Are you curious about a safe way to make quick money with cryptocurrency? Let’s talk about crypto arbitrage! In this blog, we’re going to explore this cool topic, perfect for both beginners and experts.

First, we’ll explain what arbitrage in crypto is and why the prices are different on various trading platforms. Next, we’ll look at the different kinds, like trading between exchanges, within the same exchange, and a special kind called triangular arbitrage. We’ll also talk about how trading bots can help in arbitrage crypto trading and look at the good and not-so-good sides of this trading method. Finally, we’ll think about how arbitrage in cryptocurrency fits into your overall money-making plans and give you some tips on how to handle quick changes in the market.

Watch the video to get a short overview and then read on to learn everything in detail and discover an exciting way to make money in the world of cryptocurrency!

- 1. What is Arbitrage in Crypto?

- 2. Delving into Types of Crypto Exchange Arbitrage

- 3. Role of Trading Bots in Cryptocurrency Arbitrage

- 4. Highlighting Advantages of Crypto Arbitrage Trading

- 5. Discussing Potential Disadvantages of Crypto Arbitrage

- 6. Why Is Crypto Arbitrage a Low-Risk Trading Strategy?

- 7. How Does Crypto Arbitrage Fit Into Your Investment Portfolio?

- 8. Conclusion

- 9. FAQ

What is Arbitrage in Crypto?

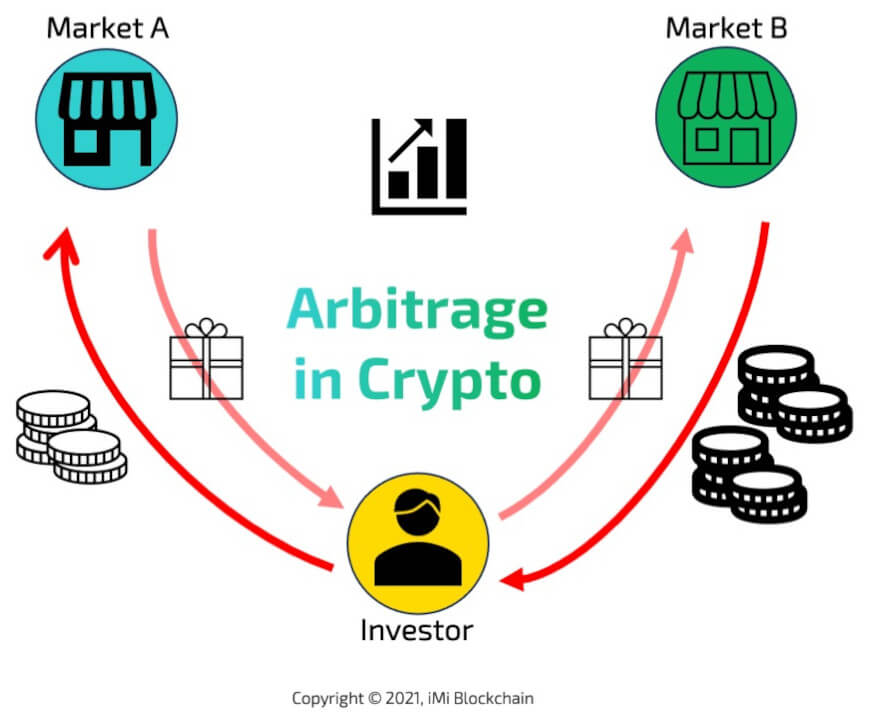

Interested in making money with cryptocurrency? Arbitrage in crypto could be your answer! It’s a way to take advantage of different prices for the same cryptocurrency on different exchanges. Here’s how it works:

- Understanding arbitrage in crypto: Imagine finding a pair of sneakers cheaper in one store than another. You buy crypto where it’s cheaper and sell it where it’s more expensive.

- Different Prices on Different Exchanges: The prices of cryptocurrencies like Bitcoin can vary slightly on different exchanges. This is where your chance to make a profit comes in!

- Strategies for Making Money: You can develop strategies based on these price differences. Keep in mind that you have to consider transaction fees – the cost of buying and selling crypto.

- Using Tools to Help: Some people use crypto trading bots, which are like computer programs, to automatically buy and sell for them. This can make things faster and easier.

- Bitcoin and Other Cryptocurrencies: While Bitcoin is popular, there are other cryptocurrencies you can use for it too.

- Learning and Growing: The more you learn about how crypto prices change and why, the better you can become at it to make money.

