Cryptocurrency has taken the financial world by storm, with new coins and tokens being introduced regularly. Terra, a blockchain protocol, has gained attention for its innovative features, including its native token. However, after the implosion of the network and its tokens, the community relaunched the project.

There is a lot of confusion surrounding two versions of the token: Terra Luna Classic, with the new tokens being airdropped to holders of original tokens and UST before the de-peg and subsequent crash occurred. This airdrop was done to preserve the value and ownership of the original token, making the holders of Luna Classic the holders of LUNA.

In this blog, we will delve into the differences between the two tokens, explore the rise and fall of the Terra network, and discuss the unique attributes of Terra Luna Classic tokens. By the end of this article, you will have a better understanding of the ecosystem and the investment potential of these tokens.

Continue reading to find out why crypto experts believe that both coins will fail soon.

- 1. Is Terra LUNA Classic and LUNC the same?

- 2. Terra Network: The Rise and Fall

- 3. Why Two Versions of Luna Coins?

- 4. Understanding Terra Classic (LUNC)

- 5. Understanding Terra (LUNA)

- 6. Competition in the Market: Polygon and Kadena

- 7. What is the Future of Terra?

- 8. The Risk Factors of Investing in LUNC and LUNA

- 9. How Sustainable are LUNC and LUNA Investments?

- 10. Conclusion

- 11. FAQ

Is Terra LUNA Classic and LUNC the same?

Investors often find it challenging to differentiate between Terra Classic (LUNC) and the new token LUNA due to their similar names. However, it is crucial to understand that these tokens are distinct entities within the ecosystem.

Terra Luna Classic, also known as LUNC, refers to the original native token of the original Terra Chain. It was the first version of the token launched in 2018 by Terraform Labs, the creators of the ecosystem. It witnessed historic price jumps, had exchange rates, and showed the demand for this Altcoin during its time of operation. However, this token faced financial risks, price deviation, wide adoption, and the collapse of the terraUSD stablecoin UST, which impacted the value and demand of the original token. As a result, the token that was worth $119 in early April of 2022 fell below one cent by the end of May 2022 on the original Terra Chain, now known as Terra Classic.

On the other hand, LUNA, which stands for their new blockchain protocol represents the new chain, launched as part of the revival plan for the Terra ecosystem. There are some key differences between the new token and the old one. We will explain the details later.

Share this Image on Your Site:

It’s important to note that the collapse of the original terraUSD (UST) stablecoin crypto played a significant role in the creation of the new chain. The collapse of UST affected the price stability of fiat currencies within the ecosystem, leading to the need for a revival plan. The revival plan, also known as the recovery plan, aims to stabilize the market and improve the adoption rates of the ecosystem.

Terra Network: The Rise and Fall

To comprehend the differences between Terra Luna Classic (LUNC) and LUNA, it is essential to understand the rise and fall of the network. The blockchain protocol gained recognition for its innovative approach to stablecoins and blockchain technology, particularly in the South Korean market. However, the collapse of the UST stablecoin and the price deviation of the algorithmic stablecoin impacted the market cap of the ecosystem. Despite facing challenges, the Terra ecosystem tries to evolve and adapt to the ever-changing cryptocurrency landscape, with the help of its unique algorithm that automatically adjusts stablecoin supply based on demand.

Share this Image on Your Site:

The Founders of Terraform Labs

Terraform Labs, the company behind the ecosystem, played a crucial role in the development and growth of the network. Led by CEO Daniel Shin, the team at Terraform Labs worked tirelessly to bring their vision of a blockchain protocol to life.

Daniel Shin, a prominent figure in the cryptocurrency space, is known for his expertise in blockchain technology. He played a pivotal role in the development of the original blockchain and the subsequent launch of Luna Classic tokens. As the CEO of Terraform Labs and co-founder of Fast Track Asia, Shin leads the strategic direction of the company and ensures the ecosystem’s continued growth and success.

Another key individual involved in the creation of the new chain is Do Kwon, a software engineer who contributed to the genesis block of the new chain. His technical expertise and contributions to the ecosystem have been instrumental in the revival plan and the future of their tokens.

Together, the founders of Terraform Labs have shaped the network and contributed to its unique features. Their dedication to the ecosystem’s growth and innovation has maybe paved the way for the success of Terra LUNA and Terra Luna Classic tokens.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWThe History of Crypto Terra

The history of the crypto Terra and its ecosystem traces back to the launch of their original blockchain in 2018, which introduced the concept of algorithmic stablecoins. This blockchain protocol aimed to address the issues faced by traditional stablecoins, such as price stability and market demand.

