The cryptocurrency market has grown a lot in the past few years. More and more people are interested in investing and trading digital currencies. Because of this, there’s a bigger need for places where people can buy, sell, and trade these digital currencies, known as cryptocurrency exchanges.

However, it’s important to know that not all exchanges are the same. People who trade need to be aware of the risks when they use these exchanges that are run by others.

We give you a list of the top 10 crypto exchanges and rank them by risk level. Why is this important? Cryptocurrencies were made to cut out middlemen, while these exchanges bypass exactly that.

- 1. What is a crypto exchange and how does it work?

- 2. The Attraction of Third-Party Crypto Exchanges

- 3. The Risks Involved in Third-Party Crypto Exchanges

- 4. The Best Top 10 Crypto Exchanges in 2024

- 5. Ranking of Crypto Exchanges by Various Measures

- 6. Alternative Solutions to Third-Party Crypto Exchanges

- 7. Crypto Exchange Comparison for Your Trading Needs

- 8. Conclusion

- 9. FAQ

What is a crypto exchange and how does it work?

A crypto exchange is a platform where you can buy, sell, and trade cryptocurrencies. It acts as an intermediary between buyers and sellers, matching their orders and facilitating transactions. Exchanges can be centralized or decentralized, with varying levels of security and regulatory compliance.

Share this Image on Your Site:

The Role of Crypto Exchanges

Cryptocurrency exchanges are like online marketplaces where people can buy, sell, trade, and invest in top cryptocurrencies. These exchanges became important because they made it easy for people to deal with cryptocurrencies. They also try to provide a safe place for people to keep their digital money.

Another key role of these exchanges is to make sure there’s always someone willing to buy or sell, so transactions can happen smoothly. When we talk about the trading volume of an exchange, we’re looking at how much trading is happening over a certain time. If a lot of trading is happening, it means the market is active and people have more chances to trade.

Traders and investors need to understand how these exchanges work, how they make money, and understanding the risks of dealing with them, if you want to be successful in the cryptocurrency market.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWTypes of Crypto Exchanges: Centralized vs. Decentralized

Crypto exchanges are like places where you can buy and sell digital money, kind of like a digital marketplace. There are two main kinds: centralized exchanges and decentralized exchanges.

Centralized exchanges are run by one main group or company. They help connect people who want to buy digital money with those who want to sell it. These exchanges are easy to use, have a lot of activity, and offer cool trading options. Some well-known centralized exchanges are Coinbase, Binance, and Kraken.

Decentralized exchanges (DEXs) are different. They let people trade directly with each other, without a middleman. This means you have more control over your money and it can be safer and more private. However, these exchanges might not have as much trading going on and can be harder to use than centralized exchanges.

It’s also important to know that different countries have different rules about crypto exchanges. So, when you’re picking where to trade, you should think about these rules.

The Attraction of Third-Party Crypto Exchanges

Even though using third-party crypto exchanges can be risky, there are reasons why people like to trade and invest with them. These exchanges have things that make trading easier and better, like a simple design, lots of different cryptocurrencies to choose from, and a lot of trading happening. In the next parts, we’re going to talk more about what makes these exchanges attractive and what dangers come with using them.

Share this Image on Your Site:

User Interface and Ease of Use

Third-party crypto exchanges are popular because they have easy-to-use interfaces. This means both new and experienced traders can easily find their way around the platform and make trades. These exchanges work hard to make their interfaces simple and helpful. They include things like detailed charts, different kinds of orders, and ways to manage your account.

Because these platforms are easy to use, traders can concentrate on their trading plans instead of getting stuck with difficult interfaces. No matter if you’re just starting or have been trading for a while, having an interface that’s easy to understand can make trading smoother and more effective.

Range of Available Cryptocurrencies

Third-party crypto exchanges are popular because they have lots of different cryptocurrencies to choose from. This means traders can find lots of ways to invest and try out different trading ideas. They can pick from famous ones like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), or go for new ones that might grow a lot. Having lots of choices helps traders spread out their investments across different digital currencies. Plus, these exchanges let people trade one cryptocurrency for another, which opens up even more options for trading.

Trading Volume and Liquidity

Crypto exchanges that are run by outside companies often have a lot of trading volume and liquidity. This means a lot of crypto is bought and sold on these exchanges. When there’s a lot of trading, it’s easier to buy and sell quickly because there are more people ready to trade. This is called liquidity. Liquidity is good for traders because it means they can make trades without changing the price too much. Additionally, it is important to note that different exchanges may have different maker fees, which are usually slightly less than taker fees, but this is not always the case. Traders need to research and compare fees on different exchanges before making trades.

