As we approach Spring in 2024, people who are interested in cryptocurrencies and investors are eagerly waiting for a big event related to the cryptocurrency BTC – the next Bitcoin halving.

It’s such an important event for this cryptocurrency that happens about every four years. This event doesn’t just affect miners; it also has big effects on the BTC price, how many coins are available, and the economy of this major cryptocurrency.

In this article, we’ll look at the interesting world of BTC, its history, what experts think might happen during the big event in 2024, and how it affects investors, miners, and the whole cryptocurrency market.

Understanding Bitcoin Halving

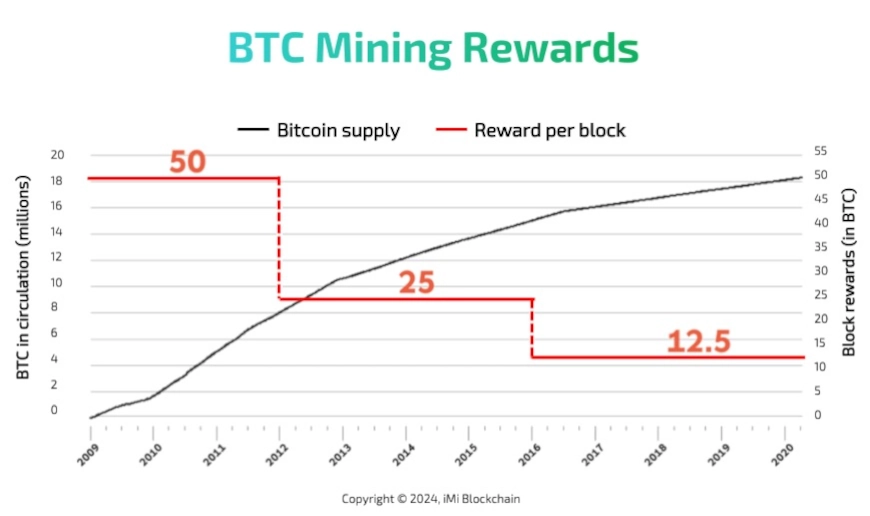

To understand what Bitcoin halving means, let’s break it down. It is when the rewards miners get for adding new blocks to the blockchain are cut in half. This happens automatically in this cryptosystem after about every four years, or once every 210,000 blocks are added. So, during this event, the reward that miners get is reduced by half, also known as BTC mining rewards.

This directly affects how many new BTCs are created and put into circulation, as it is a fundamental event pre-programmed into the Bitcoin protocol. Essentially, it makes Bitcoin rarer as time goes on and this makes it a big deal when we think about the future Bitcoin price predictions.

Share this Image on Your Site:

The Mechanism of Bitcoin Halving

The Bitcoin halving cycle is a crucial part of how cryptocurrency BTC works. When Bitcoin was created by someone named Satoshi Nakamoto, they decided there would only ever be 21 million BTCs. This makes Bitcoin scarce, which helps make it valuable.

To keep track of how many Bitcoins are made, there’s something called the block reward. This is a reward that people who mine Bitcoin get when they successfully add a new group of transactions to the network. At first, when this crypto started, miners got 50 Bitcoins each time they added a block. But every so often, the reward gets cut in half. The first made the reward 25 BTCs, then 12.5 BTCs, and the most recent in 2020 made it 6.25 BTCs.

Cutting the block reward helps make sure that new Bitcoins are released into the system at a steady pace. This controlled release, along with more and more people wanting this cryptocurrency, affects its price.

Also, it encourages miners to keep working to secure the network. As the reward gets smaller, miners have to work harder to get it. This competition helps keep the system safe and trustworthy, as miners want to get rewards, so they make sure transactions are valid and add new blocks to the chain.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWThe Bitcoin Halving Cycle

The Bitcoin halving cycle is a big deal in the cryptocurrency world for a few reasons. First off, it gets a lot of attention from people who are into cryptocurrencies because it’s seen as a really important moment in its history. These events have usually caused the price of Bitcoin to go up a lot, both before and after the event, for various reasons. This happens because fewer new BTCs are made, and more people want them, so the price goes up.

