fancy math stuff, called algorithms, to figure out prices and how much all the cryptocurrencies are worth altogether. They look at all the trading actions from different exchanges to give you a good picture of what’s happening with crypto prices.

By putting together info from lots of exchanges, CoinMarketCap helps people who want to invest in cryptocurrencies. It gives them a better understanding of what’s happening in the market so they can make smart choices about buying and selling.

Risks to Crypto Investors Relying on CoinMarketCap

Using CoinMarketCap for market data is helpful, but it’s not the whole picture. If you only look at CMC, you might miss important changes in cryptocurrency prices. These changes can happen quickly and might not always reflect the real value of a cryptocurrency.

It’s important to do more research before you decide to invest in cryptocurrency. The crypto market is always changing, and many things can affect it. If you only rely on CoinMarketCap, you might not understand everything that’s going on in the crypto world. This could mean you miss out on good opportunities or make bad investment choices.

To make smart decisions about cryptocurrency, you should use other sources of information as well as CoinMarketCap. This will give you a better understanding of what’s happening in the market.

Alternative Data Sources for Crypto Investors

If you’re investing in cryptocurrencies, it’s important to not just rely on CoinMarketCap. There are other places you can look for information that can help you understand the market better. Here are a few options to check out:

Blockchain Explorers

Tools such as Blockchair allow investors to directly access cryptocurrency data from the blockchain network, providing a transparent and decentralized source of information.

ETFs Explorer

An ETF explorer is a tool or platform that allows investors to research and analyze exchange-traded funds (ETFs). These platforms typically provide information such as ETF performance, holdings, expense ratios, historical data, and other relevant metrics to help investors make informed decisions about their investment strategies.

Decentralized Finance (DeFi) Platforms

DeFi platforms such as offer an innovative and decentralized approach to financial services. They provide investors with real-time data on lending, borrowing, and yield farming activities, offering unique insights into the decentralized finance space.

Non-Fungible Token (NFT) Marketplaces

As the NFT market continues to grow, tracking data of non-fungible tokens (NFTs) can help investors gain insights into the popularity and value of digital collectibles, artwork, and other NFT-based assets.

Blockchain News and Analysis Websites

Stay updated with the latest industry news and analysis from reputable websites and trustworthy research centers. These platforms provide comprehensive coverage of the cryptocurrency market, project updates, regulatory developments, and market trends.

In fact, other websites like CoinGecko, CoinCap, CoinRanking, and Coinpaprika offer different perspectives and features compared to CoinMarketCap. They can help investors see things from different angles and spot new opportunities in the market.

When you use multiple reliable websites, you can compare the information they provide and see if there are any trends or patterns. This can help you make smarter decisions when investing in cryptocurrencies. By using a few different sites together, investors can feel more confident about their strategies in the world of crypto.

Conclusion

In summary, while CoinMarketCap is a well-known tool for keeping track of cryptocurrency information, it’s important to understand its limitations and possible issues with data accuracy. The recent takeover by Binance has led to worries about whether the data provided is unbiased and precise. It’s essential for people investing in crypto to be careful and not rely solely on CoinMarketCap when making decisions about trading.

Luckily, there are other places to find data and market capitalization information that might offer a more complete and trustworthy view of the crypto market. It’s a good idea to check out these alternatives and do thorough research before making any investment choices.

If you have more questions or need help navigating the world of cryptocurrency, feel free to reach out to us. Our team of experts is here to offer advice and assistance.

Learn Cryptocurrency Investment!

Bitcoin Training in Small Classes

Webinars about Cryptocurrencies

Bitcoin Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

How accurate are the rankings and data on CoinMarketCap?

CoinMarketCap is often seen as a trustworthy place to find out which cryptocurrencies are doing well and to get information about them. But, just like with any website that provides data, sometimes there might be mistakes or differences because of how quickly the market changes or if there are problems with collecting data. It’s smart to do your research, check information from different places, and look at more than one source before deciding to invest in something. Their website is helpful, but it’s not the only thing you should rely on when you’re thinking about buying or selling cryptocurrencies.

Can you track your portfolio on CoinMarketCap?

Yes, with CoinMarketCap, you can keep an eye on your crypto stash. Just sign up on their website, and you can add your coins to see how much they’re worth anytime. It lets you follow how your cryptocurrencies are doing, so you know if they’re going up or down. Plus, you can get alerts for when prices change or there’s news about the coins you’re interested in. It’s a handy tool for keeping track of your crypto investments and making smart choices.

How frequently is the data on CoinMarketCap updated?

CoinMarketCap makes sure its information is accurate and up-to-date by regularly updating its data. This includes prices, market sizes, trading volumes, and other measurements, which change frequently in the world of cryptocurrency. Users can choose how far back they want to see data, whether they’re interested in past trends or what’s happening right now. This commitment to keeping information current makes their service easy to use. It helps investors stay on top of what’s happening in the market and make smart choices using the platform’s graphs. CoinMarketCap also offers free charts that show both live and past data for popular cryptocurrencies like Ethereum, BNB, and Solana. By including these currencies in its charts, CMC stays a dependable place to find the latest cryptocurrency news.

Can you use CoinMarketCap to make informed trading decisions?

CoinMarketCap is a well-liked website for people who invest in cryptocurrencies. It gives a lot of details about different cryptocurrencies, like their prices, how much they’re being traded, and how much they’re worth overall. But it’s not enough to just look at CoinMarketCap and decide what to do with your money. The cryptocurrency market is tricky and affected by lots of things, such as how people feel about it, news that comes out, and rules set by governments. That’s why investors need to do their research, talk to experts, and look at lots of different places for information before they decide what to do with their investments.

How reliable are alternative market capitalization sites?

Alternative websites for tracking market capitalization offer different viewpoints, giving a complete look at the cryptocurrency market. When investors use these sites, they can learn more about the worldwide crypto community. Relying on several trustworthy market capitalization sites makes analyzing cryptocurrency prices and market patterns more thorough.