Exchanges with a lot of trading let traders move in and out of their investments quickly. This makes trading smoother and more effective. Also, when there’s a lot of trading, it shows that many people are interested in the market. This can be helpful information for traders when they decide what to trade.

So, the amount of trading and the ease of trading quickly are big reasons why people like using these third-party crypto exchanges.

Unlock the Secrets of Crypto Trading

Join our Live Online Course today!

Live, interactive online sessions – 1-on-1 sessions from a seasoned crypto trading expert.

Personalized coaching – from a certified crypto expert.

Learning Material – comprehensive learning from basics to advanced strategy.

Flexible Scheduling – to fit your busy life.

ENROLL IN THE BEST CRYPTO TRADING COURSEThe Risks Involved in Third-Party Crypto Exchanges

Crypto exchanges run by other companies have some great things to offer, but it’s important for people who trade there to know about the risks. There are a few things to watch out for: the problem of having a middleman, the chance of security problems, and rules and laws that could affect trading. These risks can change how safe your money is and how your trading goes. In the next parts, we’re going to talk more about these crypto compliance risks. This will help traders understand better and make smart choices when they use these exchanges.

Share this Image on Your Site:

The Middleman Issue

When you trade using a third-party exchange, you’re letting a central platform hold your digital money for you. This is like having a middleman between the people who want to buy and the people who want to sell. But this can be risky. Sometimes, the exchange might not handle your money right or might use it in ways it shouldn’t.

Even though good exchanges try to keep your money safe, there have been times when these exchanges got hacked or did things that weren’t honest. If you’re going to use an exchange, be careful and learn a lot about it first. Also, in recent years, centralized exchanges have beefed up security measures to address this risk. Among other strategies, they now store most customer assets offline and take out insurance policies to cover crypto losses in the case of hacking. If you like the convenience of a centralized exchange, you can reduce your risk by transferring crypto to a separate, off-exchange hot or cold wallet. These steps can help lower the risks of having a middleman.

Potential Security Threats

Using third-party crypto exchanges is very risky because:

- They might get attacked by hackers. Even though these exchanges try to keep your digital money safe, hackers are always finding new ways to break in.

- They might steal your crypto, trick you with fake messages (phishing), or get into your trading account without permission.

- They might go bankrupt and your money is gone forever.

- They could use your money for fraudulent activities, such as money laundering, investment fraud, Ponzi scheme scams, and more.

It’s important for people who trade crypto to know how different exchanges keep their assets safe. Some ways they do this include storing assets offline (cold storage), using really good encryption, and double-checking when you want to take money out.

To protect their money, traders should pick exchanges that have strong security and do extra things themselves like using two-factor authentication and watching their bank accounts for anything weird. This helps them be more secure and lowers the chance of losing their assets to hackers.

Legal and Regulatory Concerns

When using crypto exchanges that are run by other companies, it’s really important to think about legal stuff, rules, compliance, and not existing regulations. The world of crypto changes fast, and different places have different crypto regulations about exchanges. Some places have clear rules, but others might have strict limits or even ban them. This is especially true for crypto exchanges that move offshore to avoid regulations.

If you’re trading crypto, you should know what the laws in your country are and use exchanges that follow these laws. If you use exchanges that don’t follow your country’s laws, you could get into trouble and might even lose your money. It’s smart to do your homework and pick exchanges that are serious about following the law and being open about how they work.

The Best Top 10 Crypto Exchanges in 2024

Cryptocurrencies are getting popular, and because of that, there are now a lot of crypto exchanges where people can trade. There are more than 600 cryptocurrency exchanges worldwide inviting investors to trade Bitcoin, Ethereum, and other digital assets. This can make it hard for traders to pick the best one for them.

To help out, we’ve put together a list of the top 10 crypto exchanges in 2024. We looked at things like how safe they are, how much they charge for fees, how much trading they have, and how good their customer service is. If you’re interested in trading cryptocurrencies, here are the best exchanges to consider, based on data from each exchange’s website. We’re going to give you more details about these exchanges, so you can know more about what they offer and their cool features.

Share this Image on Your Site:

1. Binance

Binance is the biggest cryptocurrency exchange in the world. You can buy and sell lots of different digital currencies. It has a bunch of cool features for trading, like different pairings of currencies, low fees for making transactions, and options for different types of trading like spot, margin, and futures.

Binance is also known for being safe because it stores digital money securely and helps customers quickly when they need it. The website is easy to use, so whether you’re new to trading or experienced, you’ll find it helpful. When you compare it to other cryptocurrency exchanges, Binance is often seen as one of the best. It’s a reliable and effective place for trading digital currencies.