| Event | Date | Block Number | Mining Reward |

|---|---|---|---|

| Launch of BTC | 2009-01-03 | 0 | 50 new BTC |

| 1st | 2012-11-28 | 210.000 | 25 new BTC |

| 2nd | 2016-07-09 | 420.000 | 12.5 new BTC |

| 3th | 2020-05-11 | 630.000 | 6.25 new BTC |

| 4th | Expected 2024 | 740.000 | 3.125 new BTC |

| 5th | Expected 2028 | 850.000 | 1.5625 new BTC |

| Max. Supply reached | Expected 2140 | 6.930.000 | 0 new BTC |

Also, when this happens, it shows that this crypto isn’t like regular money that can lose value over time because of inflation. Bitcoin has a limited supply, so it doesn’t lose its value as easily. This scarcity of BTC, which is made clear during this process, makes people think of it as a safe way to keep their money and a good way to protect themselves from inflation in regular economies.

Besides just affecting prices, and as a result, it is also important for keeping its economic system stable and sustainable. Making new coins slower to come out, keeps inflation under control in the Bitcoin world. As we get closer to the total number of coins that can ever exist (which is 21 million), the inflation rate goes down, which means Bitcoin is less likely to lose value over time, unlike regular money.

To sum it up, the Bitcoin halving cycle affects the price, supply, and inflation rate of BTC, making it a big deal for people who invest in cryptocurrencies, mine them, and everyone else involved in the market. The excitement and attention around these events show just how important BTC is as a digital currency and a way to store value, especially considering the impact it has on Bitcoin’s price.

Bitcoin Halving Dates

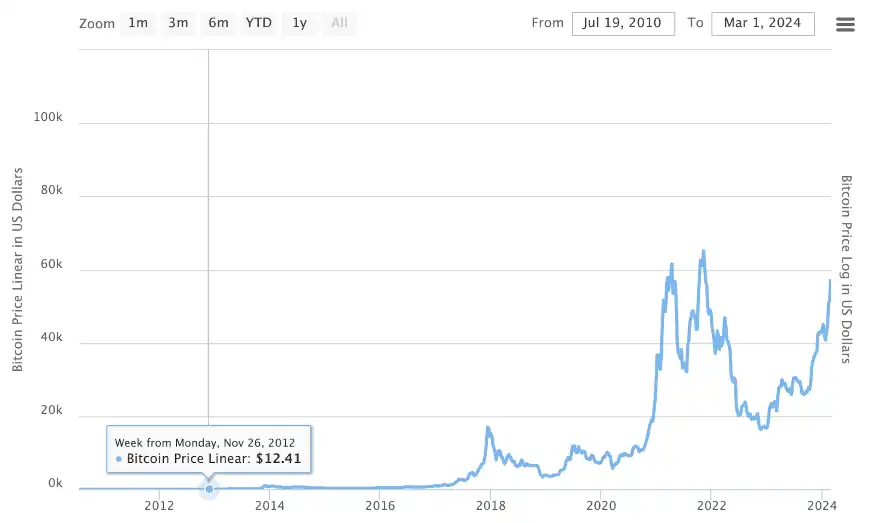

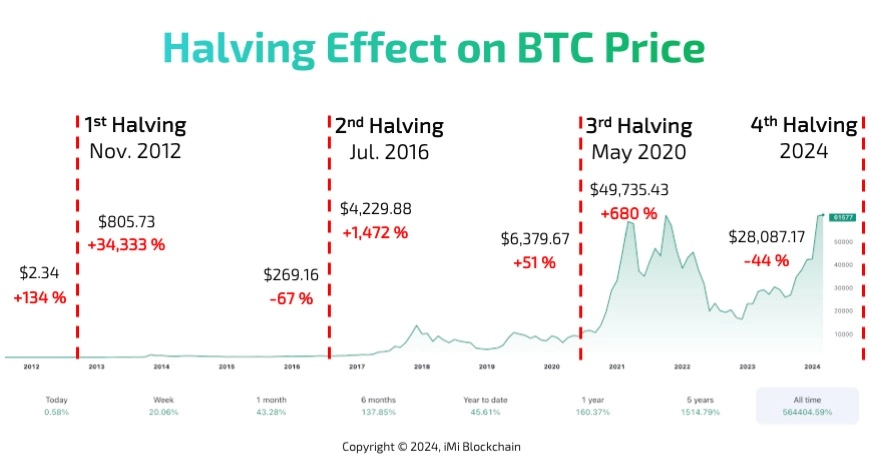

To understand why these dates are important, let’s look back at what happened during past events. There have been three such events so far. The first one, known as the first Bitcoin halving, occurred on November 28, 2012. During this event, the reward for mining blocks went down from 50 BTC to 25, marking the first time the rate at which new Bitcoin is created decreased by half. This showed that Bitcoin’s supply is limited, which affects its value.

