Cryptocurrencies, like Bitcoin, are really popular in the world of money and investing. But they can be pretty unpredictable – their values go up and down a lot. That’s where stablecoins come in; they’re like the steady, reliable cousins of regular cryptocurrencies. In this blog post, we’re going to explore them: what they are, how they work, and why they’re getting a lot of attention in the volatile market of November 2021.

We’ll look at different kinds of stablecoins and talk about some well-known ones like Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). These special coins are designed to have a stable value, unlike other cryptocurrencies that can change value quickly. We’ll dive into the good and bad sides of a stablecoin example, including the first one, BitUSD, launched in 2014, and what makes them useful and what risks they might have in the cryptocurrency market.

So, come along as we learn all about it, define stablecoin, and become smarter about this cool part of the digital currency world!

Stablecoin what is it?

Now, Stablecoin what is it? A stablecoin is an Altcoin (alternative to Bitcoin), another form of cryptocurrency designed to maintain a consistent value, typically pegged to a fiat currency. Offering stability and reliability, stablecoins are backed by real assets like fiat currencies, precious metals, or digital assets. Leveraging blockchain technology, they serve as a medium of exchange within the volatile crypto market, providing an alternative to high-volatility cryptocurrencies like Bitcoin (BTC) and other volatile cryptocurrencies.

Share this Image on Your Site:

The Concept of a Stablecoin

Stablecoins are a special type of cryptocurrency that try to keep their value the same, unlike other cryptocurrencies that can change in value a lot. They do this by tying their worth to something steady, like regular money (dollars, euros, etc.) or things like gold. Think of these coins as digital versions of these stable things, keeping a one-to-one value with them, making them a more reliable option than traditional cryptocurrencies.

Stablecoin crypto uses something called smart contracts, which are like digital rules, to manage how they work. These smart contracts help make everything clear and stable, making it easier and cheaper to do things like send money. Because they use blockchain technology, which is the tech behind cryptocurrencies, stablecoins are a trustworthy way to use money digitally in the crypto world.

The big deal about stablecoins is that they’re predictable. While other cryptocurrencies can be like a rollercoaster in their value, stablecoins are more like a calm sea. This is really appealing for people and businesses who want something less risky, especially when dealing with money across countries or trying to avoid big ups and downs in value. In the fast-moving and often unpredictable world of crypto, they offer a bit of peace and order.

Stablecoins vs. other Cryptocurrencies

Stablecoin what are they and how are they different from cryptocurrencies? We can give you a good Stablecoin example by comparing it with other cryptocurrencies like Bitcoin, which can change a lot in value. They do this by being linked to things that have a stable value, like regular money (like dollars or euros) or sometimes other things like commercial paper. This link helps keep their price from going up and down too much, which is why people who want a digital currency they can trust, like a central bank digital currency (CBDC), prefer to use stablecoins.

One big reason people like stablecoins is that they don’t change in value as much as other digital currencies. This is good for people who want to use them for buying and selling things regularly, without worrying about the value suddenly dropping or spiking. It’s especially helpful for folks who want to make sure the digital money they have today will be worth about the same tomorrow.

Stablecoins are really important for the world of digital money because they let people and businesses use them confidently. They’re stable, fit well in the digital currency world, and are a handy choice for anyone looking for a dependable digital currency for everyday stuff.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWStablecoin is Important

Stablecoins are a special kind of digital currency that helps make trading with cryptocurrencies easier and safer for traders. They are important because they don’t change in value as much as other cryptocurrencies like Bitcoin, providing stability and protection for traders. This stability is really useful because it makes stablecoins more like regular money (like dollars or euros), which doesn’t change in value a lot. They do this by tying their value to things that are stable, like regular money or certain kinds of financial agreements, making them a reliable alternative to traditional fiat currencies.

This stability is key for using digital currency in everyday life. If you’re using a stablecoin example, you don’t have to worry about its value dropping suddenly when you’re buying something. This makes more people trust and use them, which is great for the world of digital money. Plus, stablecoins make it cheaper and easier to send money, even across borders and without the need for a bank account, for only a few cents. This way, they are helping more people get into using digital currencies in a safe and easy way.

Define Stablecoin

A Stablecoin is a type of digital money, similar to Bitcoin or Ethereum, but it’s made to keep its value the same over time. Think of it like a “steady” coin. It does this by matching its value to things we already know and use, like dollars or gold. This is helpful because, unlike other digital currencies that can change value a lot, Stablecoins stay more predictable. This makes them really useful for buying and selling things using digital currency because their value doesn’t increase too much. They use special computer technology, called blockchain, to make sure they’re safe and transparent. This means that people can trust them for everyday use, just like they trust regular money.