Cons & Security Risks:

On November 21, 2023, the United States Department of Justice (DOJ) said that Binance and its CEO, Changpeng Zhao, did something illegal. They were accused of handling a lot of illegal money from countries like Russia, Iran, and Cuba. Zhao admitted he did wrong things about money laundering. Binance, the company he leads, agreed to pay $4.3 billion because they broke a law called the Bank Secrecy Act and didn’t follow rules about dealing with certain countries.

2. Coinbase

It’s known for being safe and simple for trading digital currencies. They have lots of different cryptocurrencies, low fees, and charge less if you trade more. Coinbase is really careful with security, keeping most of the customer’s money in a super safe place. They also have a mobile app called Coinbase Wallet, which makes trading easy and keeps your crypto safe. However, the platform’s ease of use and simplicity come at a cost, with higher and somewhat more complicated trading fees. This may be worth it for infrequent and relatively modest transactions, but it’s important to be aware of these fees when using Coinbase.

Cons & Security Risks:

Using a place like Coinbase to trade crypto can have some downsides, like high costs for transactions and other charges. Furthermore, on June 6, 2023, the Securities and Exchange Commission (SEC) charged Coinbase with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency. The SEC also charged Coinbase for failing to register the offer and sale of its crypto asset staking-as-a-service program. It is important to note that using a crypto wallet, such as a hardware wallet or a software wallet, can provide added security for your investments in case of exchange failures.

3. Kraken

Kraken is a popular crypto trading platform where you can buy and sell different cryptocurrencies and regular money. It’s known for having low fees, lots of options, and being safe for trading digital money. Kraken lets you do different kinds of trades like spot trading, margin trading, and futures trading, making it a top choice for experienced traders looking for high liquidity.

They take safety seriously, especially by keeping digital money in cold storage, which means it’s not connected to the internet. This makes Kraken a good choice for people who have been trading for a while and want a trustworthy place to trade. Also, Kraken has helpful customer service to make sure trading goes smoothly. These things make Kraken one of the best choices for experienced traders in the crypto world.

Cons & Security Risks:

On November 20, 2023, the U.S. Securities and Exchange Commission (SEC) sued Kraken. They claimed that Kraken was running as a securities exchange without the proper registration. The SEC is a government agency that oversees activities like this to ensure they follow the law.

4. KuCoin

KuCoin is a well-known crypto exchange where you can find many different cryptocurrencies to trade. They have low fees, which is good for people who trade a lot. The platform is easy to use, even for those who are new to trading crypto. KuCoin lets you do different kinds of trading, like spot trading and margin trading. This means traders have many options to choose from.

KuCoin is also busy with lots of trading happening, so it’s easy to buy and sell quickly. They take safety seriously and keep the digital money in secure storage. Plus, KuCoin is great at helping their customers, giving them the help they need quickly.

Cons & Security Risks:

Many people had problems with KuCoin. They say that KuCoin suddenly stopped their trades and turned off their accounts for no clear reason. Also, when these people tried to get help from KuCoin’s customer service, they didn’t get good answers. Some users claim it is a scam and are telling others not to use it because they believe it’s a waste of time and money.

5. Bybit

Bybit is a place where you can trade cryptocurrencies, like Bitcoin. It’s special because it focuses on a type called derivatives, which is a more advanced way of trading. Bybit has low fees for trading, which is a plus. They offer something called perpetual contracts, which lets you trade with extra money borrowed (that’s leveraged trading) and these contracts don’t have an end date. The Bybit platform is really fast and good for quick trades. They have different kinds of trading like spot trading, margin trading, and futures contracts, making it one of the best crypto exchanges for accessing a variety of different assets. This means they have something for everyone, whether you’re just starting or have been trading for a while. They support over 100 different kinds of digital money.

Bybit also takes safety and helping customers seriously. This makes trading there safe and easy. All these good things make Bybit a popular choice for people who want to try more advanced trading in cryptocurrencies.

Cons & Security Risks:

FTX sued ByBit for $953M in a VIP withdrawal scandal. Claims have surfaced that ByBit hastily withdrew all funds just before FTX filed for Chapter 11 bankruptcy in 2022. And in Canada, the Ontario Securities Commission (OSC) is taking Bybit to court for violating its laws. Bybit is a typical offshore company based in the British Virgin Islands. They are being asked to stop trading securities and pay a fine of 1 million dollars.

6. OKX

OKX is a popular cryptocurrency exchange known for having a lot of trading activity and options for trading different cryptocurrencies. This exchange lets you trade many types of cryptocurrencies and has advanced features for trading, all with low costs. The website and platform of OKX are easy to use, making trading smooth and efficient. However, it is important to note that when using instant payment methods like Visa and Mastercard, there may be additional charges of up to 4% per transaction.