This blockchain protocol gained recognition for its unique features, including the native token, which served as the backbone of the ecosystem. The integration of new tokens into the existing chain expanded the capabilities of the ecosystem and facilitated the wide adoption of fiat currencies within the blockchain network.

However, the Terra ecosystem faced challenges, particularly with the collapse of the UST stablecoin, which impacted the stability of the ecosystem and led to the need for a revival plan. Despite these difficulties, their blockchain protocol demonstrated its resilience and adaptability, attracting users and investors looking for alternative blockchain solutions.

The UST and Crypto LUNA Crash

Its role was to serve as a twin token to absorb any price deviation of the blockchain’s algorithmic stablecoin, terraUSD (UST). UST was supposed to keep its price pegged to the U.S. dollar by creating (minting) and (destroying) burning UST tokens to balance the stablecoin’s supply and demand at a $1 price peg.

When UST lost its dollar peg and collapsed in May 2022, the token fell into a hyperinflationary spiral because the algorithm that was intended to back up UST created trillions of tokens, diminishing its value by almost 100%. This led to a crash in both the price of the UST stablecoin and the crypto LUNA, causing concern and speculation among investors about the stability of the UST and its relationship to the US dollar over the next week, reaching an all-time high of $119.51 before its collapse.

After facing this significant crash, the wide adoption of Classic had a substantial effect on all token holders.

Why Two Versions of Luna Coins?

There are two versions of Luna Coins in circulation due to the collabs of UST a change in the blockchain technology. Coin 1.0 was built on the Proof of Work (PoW) consensus algorithm. After the crash, the old version was left and the name of the coin was changed to Classic (LUNC). Coin 2.0, also known as LUNA v2, is now built on the Proof of Stake (PoS) consensus algorithm and the token is called LUNA. The quantity of LUNA 2.0 connected to each node determines their voting privileges in the network consensus, making it a crucial factor in the success of the cryptocurrency.

Understanding Terra Classic (LUNC)

Terra Luna Classic, a mainstay in the crypto space, has had its share of volatility, with the community witnessing both its rise and fall. As for LUNC, the market situation is a topic of interest. Can LUNC recover from its current position? The future of both raises questions, making it crucial for investors to analyze the sustainability of their investments amidst market predictions and financial risks.

Share this Image on Your Site:

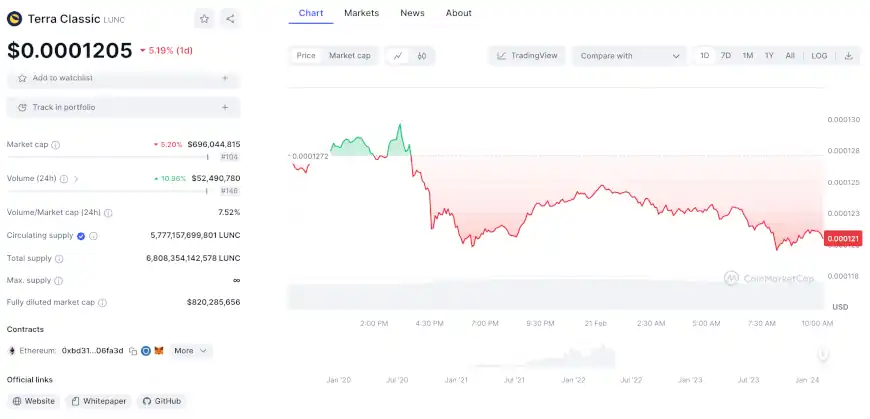

What is the current market situation of LUNC?

LUNC is bobbing along. It is not easy to understand why the old blockchain is still in use. Accordingly, the cryptocurrency is more or less only traded for fun.

Can Terra Classic (LUNC) Recover?

The tumultuous rollercoaster has nevertheless led crypto experts to maintain an optimistic perspective on Terra Luna Classic’s future. Binance announced it would burn all trading fees related to Classic spot and margin trading pairs. This was a short booster for LUNC.

Based on the predictions from DigitalCoinPrice, it’s expected Classic’s price to creep up to around $0.00067 by the year 2025 and rocket to $0.0019 by 2039. AMB CRYPTO shares a similar sentiment, projecting Luna Classic’s price to rise to $0.00046 by 2025 and reach $0.001 by 2030.

Several factors have combined in contributing to the recent upward trend in Classic’s (LUNC) value. The key events trace back to late September 2023, when the Classic community made significant decisions that had a broad impact on the cryptocurrency’s trajectory.