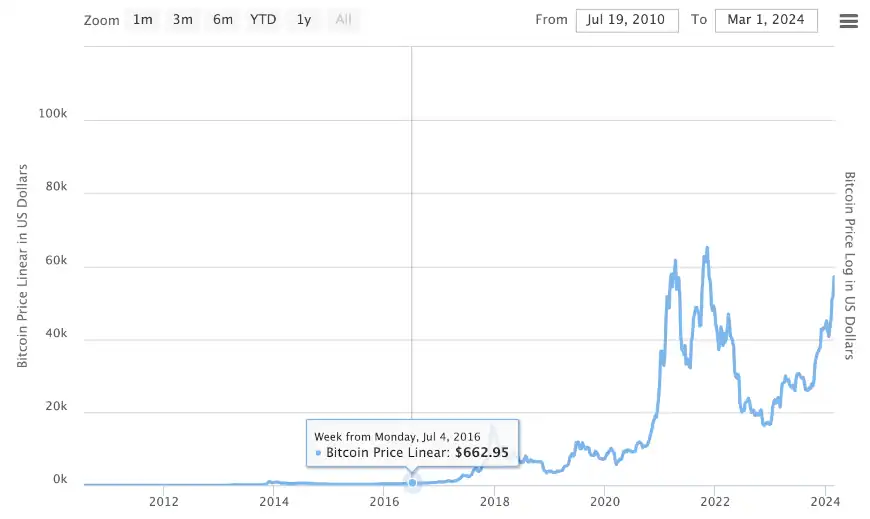

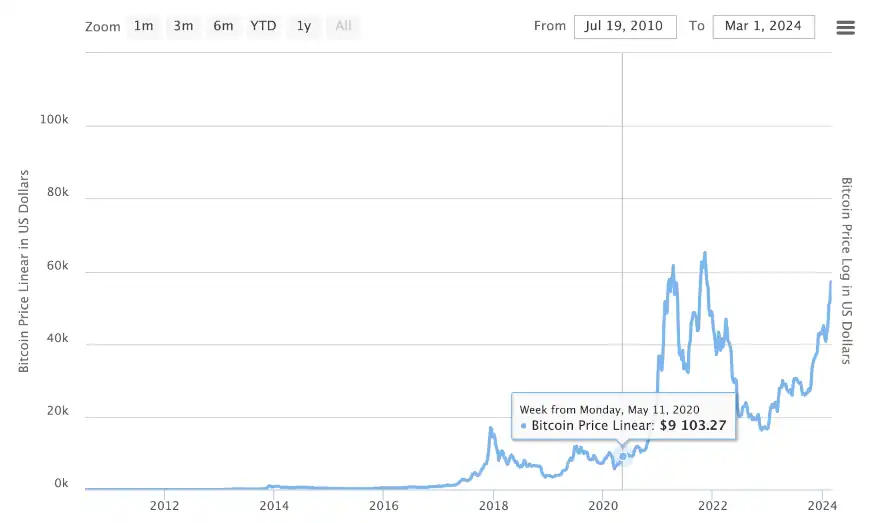

The second halving occurred on July 9, 2016, when the reward dropped from 25 to 12.5 BTC. After this, its price went up significantly, proving that it’s seen as a valuable asset. The most recent halving happened on May 11, 2020, reducing the reward to 6.25 coins per block. Now, we’re waiting for the next halving event, known as the fourth Bitcoin halving, which is set to occur in 2024.

Share this Image on Your Site:

Bitcoin Halving History: First Event 2012

The initial event in Bitcoin halving history occurred on November 28, 2012, around four years after the cryptocurrency was introduced. At that time, the block reward decreased from 50 to 25 coins, effectively cutting in half the rate at which new coins were generated. This marked a crucial moment for Bitcoin, confirming its status as an innovative digital currency.

