Our world is filled with tons of new innovations. As we evolve in thinking and technology, we get to build products that help us live better. An expression of one of these innovations is Bitcoin, the cryptographic digital asset popularly called cryptocurrency.

Bitcoin represents a shift from the usual government-issued money to that issued by virtue of solving cryptographic puzzles. Many people seek to know what is Bitcoin, and a lot more ask, how does Bitcoin work?

This post gives an eye-opener to this subject matter and can provide a good answer to the majority of the questions you may have. Ride along with us and let us explore What is Bitcoin together.

What is Bitcoin and how does it work?

In providing an answer to the question, what is Bitcoin and how does it work? We can project Bitcoin’s value as digital money, generally known as a cryptocurrency. It is a product of technology but with the aim of overhauling the existing financial structure. Bitcoin works based on blockchain technology and is derived as rewards paid out to miners, or validators who keep the network running. Bitcoin explained, in a nutshell, involves sending virtual money to your family or friend, without the need of any authorizing body.

More on how Bitcoin works in transactions will be unfolded in the course of this article. Stay with us!

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWOur Bitcoin definition

Bitcoin is a digital currency that operates in a decentralized manner, that is a central bank or a single authorized administrator. The lack of control by one entity makes it easy for Bitcoin transactions to be carried out on a peer-to-peer basis. Bitcoin is essentially a technological innovation, one that is revolutionizing electronic cash systems, and financial services.

Bitcoin is based on blockchain technology, and it is secured by cryptography. The digital currency transcends just being a payment system. More Bitcoin definitions are now being outlined based on what it represents socio-economically. Two of these definitions are outlined to better explain the phrase: What is BTC? (BTC is the acronym for Bitcoin).

What is a Bitcoin (single unit)?

How to explain Bitcoin in simple words? BTC is digital money, which in most cases can be used to facilitate payments. Bitcoin does not behave like the usual fiat currency, as it is an intangible asset, that is, it cannot be held, felt, or touched. The digital currency is not issued by a central bank, however, it is generated in a process called Bitcoin mining.

Here, a distributed network of transaction validators called miners solves complex cryptographic puzzles to register a transaction in a block. Successfully confirmed transactions are grouped within a block and a reward is issued for that block. That block reward is in the form of new bitcoins. In a nutshell, Bitcoin is a virtual currency that helps process faster, and cheaper transactions and is maintained by miners.

What is Bitcoin in a general sense?

In understanding Bitcoin in the general sense, we can picture the new money as an internet-empowered financial tool. It is designed to help bypass unfavorable banking institutions by letting people transact directly. Bitcoin is a revolutionary asset, that is defined by a progressive valuation that is fast helping to redefine its purpose.

The price of Bitcoin has grown over time, from almost a price below $1 to over $64,000. The technological property of the cryptocurrency is structured such that its total supply is fixed at 21 million. This will help guard against inflation, a unique way Bitcoin is different from fiat currencies. This limited supply is also billed to help the price and valuation growth of the digital currency.

What is the purpose of Bitcoin?

How did Bitcoin start? This is one of the basic questions new adopters tend to ask. Understanding how and why the digital currency was created can be a good point to know its purpose. Bitcoin’s inventor goes by the pseudonym, Satoshi Nakamoto. He introduced the Bitcoin Whitepaper in 2008 and minted the very first Bitcoin in 2009.

Satoshi designed the digital currency to serve as an electronic payment system, and that represented its fundamental purpose at the early stages. However, times have changed, and Bitcoin has evolved from serving as just a payment system. Today, amidst the numerous unfavorable economic policies being introduced by Central Banks, Bitcoin now serves as both a hedge against inflation and as a store of value.

The past year has seen an increase in the number of institutional investors who now keep Bitcoin on their balance sheets. American business intelligence and software firm, MicroStrategy Incorporation is an advocate of storing up Bitcoin in the place of fiat. Other notable firms with Bitcoin investments include electric automaker, Tesla Inc., and payment firm, Square Inc. amongst others.

Judging by the design of Bitcoin and its deflating supply over time, many believe the cryptocurrency is billed to grow in price over time. While cryptocurrency battles with the impacts of harsh regulations from countries like China, a growing number of proponents believe the cryptocurrency is a standard against bad governments. Bitcoin is also seen as a social tool that embodies revolution against centralized authorities and undue money allocations.

The fact that digital currency lowers the barrier of entry in relation to regular bank accounts, is being championed as a tool to drive global financial inclusion.

How long has Bitcoin been around?

When did Bitcoin come out? As highlighted earlier, Bitcoin was floated officially in 2009 and marked the new reign of a digital monetary and financial revolution. Based on the anonymity maintained by Satoshi, and whoever he conceived the Bitcoin idea with – if any – we are unable to tell how long he worked on developing the Bitcoin code.

Bitcoin is a relatively new asset, however, the point in time when everyone discovered its value usually differs. There are some who discovered and were amongst the early adopters of the technology, and there are some who have not yet awakened to the potential of cryptocurrency. Beyond the historical dates, the length or duration per the time Bitcoin has been around differs and is unique from one person to the other.