Security is a big focus for OKX; they use secure storage methods to protect the money of the people who trade there. Because there are so many trades happening on OKX, it’s easy to buy and sell quickly. If you need help, their customer support is quick to respond and helpful. OKX is great for traders who want lots of choices in trading different digital currencies. Traders in the United States can use OKCoin, which is like a sister exchange to OKX.

Cons & Security Risks:

In 2022, OKEx users found that they were unable to redeem their chips because the founder, Mingxing Xu, also known as Star Xu, was arrested by the Chinese. No one was able to withdraw their money. The digital coin of the company, OKB, based in Hong Kong, fell by 11% at the time.

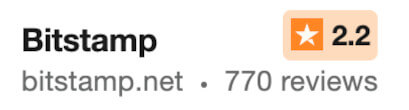

7. Bitstamp

Bitstamp is a crypto exchange known for being easy to use, having low fees, and offering many different types of cryptocurrency for trading. It has a website that’s easy to navigate, making it a good choice for both beginners and experienced traders. Bitstamp also has low fees, which means it doesn’t cost a lot to trade on their platform.

They take security seriously by storing most of their customers’ digital assets in a safe place, so your investments are more or less safe. If you ever need help, their customer support team is quick to assist you. Overall, Bitstamp is a popular option for people who want a reliable and easy-to-use platform for trading digital currencies.

Cons & Security Risks:

Bitstamp is a European Bitcoin exchange based in Luxembourg. In 2015, some of Bitstamp’s operational wallets were compromised by malware and became the target of a major DDoS attack. This resulted in a loss of 19,000 BTC, just over 5 million dollars at the time. In response to the incident, the exchange introduced several new security measures such as multi-sig technology.

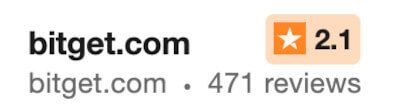

8. Bitget

Bitget is a crypto exchange that’s well-liked by crypto traders because it has lower fees, including the lowest trading fees of any exchange on this list. This makes it a good choice for people who want to trade cryptocurrencies. The exchange has a special fee system that’s based on how much you trade. So, if you trade a lot, you can pay less in fees.

Bitget also offers some advanced ways to trade. You can do things like margin trading, futures trading, and options trading on their platform. This gives traders a lot of different ways to make trades.

The platform itself is easy to use. It’s designed to be simple to navigate, and they even have a mobile app you can use. This means you can trade on the go.

Bitget has a lot of people using it, so there’s always a lot of trading happening. This is good because it means your orders can be executed quickly.

Overall, Bitget is a popular choice among traders because it’s easy to use, has low fees, and offers a variety of trading options.

Cons & Security Risks:

Singapore’s financial regulator has taken action against Bitget in 2021. Bitget was facing issues related to South Korea’s popular boyband, BTS. Bitget also removed the logo of the Monetary Authority of Singapore from its website, as reported by The Guardian. However, the platform continued to state that it holds licenses from Australia, Canada, and the United States on its website, which was never the case.

9. Bitfinex

Bitfinex is a cryptocurrency exchange that offers a wide range of cryptocurrencies to trade, and it has low fees. The platform of Bitfinex has some advanced trading options, like regular trading, trading with borrowed money (margin trading), and trading contracts for future prices (futures trading).

Bitfinex also takes steps to keep your digital assets safe, like storing them in a secure way that’s not connected to the internet (cold storage). They have a lot of trading happening on their platform, which means it’s easy to buy and sell cryptocurrencies quickly. Bitfinex is designed for experienced traders who want to use advanced features. They also prioritize security and helping customers, making it a good place for trading digital assets.

Cons & Security Risks:

The U.S. Department of Justice made history when it seized a massive amount of money in 2016. They found that 3.6 billion dollars worth of Bitcoin was stolen in a huge cyberattack. It took the police about six years to catch the people responsible for stealing 119,754 Bitcoin from Bitfinex. The thieves were able to take the money quite easily from people’s accounts, which were all stored in one digital wallet.

10. Gemini

Gemini is a crypto exchange that’s easy to use, especially for people who are new to cryptocurrency. They have low fees for buying and selling digital money, which makes it better for people who trade. Gemini also takes safety seriously by keeping digital money in a secure place and using advanced security to protect your money. They have special features for people who want to trade in the cryptocurrency market, including free crypto deposits and dynamic network fees for crypto withdrawals.

Gemini’s website is easy to use, and you can use it on your phone too, which is great if you live in New York. They also have a customer support team that’s ready to help when you need it, so you can trade without any problems.