Following the first event in 2012, BTC saw a significant increase in its value, driven by speculation in the market and growing demand. This event emphasized the finite supply of Bitcoin, strengthening its reputation as a dependable asset and kickstarting the bull run. Consequently, this cryptocurrency gained widespread attention, drawing in new investors and supporters to the cryptocurrency realm.

Second Bitcoin Halving in 2016

On July 9, 2016, something important happened to Bitcoin. It was its second halving event. This event made a big change to how many miners could get as a reward for verifying transactions. Before this, they could get 25 BTC, but after, it became 12.5 coins. This change was a big deal in the history of Bitcoin. It showed that this crypto was becoming more important, like digital gold or something valuable to keep.

After the second split, its price went up a lot. Many people were excited about this event, especially investors and people who like to take risks to make money. The reason for the price going up was that there would be fewer new coins made, and people started to understand that there would only ever be a limited number of Bitcoins. This made them want to buy more BTC, which made the price go up even more. The second showed that Bitcoin was not just a type of money but also something you could invest in like stocks or gold.

Third Bitcoin Halving in 2020

The most recent Bitcoin halving, also known as the third halving, happened on May 11, 2020. This was the last Bitcoin halving event, reducing the block reward from 12.5 BTC to 6.25 BTC. This means there are now fewer new coins entering circulation.

This event got a lot of people talking again about why Bitcoin is valuable and why there’s a limit to how many can be made. Big investors, regular people who invest, and fans of cryptocurrency were all paying attention.

Before and after this most recent event, the price of Bitcoin went up and down a lot. Lots of things can affect the price of Bitcoin, like how people feel about it, what they think will happen, and stuff going on in the world.

Now, people are thinking about what will happen in 2024. It’s important to think about what happened in the past, how it affected the price of Bitcoin, and how people see Bitcoin as a kind of money and as something valuable.

The Next Bitcoin Halving 2024

As we look ahead, one question that many people are asking is, “When will the future Bitcoin halving 2024 happen?” The exact date is set in advance based on block height, which makes it tricky to know the exact date. However, by looking at past patterns, we expect the next BTC cut to occur around May 2024.

We estimate this based on what has happened in the past. Previous events have happened about every four years. As we get closer to the big day, people involved in the market, like investors, miners, and fans of cryptocurrency, are paying close attention to the countdown to this big event.

Share this Image on Your Site:

Factors Influencing the Halving

Many things affect Bitcoin halving and what happens afterward. One big thing is how Bitcoin mining works. This is when new coins are made, and transactions are checked on the blockchain. Miners are really important because they help keep the network safe and make sure the decentralized ledger stays correct.

Other things outside of Bitcoin mining can also make a difference. Like, what central banks do with money and how people feel about the cryptocurrency market. If central banks change interest rates or do things like making more money, it can change how the market works. And if the overall mood about cryptocurrency changes, or if big things happen in the world, that can also change what happens during this important event.

Expected Halving Dates and Changes

The 2024 Bitcoin halving is a big deal for people who follow cryptocurrency. Basically, every so often, the reward that miners get for verifying transactions gets cut in half. This time, it’s going from 6.25 down to 3.125 BTC for every block of transactions they verify.

This happens after about every 210,000 blocks are added to the network. But because the time it takes to add these blocks can change, it’s hard to know exactly when it will happen.

Still, as the big day gets closer, investors, miners, and fans of cryptocurrency get ready for what might happen to its price. The 2024 split is another important moment in Bitcoin’s history, showing how the world of digital money keeps changing and bringing in new people.

Bitcoin Halving Price

The Bitcoin halving price is a huge search term every 4 years. Because it is such a big deal in the cryptocurrency world. They happen every so often and they can really affect the price of Bitcoin. When this occurs, it means the rate at which new coins are made gets cut in half. This can make the BTC price go up because fewer new ones are coming into the market, but lots of people still want to buy them. So, when there’s less supply and more demand, the price tends to go up. This is why these cuts are so important for people who invest or trade cryptocurrencies.

Share this Image on Your Site:

Bitcoin Halving Chart Analysis

Studying the Bitcoin halving chart and analyzing how the value changed after previous events can teach investors useful things about how BTC prices work. When this happens, the number of new coins created gets cut in half. This event tends to make BTC prices go up. This is because fewer new Bitcoins are being made, and more people become interested in buying them.