Understanding Terra (LUNA)

Terra (LUNA) has gained attention due to its resilience during the UST crash and its pivotal role in the Terra Alliance. Its adherence to the protocol safeguards it from vulnerabilities like the DAO hack. Notably, it’s backed by strategic partnerships with crypto exchanges in South Korea and the United States, as listed on our crypto exchanges page. They have shown significant interest in its progress, reflecting its potential for sustainability in the crypto market.

Share this Image on Your Site:

The relaunch of Terra 2.0

Based on Tendermint, Terra 2.0 or v2 is a public blockchain that emerged from Terra luna Classic. After the “de-peg” of USTC in May 2022, the community behind Classic decided to create a new Terra blockchain without the algorithmic stablecoins, called Terra 2.0. The new LUNA tokens were airdropped to the old users that were affected by the de-peg event, and the new Terra blockchain, with its innovative features and improved user experience, is set to be relaunched. The LUNA community, known as “LUNAtics“, will continue to play a crucial role in the development and growth of Terra 2.0. Additionally, many DApps have agreed to migrate to Terra 2.0, ensuring the continuation of their functionality.

What Makes Terra LUNA Unique?

LUNA is the native token of the Terra 2.0 project. The current use cases include:

- Staking: Users stake this coin to validators who record and verify transactions on the blockchain in exchange for rewards from transaction fees.

- Governance: Token holders can participate in treasury governance and stakers can participate in proposals and voting.

- Paying Fees: Users use tokens for processing transactions and storing data.

The project consists of the following major components working in conjunction:

- Terra Core: the official Golang reference implementation of the protocol.

- Terra Station: the official wallet, allowing transactions, smart contract testing and interactions, and other functions.

- Terraform Labs (TFL): an entity that facilitates the development, and maintains the explorer, the Core, and other technical infrastructures.

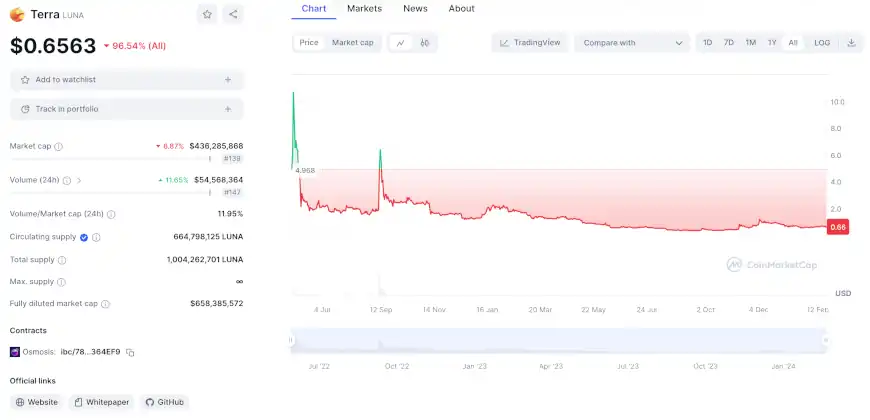

What is the current market situation of LUNA?

LUNA got off to a brilliant start in May 2022 and jumped to a price of $10.72. However, it immediately collapsed again. In November 2022, the price shot up again to $6.4193. But in between and since then, it has just been bobbing along with a current market price of $0.66. You can track the live LUNA to USD price in real-time and see its ranking on CoinMarketCap at #138 with a market cap of $448,252,526. However, the current market situation of LUNA is not looking promising, with a 24-hour trading volume of only $52,699,867 and a decrease of 5.93% in the last 24 hours. This raises concerns about the future success and its potential to fail in the market.

Competition in the Market: Polygon and Kadena

The competition in the market extends with Polygon (MATIC) and Kadena (KDA) gaining significance. This has led to increased attention from crypto exchanges and investors, with the top cryptocurrency exchanges for trading in Terra stock being Binance, OKX, Bybit, DigiFinex, and UEEx. If you would like to know where to buy Terra at the current rate, these are the top exchanges to consider. Polygon’s scalability and interoperability, combined with Kadena’s focus on security, pose a challenge to the protocol and its position in the market. If we look at the price trends of the three coins, it is clear that Polygon is and will probably remain the clear favorite in the crypto community.

It seems that Whales, the biggest investors, are trying everything to prevent the definitive demise of the company. The strategy of keeping two blockchains and two tokens running could work, but in the long term, it will be difficult to leave the competition behind. Polygon in particular has long outstripped Luna on the market.

What is the Future of Terra?

The bear case is much stronger for Terra in its current state. Its biggest challenge is the progress of Ethereum, which has traditionally struggled with scalability.

In recent years, alternative layer-one (L1) blockchains have benefited from Ethereum’s inability to handle significant user demand without fees rising to unsustainable levels. But Ethereum 2.0 now offers layer-two (L2) solutions as well.