Share this Image on Your Site:

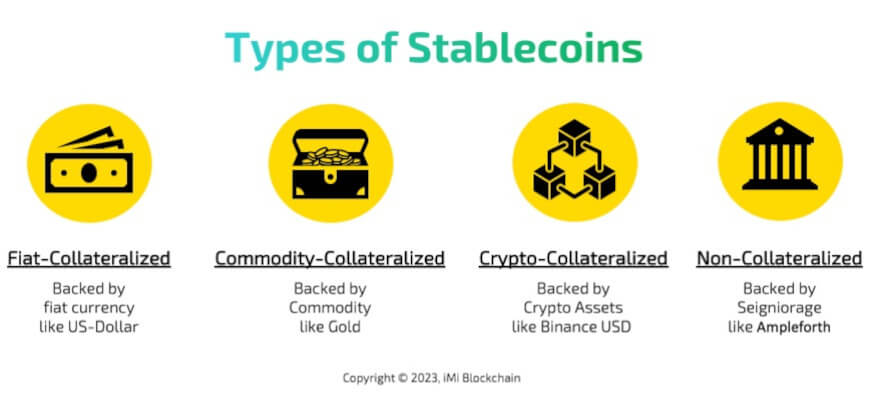

Types of Stablecoins

Now, Let’s look at the different kinds of Stablecoins and dive into a Stablecoin example:

- Fiat-Collateralized Stablecoins: These are like having a piggy bank at a bank. For every digital coin, there’s real money, like dollars, saved in a bank. This makes sure that the digital coin’s value doesn’t change too much.

- Algorithmic Stablecoins: These are pretty smart digital coins. They don’t have real money saved in a bank. Instead, they use computer programs (algorithms) to make sure they don’t get too expensive or too cheap. The program automatically changes how many of these coins are available based on how much people want them.

- Commodity-Backed Stablecoins: These coins are like having a digital coin that is equal to something real like gold or a house. The value of these coins is based on these real things, which helps keep their value steady.

Share this Image on Your Site:

Each type of stablecoin has its own way of making sure its value doesn’t jump around too much. Some people might like the safety of having real money backing their digital coins (fiat-collateralized). Others might prefer the cleverness of computer programs (algorithmic) or the real-world value of things like gold (commodity-backed). The stablecoins entitle a purchaser to redeem the coin with real estate.

Stablecoins offer different choices for different needs, making it easier for people to use digital money in their daily lives. This variety helps more people get comfortable with using digital cash, making it a more common part of buying things and saving money.

Stablecoin Example

Now we dive deeper into a stablecoin example. The special kind of digital money in the world of cryptocurrencies, and they’re really important. They come in different types, each with its own unique features. Here are some examples to help you understand how they work and why they’re useful.

The first stablecoin example is Tether (USDT). Think of it as digital money that’s like having US dollars in your pocket. It’s really popular because it’s like using regular money, but in the digital world. This makes it easy for people to buy and sell things with it.

Then there’s DAI, another stablecoin example, which is a bit different. It’s not backed by regular money like dollars or euros but by other digital assets (like Ethereum). DAI is special because it’s controlled by computer programs (smart contracts) that make sure everything is open and fair.

USD Coin (USDC) is another important stablecoin example. It’s supported by a group of companies and is also tied to the US dollar. It’s like having a digital dollar that’s watched over by these companies to make sure it’s safe and follows the rules.

TerraUSD (UST) is an interesting stablecoin example because it uses a smart system to keep its value stable. It’s linked to a mix of regular currencies, and it can adjust itself to stay steady in value.

The last stablecoin example is Luna. A part of the Terra system and helps keep everything balanced and trustworthy. It’s like a support beam that makes sure the Terra digital world stays strong and reliable.

These examples show how stablecoins can be different but all aim to offer a stable and secure way to use digital money in the fast-moving world of cryptocurrencies.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWTether (USDT) – The Pioneer of Stablecoins

Tether (USDT) is a special kind of digital money called a stablecoin, and it was the first one ever made for the cryptocurrency world. It’s linked to the US dollar’s value, which keeps its price steady and contributes to its high market capitalization. This makes Tether a dependable way to buy and sell in the crypto world. It’s supported by things like real money, which makes people feel more secure about using it.

Tether is really popular and is used a lot in the world of cryptocurrencies. This popularity shows that both people who trade and those who issue it trust Tether a lot. Tether, with its high market cap, started a trend for other stablecoins to follow, making a way for them to join the market and help keep prices stable. As an example of a stablecoin, Tether is a go-to choice for people who want something stable and reliable when dealing with the often-changing world of digital currencies.

USD Coin (USDC) – A Strong Contender

USD Coin (USDC) is a popular type of stablecoin that always tries to have the same value as the US dollar. This makes it a stable and safe choice for people interested in cryptocurrencies. It’s built using blockchain, which means it’s secure and its transactions are clear for everyone to see. With a total of 55.8 billion USD Coins in global circulation since its launch in September 2018, it is a strong contender in the stablecoin market.