In the past, every time Bitcoin halved, its price went up a lot. For example, after the first halving in 2012, the BTC price went from about $11 to over $1,000 in just one year. Similarly, after the second halving in 2016, its price went up a lot again, reaching nearly $20,000 by the end of 2017. Even the most recent halving in May 2020 made the price go up, with Bitcoin reaching its all-time high of nearly $69,000 by November 2021. This trend can be seen in the Bitcoin halving chart analysis, showing the significant impact of halving events on the cryptocurrency’s price.

It’s important to remember that just because something happened before doesn’t mean it will happen again. But looking at what happened in the past can help investors make smarter choices, especially with the next halving event expected in 2024.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWPredictions for Post-Halving Bitcoin Prices in 2024

Predicting what will happen to Bitcoin prices after the 2024 halving is really tough because there are so many things that can affect how the market works. But, based on what has happened before and what people think, there are some ideas about what might happen.

One idea that people talk about is called the “Bitcoin halving cycle.” This means that after such an event, this coin tends to have good times in the years that follow, with prices going up a lot. This happens because fewer new coins are being made, and more people are using it and paying attention to it.

Even though it’s hard to say for sure what will happen to the BTC price after the 2024 halving, experts and people who trade in the market use different methods to guess what might happen. They look at things like charts, technical stuff, and what’s going on in the market to guess where the price might go. But, it’s important to be careful with these predictions because the cryptocurrency market can change a lot and is affected by many different things, including the introduction of Bitcoin ETFs.

No matter what actually happens to the price, the 2024 halving will probably have a big effect on its price, how much of it is out there, and how the market works. This shows how important these events are for the future of digital money.

Bitcoin Halving and its Impact on Miners

Bitcoin halving has a big effect on miners, the people, and companies who make sure the blockchain is safe and transactions are valid. When a halving happens, miners’ rewards get cut in half. These rewards usually come from block rewards and transaction fees. This change affects how much money miners make and how they run their mining business.

As the block rewards go down, miners have to find new ways to make their mining business profitable. Transaction fees become more important because they’re another way miners can make money. This makes miners want to focus on transactions that have higher fees. Because of this, some miners might decide to stop mining, while others change how they work to stay competitive.

Share this Image on Your Site:

How Halving Affects Mining Profits

After a Bitcoin halving event, the rewards miners get for successfully adding a new block to the blockchain get cut in half. This means they earn less money for their work. As a result, it’s harder for miners to make a profit because they’re getting less money for doing the same job.

Because miners earn less, they have to find ways to save money and make more from other sources, like transaction fees. These fees are what users pay to have their transactions included in the blockchain. So, after a halving event, transaction fees become even more important for miners because they make up a bigger part of their earnings.

With less money coming in from block rewards, miners have to be smart about which transactions they prioritize. They’ll focus on the ones with higher fees to make the most money.

After a halving event, the BTC mining business gets even more competitive. Miners have to keep a close eye on everything, like their equipment, how much energy they’re using, and how much everything costs. To stay in business, they have to make smart decisions and change the way they operate.

Possible Scenarios for Miners After 2024 Halving

Looking ahead to the 2024 halving, miners are facing different situations that could happen, each with its own challenges and chances.

One possible situation is that miners change how they work to keep making money despite getting fewer rewards for each block they mine. This change might mean getting better mining gear, making deals for cheaper energy, or spending less money on running their operations. On the other hand, some miners might decide to leave the market completely because there are more people competing for rewards and it’s harder to make a profit. Mining Bitcoin becomes less worth it for Bitcoin miners who have to spend a lot on running their equipment or don’t have access to cheap energy. This could lead to fewer miners overall and change who has the most power in mining, making it more competitive.

Besides, after the halving, transaction fees become even more important for miners. Since they’re getting fewer rewards from mining, they rely more on the fees people pay to have their transactions included in blocks. Because of this, miners might give priority to transactions with higher fees, which could make it take longer for transactions to go through and cost more.

In the end, what happens to mining after the 2024 halving will depend a lot on what’s happening in the market, how technology is improving, and the choices miners make. Being able to adjust to the new rewards and making their mining operations better will be really important for miners to do well and keep making money in the changing Bitcoin world.

Charting the Future of Bitcoin Post-Halving

Charting the future of BTC post-halving also shapes what might happen with BTC in the future. As we get closer to the 2024 cut, folks in the market are thinking about what this means for how many coins there will be, how fast they’re made, and whether Bitcoin will keep being used like money online.