Solana, Polkadot, and Avalanche are no longer just “competitors” in this space, but miles ahead. With these findings, it is clear that Terra has potential growth opportunities, but also faces huge challenges.

The Strategy of Terraform Labs and Do Kwon

Terraform Labs, led by CEO Daniel Shin, holds a crucial position in the ecosystem. The international monetary fund’s backing of Terra through the fast-track Asia initiative has garnered attention. Emphasizing coin demand and exchange rates, Terraform Labs’ strategy aligns with the development of the new blockchain by software engineer, Daniel Shin. This strategy encapsulates the live market cap and current Coinmarketcap ranking, positioning them still as a significant player in the crypto market.

Does LUNC have a Future?

In the analysis cited above, Terra Luna Classic (LUNC) projections are rather contradictory. There is no universal consensus either about positive or negative future LUNC price movements. Indeed, the future possible growth depends on various factors: announcements, new technological solutions of the Terra Luna Classic projects, the crypto environment in general, legal position, and so on.

Is there a Future for LUNA?

The future of LUNA depends on the stability and demand of the coin, as well as the wide adoption of fiat currencies within the ecosystem. The circulating supply of these tokens also plays a crucial role in the price stability of the UST stablecoin. The revival and success of Terra hinge on many factors. But after the first collapse and the overwhelming competition, it will be very difficult, if not impossible, for the developers to turn things around in a short space of time.

The Risk Factors of Investing in LUNC and LUNA

Investing in LUNA and LUNC comes with inherent risks, influenced by market dynamics and external factors. The UST and its crash significantly impacted investor confidence. Market predictions and financial risks also play a crucial role in investment decisions, affecting the sustainability of investments. Understanding these risk factors is essential for informed decision-making in the crypto market. Assessing the impact of events like the Terra crash and the aftermath of the DAO hack is crucial for evaluating the potential returns of investing. Overall, the risk factors for investing are very high.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWHow Sustainable are LUNC and LUNA Investments?

Investors need to evaluate the long-term stability of LUNC and LUNA investments. Market factors, demand dynamics, and blockchain protocol stability all play a role in determining sustainability. Understanding market trends and adoption rates is crucial for assessing the viability of these investments. It will take much more time to see whether such an investment is sustainable or not.

Conclusion

In conclusion, understanding the differences between Terra Luna Classic (LUNC) and LUNA is crucial for making informed investment decisions. While Classic has faced challenges in the market, it’s important to consider its potential for recovery and future growth. On the other hand, Terra has relaunched its 2.0, showcasing its unique features and positioning itself as a strong competitor in the market.

As with any investment, there are risks involved, and market predictions should be taken into account. However, both LUNC and LUNA offer opportunities for investments if approached with caution and careful consideration. Whether you choose to invest or not, it’s essential to stay informed and keep track of market developments to make well-informed decisions. If you need further information or help, then contact one of our experts.

Learn Cryptocurrency!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Crypto Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Cryptocurrency.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

Can Terra Luna Classic reach 1 Dollar?

Experts predict Terra Luna Classic’s future value is uncertain, but it has the potential to reach 1 Dollar. Market demand and adoption rate will play a crucial role in determining its success. Investors should always conduct research and seek guidance before investing in any cryptocurrency.

Where Can You Buy Terra 2.0 (LUNA)?

Terra 2.0 (LUNA) can be purchased on reputable cryptocurrency exchanges like Binance, Coinbase, and Huobi. Before buying, make sure to research and select a reliable exchange. Create an account and complete the verification process. Keep track of the market as prices may fluctuate.

Should you invest in Terra LUNA 2.0?

Investing in Terra LUNA 2.0 requires careful consideration. Assess your financial goals and risk tolerance. While there is potential for growth, it comes with risks. Conduct thorough research and seek advice from a financial advisor before investing in any cryptocurrency. Remember, investments carry no profit guarantees, so only invest what you can afford to lose.

Will Luna 2.0 fail the same way as Terra Luna Classic?

While no system is completely immune to failure, Luna 2.0, an upgrade to the Terra network, has implemented improved security measures. The team has taken steps to prevent the issues faced by the Classic coin, including implementing a proof-of-stake consensus mechanism that considers the quantity of 2.0 connected to each node. It’s important to stay updated on potential risks and take precautions when using any blockchain platform.

Is Terra Luna crypto undervalued?

Crypto valuation is constantly changing, making it difficult to predict. Terra Luna has experienced significant growth due to its unique features. Some analysts believe it may be undervalued compared to similar cryptocurrencies. Before investing, do your own research and consult with a financial advisor.