Cons & Security Risks:

Three crypto companies, Gemini, Genesis, and DCG, are facing a lawsuit for ‘fraud’ worth 1.1 billion dollars filed by New York’s attorney general. They are accused of tricking investors through their Gemini Earn program. Genesis faced financial troubles after the FTX bankruptcy and ended up going bankrupt. Gemini also had financial difficulties and couldn’t return customer funds.

Other Cryptocurrency Exchanges worth mentioning

Besides the top 10 crypto exchanges, there are some other platforms worth talking about. These options give investors more ways to trade cryptocurrencies and grow their investments.

Crypto.com

Crypto.com is a cryptocurrency exchange known for its low fees and wide range of digital currencies. It’s great for traders of all levels and even offers limited-margin trading. With user-friendly features, it enhances the trading experience. The platform prioritizes security with cold storage. It’s cost-effective with low transaction fees and high trading volume for efficient orders. Plus, it offers a mobile app for convenient trading and even has the option to earn cash back on Crypto.com Visa debit card spending for users who hold high balances in CRO.

eToro

eToro is a crypto exchange with low fees and many cryptocurrencies. It’s easy to use, even on a mobile app. They keep your assets safe and help you when you need it. High trading volume means fast trading.

Robinhood Crypto

Robinhood Crypto is a cryptocurrency exchange. It has lots of cryptocurrencies and low trading fees. The website is easy to use, and good for beginners and experts. You can do advanced trading. Many people trade here, so it’s easy to buy or sell. Your money is safe. They have a mobile app too. They help customers if needed. Overall, it’s great for trading.

Fidelity Crypto

Fidelity Crypto is a cryptocurrency exchange that offers advanced trading options and low fees. It provides a wide range of cryptocurrencies for traders with various preferences. Fidelity Crypto prioritizes security and storing digital assets safely. With high trading volume, it ensures market liquidity for efficient order execution. The platform is user-friendly, enhancing the trading experience. Mobile app support allows on-the-go access. Excellent customer support ensures a seamless trading experience.

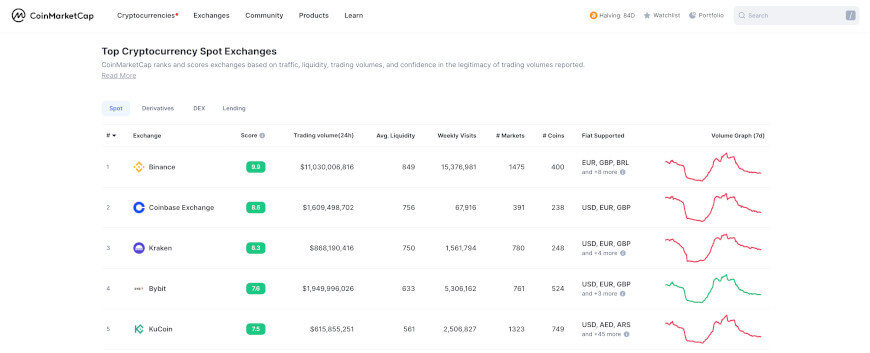

Ranking of Crypto Exchanges by Various Measures

When you’re choosing a crypto exchange, traders have various things they care about. Different exchanges are good at different things. Some have a lot of trading, others have many types of cryptocurrencies, some follow rules from specific countries, and there are fees and security to think about. In the next parts, we’ll list crypto exchanges in different ways, so you can pick the one that suits what you want.

Top Crypto Exchange By Volume

The top cryptocurrency exchange by trading volume can change over time, but as of January 2024, the top 5 crypto exchanges ranked by trading volume are:

| # | Exchange | Spot Trading Volume (24h) |

|---|---|---|

| 1 | ExMarkets | $12,104,330,072 |

| 2 | Binance | $11,006,921,490 |

| 3 | UEEx | $4,612,520,385 |

| 4 | 4e | $4,089,742,965 |

| 5 | Zedcex Exchange | $2,262,149,001 |

Please note that the ranking can vary, and it’s important to check the most recent data for the most accurate information. Cryptocurrency exchanges facilitate the buying and selling of cryptocurrencies, and their trading volumes can fluctuate based on market demand and various factors.

Top Crypto Exchange By Number of Coins

Traders need to think about how many cryptocurrencies they can choose from. Some exchanges have lots of different cryptocurrencies. This gives traders more options for their investments. Here are the winners by number of coins:

| # | Exchange | Number of available Coins |

|---|---|---|

| 1 | Gate.io | 1883 |

| 2 | MEXC | 1815 |

| 3 | BitMart | 817 |

| 4 | KuCoin | 749 |

| 5 | Bitget | 663 |

They can pick from well-known tokens and newer altcoins. These exchanges also let you trade one cryptocurrency for another, which gives you even more choices. So, if traders want lots of cryptocurrency options, they might want to check out these exchanges.