There will only ever be 21 million Bitcoins, and whenever a halving happens, it means fewer new coins are made. This makes it rarer and stops it from losing value over time like regular money does.

Halving events makes sure BTC keeps its value as something people want to have and hold onto. They also make sure it stays different from regular money, which can lose value over time because more of it gets made.

Supply and Inflation Control in Bitcoin Network

Bitcoin halving is an important part of how this cryptocurrency works. When it was made by Satoshi Nakamoto, he said there would only ever be 21 million of it, limiting the total supply of Bitcoin. This is different from regular money because central banks can make more whenever they want, which can make money worth less over time. The purpose of the Bitcoin halving is to control the inflation rate of Bitcoin by reducing the rate at which new Bitcoins are created, making it a deflationary digital asset over time. Understanding supply and inflation control in the Bitcoin network is crucial for investors and users alike.

Halving events are when the amount of new coins that get made every time a new block is added to the blockchain gets cut in half. This helps to slow down how fast new coins are made, so there aren’t suddenly too many of them.

As halving events happen, the amount of new coins that get made goes down, which makes Bitcoin rarer. This, along with more people using it and paying attention to it, makes BTC worth more over time and makes it a good way to save money.

The total amount of Bitcoin that’s being used, called the circulating supply, is also important. With each halving event, the circulating supply goes up slower, which makes this coin even more rare and special.

Because halving events helps to keep the number of new Bitcoins under control, they make it more stable and easier to understand. This, along with the fact that there will only ever be a limited amount of BTC, makes it attractive to people who want to invest in it and use it to protect their money from losing value over time.

Expected Market Reactions and Economic Implications

The 2024 halving event is expected to cause big changes in the cryptocurrency market and even affect the economy as a whole.

When halving events happen, the market tends to get a bit wild. Prices can jump around a lot, and people pay a lot of attention to what’s going on. This can make prices go up, leading to what’s called a bull market, where everyone’s excited and trading a lot.

Also, when this event occurs, more people tend to get interested in Bitcoin and Altcoins. This means regular people, big companies, and even banks start paying attention. They see this cryptocurrency as a safe way to keep their money, so they might start investing in it too. This could make the overall value of cryptocurrencies go up.

Halving events can also lead to new stuff happening in the cryptocurrency world. For instance, when the 2024 event comes around, there might be new ways to trade BTC, like through special funds or investment products. This would make it easier for more people to get involved with cryptocurrency.

When we talk about the bigger picture, halving events make people think about digital money, how central banks work, and what rules should be in place. As cryptocurrencies get more popular, governments and banks are thinking about how to handle them. This could mean new laws or policies that affect how cryptocurrencies are used and traded.

Why Should Investors Keep an Eye on Bitcoin Halving?

Bitcoin halving events are really important to investors, even those who aren’t necessarily deep into cryptocurrency. These events can seriously affect the price of BTC, how much of it is available, and how people feel about the market, which all really matters when deciding where to put your money.

Because there’s only a certain amount of BTC out there, and halving events make it even scarcer, its value tends to go up over time. This is attractive to investors who want something that holds its value well. If investors understand what happens during this event, they can make smarter choices about when to buy or sell BTC, and maybe even make some money as the price goes up.

So, basically, halving events is a big deal for anyone thinking about investing in Bitcoin.

What are the Implications of the 2024 Halving for Bitcoin Investors?

As we look forward to the upcoming big event in 2024, it’s essential for Bitcoin investors to think about how it might affect their investments and what strategies they might consider. Also, this event always has a huge impact on most cryptocurrencies, such as the Ethereum Price (ETH) or Cardano (ADA).

To begin with, during the 2024 halving event, the block reward for miners will be reduced to 3.125 BTC. This means that the rate at which new coins are produced will slow down even more. In the past, when the supply of Bitcoin decreased like this, and demand increased, it often led to the price going up. So, this is something investors might want to keep in mind.

Historically, the BTC price has gone up significantly after previous halving events, suggesting that it might happen again in the future. Investors who are thinking about the next event could try to position themselves in a way that takes advantage of potential price changes. They might want to think about things like how prices have moved in the past, what the market is doing now, and what patterns they’ve noticed.