When did Bitcoin start becoming popular?

Bitcoin has always been recognized as a superior monetary innovation of the 21st century. However, its early uses were reserved for a few computer nerds who used it for transactions. The first major acclaim in recent times the digital currency received was when it rose to a price close to $20,000 back in December 2017. The media attention shifted to the emerging asset at the time, however, this fame soon faded out as the price crashed in the weeks following.

Today, Bitcoin is now covered on the front page of mainstream media outlets, a popularity that was stirred by two key events;

- The influx of institutional and corporate buyers, and;

- The speedy growth of the cryptocurrency to a new all-time high above $64,000 this year. Also, the majority of this price gain has been shed off.

The first event has a huge bearing on the second and both attracted a lot of media jingles that have contributed to the popularity of Bitcoin in general.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWHow does Bitcoin work?

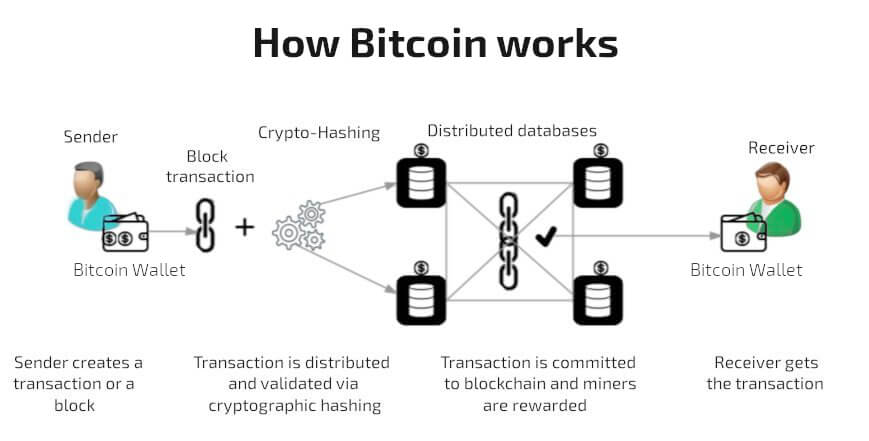

Seeking to understand how Bitcoin works depends to a large extent on the angle one is looking from. There are indeed many angles to understand how this cryptocurrency works, including in sending money, mining or validating transactions, and investing amongst others. Before we talk about Bitcoin mining, let us get a brief snapshot of how Bitcoin works for transactions.

For anyone to transact or send Bitcoin from one person to the other, he or she must have a Bitcoin Wallet, either with a digital wallet provider such as Blockchain.com or with a secure cryptocurrency exchange including but not limited to Coinbase, Binance, and Huobi Global. To gain access to these wallets, there may be a need to complete some regulatory checks including the completion of KYC requirements.

Once your wallet is set up, you can then purchase Bitcoin with a credit card dominated by U.S. dollars (USD) or any fiat currency. Once this is done, you can send the Bitcoin to anyone with a compatible address via the Bitcoin network. You will need to factor in transaction fees (also called gas fees), as the miners that validate this transaction must be paid.

If you are using a self-hosted wallet, such as a hardware or hot wallet, there is a private key that is usually attached. This must be well stored for easy accessibility of the account in case of device damage or theft. Your public key is the one where you can receive payments in Bitcoin. We always recommend storing your Bitcoins on a hardware wallet. To get started, pick one of the following wallets.

Trezor Model T

Trezor.io

$16000

-

>1,000

-

SSH

-

U2F

Ledger Nano S

Ledger

$7000

-

23

-

not available

-

SHA, Grost, KECCAK

KeepKey

Shapeshift

$4900

-

>40

-

not available

-

SHA-256

Where does Bitcoin come from?

Bitcoins are essentially a reward paid out to miners or computer nodes that help to sustain the network. As it works based on blockchain technology, each transaction must be grouped together and registered in a block. However, this transaction registration is not as easy as it sounds. The bitcoin miners are typically distributed across various locations and compete to solve a hashing puzzle that will let them register transactions in a block.

Miners whose computers are powerful enough to solve the puzzle are rewarded with Bitcoins. Following the previous Bitcoin blockchain halving, the reward paid out to miners for each block is now 6.25 Bitcoin. This payout rate is billed to be reduced again in the next three years when the next halving will take place.

The Bitcoin mining process is embodied as a Proof-of-Work (PoW) consensus model, as the nodes are rewarded for their work done in validating transactions. Mining typically consumes a lot of computing power or energy in the form of electricity. This is a situation that has drawn a lot of concern from environmentalists and governments around the world. The process of generating Bitcoin through mining is currently being tipped to embrace renewable energy sources. This will help taper down the carbon footprint of the process in the near future.

If you want to enter the Bitcoin mining business, then you will have to invest heavily in hardware such as:

WhatsMiner M30S

MicroBT

$1,40000

-

3344W

-

88Th/s

-

SHA-256

Antminer S17

Bitmain

$1,61000

-

2680W

-

67Th/s

-

SHA-256

Avalon 7

Avalon

$56000

-

2900W

-

3.5Th/s

-

SHA-256

What is Bitcoin used for in the real world?