Top Crypto Exchange with Lowest Fees

Examining crypto exchange fees is crucial for traders, as fees can significantly impact trading costs and investment returns. Different exchanges have different fee structures, which can include transaction fees, deposit fees, withdrawal fees, and trading fees.

Crypto Exchange Fees Comparison

Here are the cheapest cryptocurrency exchanges in January 2024:

| # | Exchange | Spot Fee in % | Futures Fee in % |

|---|---|---|---|

| 1 | Bybit | 0,1 | 0,01 – 0,06 |

| 2 | Binance | 0,1 | 0,01 – 0,05 |

| 3 | OKX | 0,08 – 0,1 | 0,02 – 0,05 |

| 4 | Huobi Global | 0,04 – 0,05 | 0,02 – 0,05 |

| 5 | Kraken | 0,016 – 0,26 | 0,02 – 0,075 |

Crypto Exchange by Country

The top 30 centralized crypto exchanges are located in different countries around the world. Out of these 30 exchanges, 11 of them, which is 37%, are in North America. Specifically, they are in places like the Cayman Islands, the British Virgin Islands (BVI), and the United States. The remaining exchanges are evenly distributed in countries across Europe, Asia, and Africa, with 20% or 6 exchanges in each region.

So, where are most of these crypto exchanges based? Well, it turns out that 70% of them, which is 21 out of 30, are located offshore financial centers (OFCs). Some of the popular OFCs where crypto exchanges are based include Seychelles, the Cayman Islands, and the British Virgin Islands (BVI). These places are often known as tax havens for corporations but risky for clients.

Interestingly, 20% of these crypto exchanges are incorporated in Seychelles. Seychelles is an island group in the Indian Ocean, and it has become a hotspot for cryptocurrency exchanges. Some well-known exchanges like OKX, KuCoin, and MEXC Global are incorporated there. It’s important that most of these spots currently don’t have regulations or supervision for crypto-related activities in place.

Alternative Solutions to Third-Party Crypto Exchanges

While some crypto exchanges offer tempting features, there are other options that traders can consider to lower the risks linked to using centralized exchanges. Peer-to-peer exchanges, decentralized exchanges (DEXs), and wallet-to-wallet trading are choices that provide users with more control over their money and reduce dependence on centralized middlemen. In the upcoming sections, we will delve into these alternatives, giving traders the knowledge to make smart choices for their cryptocurrency trading.

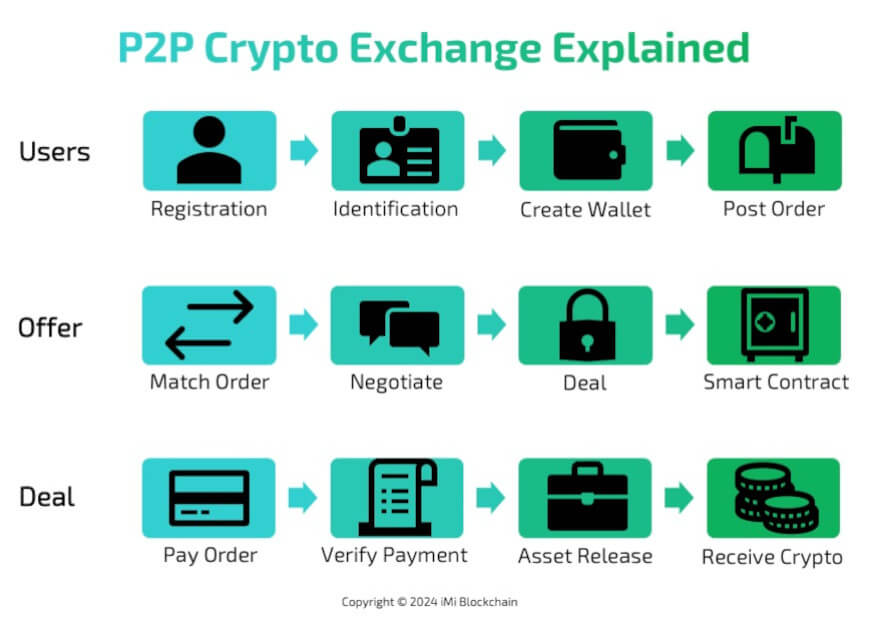

Peer-to-Peer Crypto Exchanges

Peer-to-peer exchanges, also known as P2P exchanges, offer an alternative to regular third-party exchanges. They allow direct trading between buyers and sellers without the need for middlemen. These exchanges let users connect and trade cryptocurrencies without using a central platform. When people use peer-to-peer exchanges, they have more control over their money and can avoid potential risks linked to third-party exchanges. However, it’s crucial to be cautious and do thorough research before getting involved in P2P trading, as there might be extra risks when trading with other individuals.