The halving event doesn’t just affect the supply of Bitcoin; it also has an impact on things like inflation rates and how much attention the market pays to this coin. This helps to show why Bitcoin might be valuable as an investment that can help protect against inflation or diversify a portfolio. People who want to guard against inflation or get into the cryptocurrency market might see the 2024 event as a good chance to do that.

But, it’s important to remember that every investor is different. Everyone has their own goals, their own comfort level with risk, and their own ways of investing. So, before making any decisions, investors should take the time to think about how the 2024 halving event might affect them personally. Understanding what happened during previous events, how the market has changed, and what people are saying about Bitcoin can help investors make choices that they feel good about.

Conclusion

In conclusion, the Bitcoin halving 2024 is really important for the cryptocurrency world. We’ve learned from past events that they can seriously affect Bitcoin prices, mining profits, and how the market works. It’s crucial for investors to pay attention to this upcoming split and understand what it means for their investments.

Don’t pass up the chance to explore the fascinating world of BTC halving and its opportunities for growth and making money. If you want to stay in the know and make smart choices, reach out to our experts. They can give you helpful advice and tips. In case you are new to cryptocurrencies, then consider taking courses at the iMi Blockchain Academy.

Learn Bitcoin!

Bitcoin Training in Small Classes

Webinars about Bitcoin

Bitcoin Beginners Course

Get our Top Crypto Tips!

Get monthly tips on Cryptocurrency.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

What is the next date for Bitcoin halving?

The exact date of the next Bitcoin halving, estimated to occur around May 2024, remains a point of anticipation in the cryptocurrency community. Due to the nature of the protocol, in which this cut is based on block height, the exact date cannot be determined until block time and mining difficulty fluctuations stabilize. However, based on historical patterns, market participants anticipate the next halving event to occur approximately every four years, making May 2024 a likely time frame for the next big event.

Is Bitcoin halving bullish?

Bitcoin halving events have historically been associated with bullish price movements, characterized by bull markets and price appreciation. The reduction in new supply of this coin, combined with increased market attention, has often led to heightened demand, price appreciation, and bullish market sentiment. However, market dynamics are influenced by various factors, and past performance is not indicative of future results. While these events can contribute to upward price movements, it is essential to consider market fundamentals, investor sentiment, and external factors when analyzing price trends and market trajectories post-halving.

What happens during Bitcoin halving?

During Bitcoin halving, the block reward, the reward miners receive for successfully mining a new block, is halved. This process occurs approximately every four years, reducing the rate at which new coins enter circulation and slowing down the total supply of BTC. The block reward reduction has significant implications for miners, supply dynamics, and price appreciation. Historically, these events have sparked market attention, increased price volatility, and triggered bull markets. The reduced rate of new supply, combined with increasing market adoption, further emphasizes Bitcoin’s store of value properties and scarcity, making the halving event a critical event for market participants.

How can I trade the Bitcoin halving?

Trading the Bitcoin halving event requires careful consideration of market dynamics, risk management, and individual goals. Investors interested in capitalizing on potential price movements around halving can employ various trading strategies, including technical analysis, trend following, and event-driven trading. These strategies involve analyzing market indicators, price patterns, and historical data to make informed buy or sell decisions. It is important to note that cryptocurrency markets are highly volatile, and trading should be approached with caution. Thorough research, risk management, and consultation with financial professionals are essential when engaging in trading strategies.

How does the Bitcoin halving affect its price?

The Bitcoin halving event has the potential to impact the price of BTC due to supply dynamics and market sentiment. The reduction in the block reward, which reduces the rate at which new supply enters the market, contributes to the scarcity of this coin, with potential supply-demand imbalances. Historically, halving events have prompted market attention, increased demand, and price appreciation, leading to bull markets in the cryptocurrency space. However, market dynamics are complex and influenced by various factors, including market sentiment, geopolitical events, and macroeconomic conditions. While these events have historically been associated with price appreciation, it is essential to consider market fundamentals and conduct thorough analysis when assessing price dynamics before, during, and after halving events.

Should I buy Bitcoin before halving?

It’s often said that buying Bitcoin before a halving might be a good idea. A halving reduces the supply of new coins, potentially making existing ones more valuable. However, it’s essential to do research and consider the risks before investing in any cryptocurrency. Timing the market perfectly is tricky, so be cautious and invest wisely.