The uses for Bitcoin in today’s dynamic digital world are numerous. Besides serving as a growing means of payment amongst peers, virtual currency has found uses as a form of payment in e-commerce. It is also used for real estate payments and other related activities. Usually, the volatility of bitcoin makes it hard to be used in payment. This has however been solved by instant conversion of the received funds to fiat currencies.

The presence of Bitcoin exchanges has also introduced a new financial market. People can buy and sell bitcoin, taking advantage of price changes to earn profits. How do you use Bitcoin is a relative question for everyone with Bitcoin exposure. Many just buy the cryptocurrency and store it as an asset for a long time. Others leverage the price fluctuations in the form of scalping. The use cases of Bitcoin are evolving and all these cannot be controlled by a central authority. Herein lies the power of innovation.

Who uses Bitcoin?

Bitcoin was designed by Satoshi Nakamoto to give everyone an equal opportunity with respect to access to financial tools. Who uses Bitcoin is a question of who has come to know what cryptocurrency represents. The digital currency itself was not designed to sieve out users, so anyone anywhere has an equal opportunity to transact using the asset.

Investing in Bitcoin

In the early days when Bitcoin was introduced, the ways to get involved were limited. Today, anyone can invest in Bitcoin in one of multiple ways including, buying Bitcoin to appreciate, mining Bitcoin, and Bitcoin trading amongst others.

Every Bitcoin investment comes with its inherent risks. This is why people must find answers to such questions as; how does investing in Bitcoin work? For high-net-worth individuals, Bitcoin-related hedge funds can help manage your investments. However, investors who want to get in on the trading game will need to understand such concepts as;

- Impact of volatility on price,

- Bitcoin trading tools, charts, and fundamental analysis, amongst others

- Proper risk management.

Bitcoin users can explore the multiple ways to trade and earn Bitcoin. For beginners, however, one of the safer modes of investing in Bitcoin such as small leverage buys should be the focus at the early stages.

How does a Bitcoin wallet work?

Bitcoin wallets are like a digital account number or room that houses your Bitcoin assets. All cryptocurrencies such as Ethereum, Bitcoin Cash, and more have a wallet. There are essentially two types of wallets; hot wallet (digital wallet), and cold wallet (hardware wallet).

When you open an account with a cryptocurrency exchange, you will be given a hot wallet. However, cold or hardware wallets are USB-like wallets with no connections to the internet. Both types of wallets have their advantages and disadvantages. The choice of either is based on the user and the activities they typically conduct in the crypto ecosystem.

Per the inherent security, hardware wallets are typically considered safer than hot wallets as they cannot be hacked. However, the chances that you can lose your storage keys, and lose access to your assets for life.

Key takeaways

Bitcoin is one of the most remarkable technological innovations of the 21st century. Bitcoin is also known as a cryptocurrency, and it is the product of a cryptographic algorithm that makes it secure. Bitcoin transactions are registered on a public ledger and on-chain transactions must be confirmed by miners and registered in a new block.

The Bitcoin ecosystem offers multiple ways for anyone to invest in the technology. This includes but is not limited to trading, mining, and stacking up for potential future price gains.

If you want to invest in BTC or need help to get started with Bitcoin or any other cryptocurrency, then book an initial consultation right now.

Learn Crypto Online!

Crypto Training in Small Classes

Webinars about Bitcoin and Coding

Crypto Courses at University Level

Get free Crypto

Tips!

Get monthly tips on Cryptocurrencies.

On top, you’ll get our free blockchain beginners course right away to learn how this technology will change our lives.

FAQ

Is Bitcoin real money?

Based on the government’s standpoint of what real money is, Bitcoin is not real money. However, it can serve as a store of value that can be used in e-commerce and for a wide variety of payments.

What does a Bitcoin look like?

Bitcoin is a virtual or digital currency. This implies it cannot be seen with bare eyes, thus no one can tell what it looks like. However, it has some inherent characteristics that can help one identify a Bitcoin asset. The best visual representation of Bitcoin is its tilted ‘B’ logo.

Is Bitcoin a company?

Bitcoin is neither a company nor owned by any one entity. It is a decentralized payment network that is managed by people all over the globe. Anyone can become a miner given the right resources, and contribute towards maintaining the network. While there are companies such as Coinbase, Overstock, Paypal, and others that provide Bitcoin-related services, Bitcoin itself is not a firm. However, Bitcoin shares some similarities with companies that deal with traditional currencies. One of these is that it has a market capitalization, and public figures like Elon Musk are now beginning to take an interest in the network.

Where can I use Bitcoin?

You can use Bitcoin anywhere the cryptocurrency is accepted. There is a growing list of e-commerce sites, real estate firms, insurance service providers, and more accepting Bitcoin. Based on the value of Bitcoin per time, you can use your holdings in any of these places.