Share this Image on Your Site:

List of the Best P2P Crypto Exchanges 2024

- OKX: Overall the best with a wide range of cryptocurrencies and local payment methods, from e-wallets and bank transfers to Western Union.

- Coinbase: The leading exchange is offering a self-custody wallet for P2P trading, DApps engagement, and NFT trading.

- Binance: The world’s largest exchange offers a popular P2P platform and supports Bitcoin, Tether, BUSD, BNB, Ethereum, Shiba Inu, and Cardano.

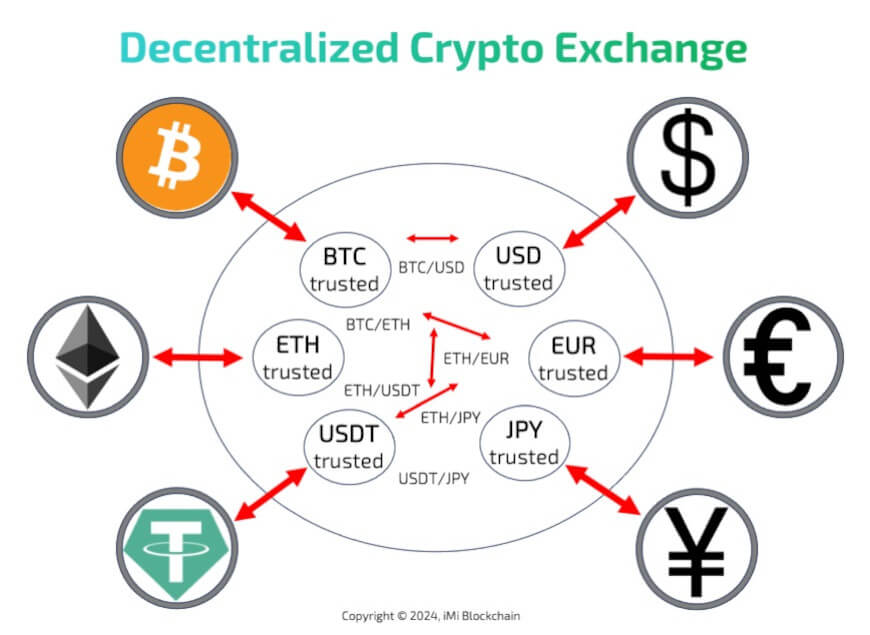

Decentralized Exchanges (DEXs)

Decentralized exchanges, or DEXs for short, are like special places on the internet where people can trade things with each other. What makes them special is that there’s no one in charge telling everyone what to do. Instead, people trade directly with each other, kind of like swapping trading cards with friends.

You know how when you play games, you have to follow the rules? Well, DEXs have something called “smart contracts” and “blockchain” that make sure everyone follows the rules when they trade. It’s like having a referee in a game to make sure nobody cheats.

One cool thing about DEXs is that you don’t have to give your money to a big company to trade. You keep your money in your own wallet, like a digital piggy bank, and use it to trade. This way, you have more control over your money.

But there’s one thing to keep in mind. DEXs might not have as many people trading, so there may not be as much stuff to trade for. However, the good news is that they usually charge less for trading, so you can save some of your money.

So, if you want to trade things online and have more control over your money while paying lower fees, you can think about using DEXs. It’s like trading with your friends safely and fairly on the internet!

Share this Image on Your Site:

List of the Best DEX Exchanges 2024

- Uniswap: Ethereum’s first and biggest DEX is a good option with a daily trading volume of $4 billion in trading every day.

- OKX DEX: OKX’s cross-chain and multi-chain DEX is an aggregator from across 20+ chains, 300+ DEX, and 200,000+ coins.

- ApeX Pro: They have a unique AMM model that helps use capital efficiently and makes transactions similar to regular spot trading and it’s very beginner friendly.

Wallet-to-Wallet Trading

Wallet-to-wallet trading is a different way to trade cryptocurrencies without using third-party exchanges. In wallet-to-wallet trading, people can swap cryptocurrencies directly by using their digital wallets. This means they don’t have to rely on big exchanges, and it’s safer because their money isn’t controlled by a middleman. To do this kind of trading, both parties need to use secure and compatible wallet software.

While it gives you more control and safety, it also means you have to take care of your digital money. To keep your funds safe, you should keep your wallet software updated, consider using hardware wallets, and follow security tips.

List of the Best Wallet-to-Wallet Trading Tools 2024

- Coinbase Wallet: It is simply the best for Beginners.