What’s special about USDC is that it’s made by official financial companies, which makes it more trustworthy. It also gets checked regularly by big accounting firms to make sure everything is clear and correct.

USDC is widely used because it’s trusted and works well for paying for things in different industries. Since it’s tied to the US dollar and is made by regulated companies, USDC is a top choice for people looking for a reliable and safe cryptocurrency.

Binance USD (BUSD) – The Rising Star

Binance USD (BUSD) is a type of digital money called a stablecoin. It’s special because it has the same value as the US dollar, which makes it stable and safe to use. BUSD is made by Binance, a big name in the digital money world, and it’s trusted because it’s backed by real money like dollars.

A lot of people are starting to use BUSD because it’s easy to understand, safe, and works well for buying and selling things. It’s also clear and open about how it works, which makes people feel more comfortable using it in the world of digital money.

BUSD is great for people who want to use digital money but don’t want to worry about big changes in value. It’s becoming more and more popular, showing that it’s a strong and important option in the world of stablecoins.

Prospects and Challenges of Stablecoins

Stablecoins are a special type of cryptocurrency that doesn’t change in value as much as others, like Bitcoin (BTC) or Ether (ETH). They’re useful because they stay steady, often tied to things like regular money (dollars, euros) or gold. This steadiness is great in the crypto world, which can be really up and down. But, they also have some challenges. For example, governments are creating their own digital money, which could compete with stablecoins. Even with these issues, stablecoins are getting more popular as people look for stable options in the crypto market.

The Potential Advantages of Using Stablecoins

Stablecoins are a type of digital money in the crypto world that stay at a steady value, often linked to stable things like the US dollar. This makes it easier for people to know how much their crypto is worth.

They’re really useful for buying and selling things in the crypto market because their value doesn’t jump around a lot. This means you can swap different types of crypto without worrying about losing money due to sudden price changes.

For those who trade in crypto, stablecoins are great for playing it safe. If you’re worried about the price of your crypto going up and down a lot, you can switch to stablecoins to keep your investment more secure.

Plus, stablecoins are easy to get and use, making them a handy choice for people who want to keep their digital money safe and steady.

Are There Risks Associated with Stablecoins?

Stablecoins, a type of digital money, can be risky because they depend on someone else (the issuer) keeping enough backup money or assets, which can be affected by counterparty risk. Governments might make more rules about them, which could change how they are used. Their value might go up and down with market changes. Sometimes, it’s not clear if there’s enough backup for these coins, which is worrying. Also, they use special computer programs (smart contracts) that could fail and cause problems.

How Stablecoins Make Money with Blockchain

Stablecoins make money in a few ways to keep their business going. They charge fees for each transaction, which helps them pay for their costs and make some profit. They also earn money from the interest on the assets that back up the stablecoin. This helps them make more money and keep the stablecoin stable. Sometimes, they make extra money by trading or investing in the assets they have. Since they have a stable value, many people find them useful, which brings in more users and more money. Stablecoins are a type of digital money that always has the same value, and they help people and businesses easily use crypto, opening up new chances for making money and growing.

Conclusion

In conclusion, stablecoins are really important in the cryptocurrency world because they help keep things stable and less risky. They are a safe and trustworthy way for people and companies to do transactions and keep their money.

Some well-known stablecoins are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD), which a lot of people use. While they have many good points, it’s also important to know about the risks that come with them. If you want to know more about stablecoins or have any questions, don’t hesitate to contact us.

Learn Cryptocurrency Investment!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

What is the best stablecoin example?

When it comes to the best stablecoin example, it ultimately depends on your specific needs and preferences. Popular options include Tether, USD Coin, and Dai. While Tether is the most widely used, it has faced controversy over transparency. On the other hand, Dai offers a decentralized approach through smart contracts on the Ethereum blockchain.

Where can I buy stablecoins?

Stablecoins can be purchased on various cryptocurrency exchanges like Binance, Coinbase, and Kraken. Some stablecoins are also available directly from the issuers’ websites. Prioritize researching the stability and reputation of the specific coin before buying, and always use a reputable exchange and follow proper security measures.

What makes a stablecoin different from other cryptocurrencies?

A stablecoin is a special kind of digital money that is made to have a constant value. It’s different from other digital currencies, like Bitcoin, because its value is usually tied to something stable like regular money (like dollars) or things like gold. This keeps its value from going up and down too much. People like stablecoins because they’re stable but also use the new blockchain technology, which is what digital currencies are built on. Some well-known stablecoins are Tether (USDT), USD Coin (USDC), and Dai (DAI). These are popular because they’re more predictable than other digital currencies.