- MetaMask: It is by far the best for Ethereum.

- TrustWallet: This is the best for Mobile users.

Crypto Exchange Comparison for Your Trading Needs

As people trade in the crypto market, it’s really important to pick the right place to trade your cryptocurrencies. Knowing about the risks of using other websites to trade, and knowing there are other options, helps you make smart choices. You can make a good decision by looking at things like how much trading happens there, what cryptocurrencies you can use, how much it costs, how safe it is, how they help you, and if they follow the rules. This way, you can find a place to trade cryptocurrencies that’s safe, easy, and right for you.

How do the risks of third-party crypto exchanges impact your trading strategy?

Knowing the possible dangers linked to third-party crypto exchanges is important for keeping your trading plans safe. By learning about these risks, you can make smart choices and take steps to safeguard your money and investments. This knowledge helps you trade with confidence and safety, guiding you through the crypto market wisely.

Conclusion

In summary, when it comes to crypto trading, it’s really important to think about the risks that come with using third-party exchanges. These exchanges might seem exciting with lots of different cryptocurrencies to choose from, but there are potential problems like middlemen, security issues, and following the rules.

To pick the best exchange for your trading, you should do some good research. Look at things like how many people use the exchange, what cryptocurrencies they offer, and whether they follow the rules in your country. Also, check out the fees they charge, how safe they keep your money, and if they have good customer support.

If you want even more control and security over your money, there are other options to consider. You can try peer-to-peer exchanges, decentralized exchanges (DEXs), or trading directly from one wallet to another. And if you have more questions or need help with the crypto market, don’t hesitate to reach out to our experts. We’re here to help!

Learn Crypto Trading!

Crypto Trading in Small Classes

Webinars about Crypto Trading

Crypto Trading Course

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

Which is the best crypto exchange?

When you’re deciding on the right cryptocurrency platform for you, it boils down to what you want and like. Some well-liked choices are Coinbase, Binance, Kraken, and Gemini. Things you should think about are how safe it is, how much it costs, what kinds of cryptocurrencies you can use, and how easy it is to use. Make sure you do a lot of research and be careful when you’re using any cryptocurrency platform that’s not run by the cryptocurrency itself.

Which crypto exchange is best for beginners?

For those who are just starting to explore cryptocurrency investment, you have some great options in user-friendly exchanges such as Coinbase, Binance, and Kraken. These platforms provide simple interfaces, a variety of cryptocurrencies to choose from, and educational materials to assist beginners in understanding the world of cryptocurrency investing. Nevertheless, it’s crucial to be aware that certain exchanges might charge substantial fees, which could reduce your profits over the long term. Always make sure to conduct thorough research and pick an exchange that matches your investment objectives.

Which crypto exchange is the most reliable and safe?

When you want to buy a cryptocurrency and you’re looking for the cheapest exchange, there are a few things to consider. The cost of buying crypto can change depending on which cryptocurrency you want and where you are. Some popular exchanges that don’t charge too much are Binance, Kraken, and Coinbase Pro. But before you decide, it’s important to compare the fees they charge, how safe they are, and what other people think about them. One exchange that’s known for having really low fees is bitFlyer. They have maker and taker fees that go as low as 0 on their Lightning Network.

How do crypto exchanges make money?

Crypto exchanges make money in several ways. They charge fees when people buy or sell cryptocurrencies, take out their money, or get their cryptocurrencies listed on the exchange. They also earn money from things like staking and lending. Some exchanges even do market activities to make more money or sell information about their users. Crypto traders need to know about these fees.

How do I open a crypto exchange account?

To open a cryptocurrency exchange account, begin by researching and choosing a trustworthy platform. Afterward, you’ll need to supply your personal details and confirm your identity to set up an account. Pick the cryptocurrencies you wish to trade and fund your account using different methods like bank transfers, wire transfers, ACH payments, or credit card payments. Before creating an account, take a look at the fees, security features, and customer support provided by the selected exchange.

Which crypto exchange does not report to the IRS?

Using a crypto exchange that doesn’t tell the IRS is against the law and not a good idea. All exchanges in the United States have to tell the IRS about transactions by law. Even exchanges outside the United States might have to tell the government about transactions according to world tax rules. Not telling the government about cryptocurrency transactions can get you in trouble with fines and the law.

Is there a crypto exchange without KYC?

There are cryptocurrency exchanges that do not require Know Your Customer (KYC) verification. These exchanges allow you to buy and sell cryptocurrencies anonymously, and you may not be required to open an account or upload verification documents. Some of these exchanges operate on a peer-to-peer basis, connecting buyers and sellers directly without intermediaries or centralized authorities.