Before you invest, please consider taking trusted crypto trading courses. Remember, always stay informed and be smart about your choices in the exciting world of cryptocurrency, especially when it comes to crypto security!

Share this Image on Your Site:

Defining Arbitrage in Cryptocurrency

Cryptocurrency arbitrage is like finding a good deal on something in one store and then selling it for a higher price in another store. Imagine you find a special toy in one shop for $10, but in another shop, it’s selling for $15. If you buy it at the first shop and sell it at the second, you make a $5 profit. That’s what crypto traders do with digital money (like Bitcoin) on different online platforms (called exchanges).

How Crypto Arbitrage works

They watch the prices of cryptocurrencies on various exchanges closely. When they see a price difference, they buy the cryptocurrency where it’s cheaper and then sell it where it’s more expensive. This is called “spatial arbitrage.”

For example, if Bitcoin is selling for $10,000 on one exchange and $10,200 on another, a trader could buy it at a lower price and sell it at a higher price, making a $200 profit. Look at crypto as cash!

Share this Image on Your Site:

Traders have to look at many different types of digital money because some might have better chances to make a profit than others. But remember, this way of making money can be risky. Prices can change quickly, and there are other things to consider like transaction fees and the time it takes to move the cryptocurrency from one exchange to another.

So, while cryptocurrency arbitrage can be a way to make money, it’s important to understand both the good and bad sides of it.

Reasons for Price Differences Across Exchanges

Do you want to know why prices for cryptocurrencies are different on various trading websites? Here’s the reason: Each trading site, or “exchange,” has its own way of matching buyers and sellers, which can change how much cryptocurrencies cost. Also, these exchanges might charge different fees for trading or moving your money, and this can affect the price too.

But guess what? These different prices can actually be good for something called “crypto arbitrage.” This is when people, called arbitrageurs, use these price differences to make money. They carefully watch the prices on different exchanges buy cryptocurrencies where they’re cheaper and sell them where they’re more expensive. This way, they take advantage of the different prices and earn a profit. It’s like finding a good deal on a game at one store and selling it for a higher price at another store.

Unlock the Secrets of Crypto Trading

Join our Live Online Course today!

Live, interactive online sessions – 1-on-1 sessions from a seasoned crypto trading expert.

Personalized coaching – from a certified crypto expert.

Learning Material – comprehensive learning from basics to advanced strategy.

Flexible Scheduling – to fit your busy life.

ENROLL IN THE BEST CRYPTO TRADING COURSEDelving into Types of Crypto Exchange Arbitrage

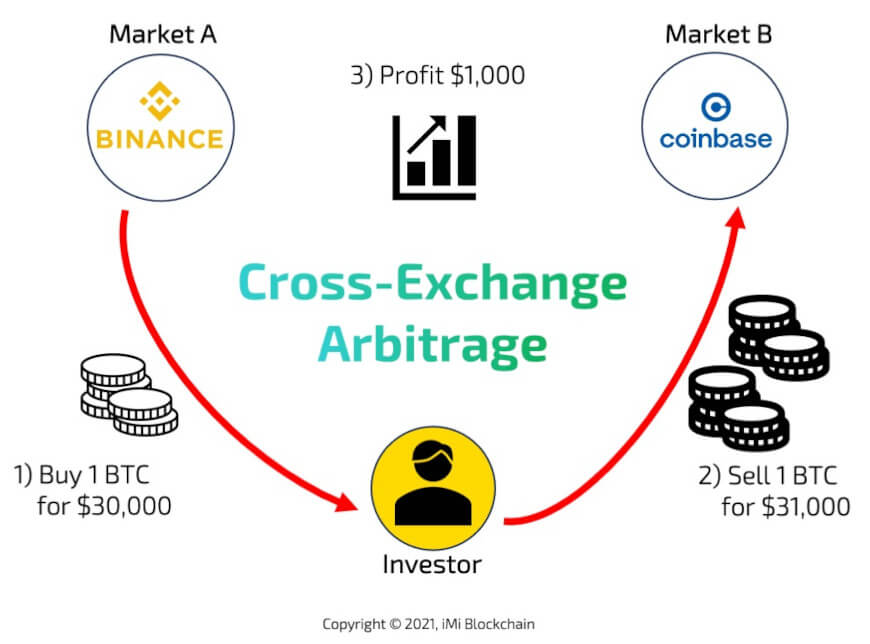

Crypto exchange arbitrage is a cool way to make money by taking advantage of different prices in the world of cryptocurrency. One of them is cross-exchange arbitrage, another type is intra-exchange arbitrage, and additionally, there is triangular arbitrage. Let’s break it down and explain in detail:

Share this Image on Your Site:

Cross-Exchange Arbitrage and its Functioning

Want to make money with cryptocurrencies by buying low and selling high on different websites (exchanges)? That’s what cross-exchange arbitrage is all about! Here’s how you can do it:

- Understand Order Books and Liquidity: Learn how these exchanges work. An order book is like a list of prices and amounts where people want to buy or sell a cryptocurrency. Liquidity means how easy it is to buy or sell without affecting the price too much.

- Compare Prices on Different Exchanges: Look at different websites where you can buy and sell cryptocurrencies. Notice how prices for the same cryptocurrency can be different on each site.

- Consider Costs and Risks: Remember, moving your money between exchanges can have costs, like withdrawal fees. Also, prices can change quickly, so what looks like a good deal might change in seconds.

- Learn from the Pros: Watch what experienced traders do. They know how to spot good opportunities and act fast.

Imagine you see a chocolate bar being sold for $1 in one store and $1.50 in another store. If you buy it for $1 and sell it for $1.50, you’ve made a profit! That’s what cross-exchange arbitrage is but with cryptocurrencies instead of chocolate bars. You buy a cryptocurrency where it’s cheaper and sell it where it’s more expensive.

Share this Image on Your Site:

By understanding and using cross-exchange arbitrage, you can find chances to make a profit in the fast-moving world of cryptocurrency trading. Just be quick and smart about it!

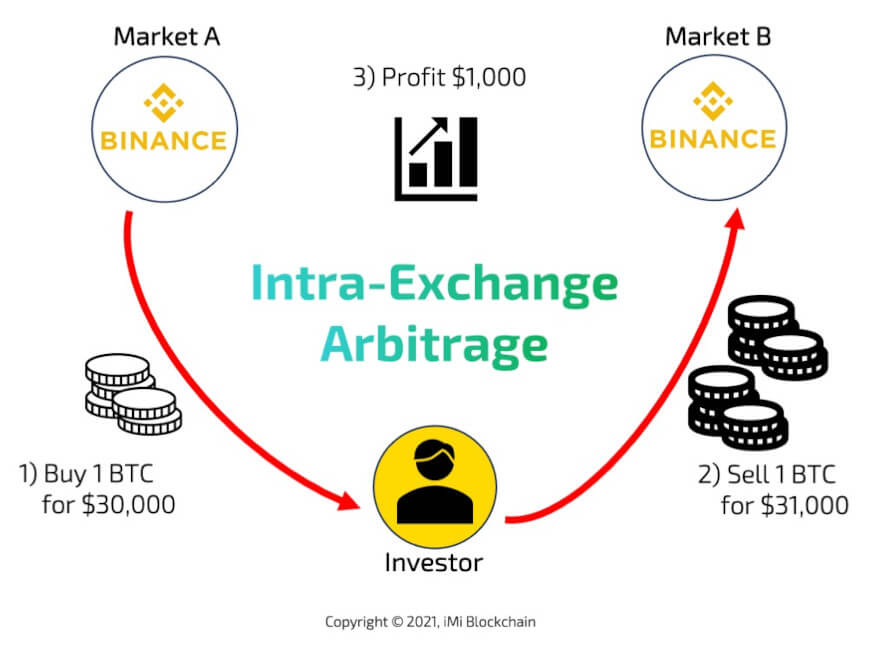

Intra-Exchange Arbitrage and How It Works

Intra-exchange arbitrage is a way to make money from the different prices of cryptocurrencies on the same trading platform. To do this, you need to look at the trading fees, check the order books (which show buy and sell orders), and understand how much the prices can change, which is known as market volatility. The idea is to spot when one cryptocurrency is priced differently than another on the same platform, giving you a chance to buy low and sell high.

Now, think about finding a good deal all within the same store. Maybe you find a way to buy and sell different things in a way that ends up making you money. Intra-exchange arbitrage is doing this within a single cryptocurrency exchange.

Share this Image on Your Site:

But, remember, this method comes with some risks and costs every time you make a trade. Also, you need to be quick and keep an eye on the market all the time to spot these changes. If you learn how to use intra-exchange arbitrage, you can really boost your trading game.

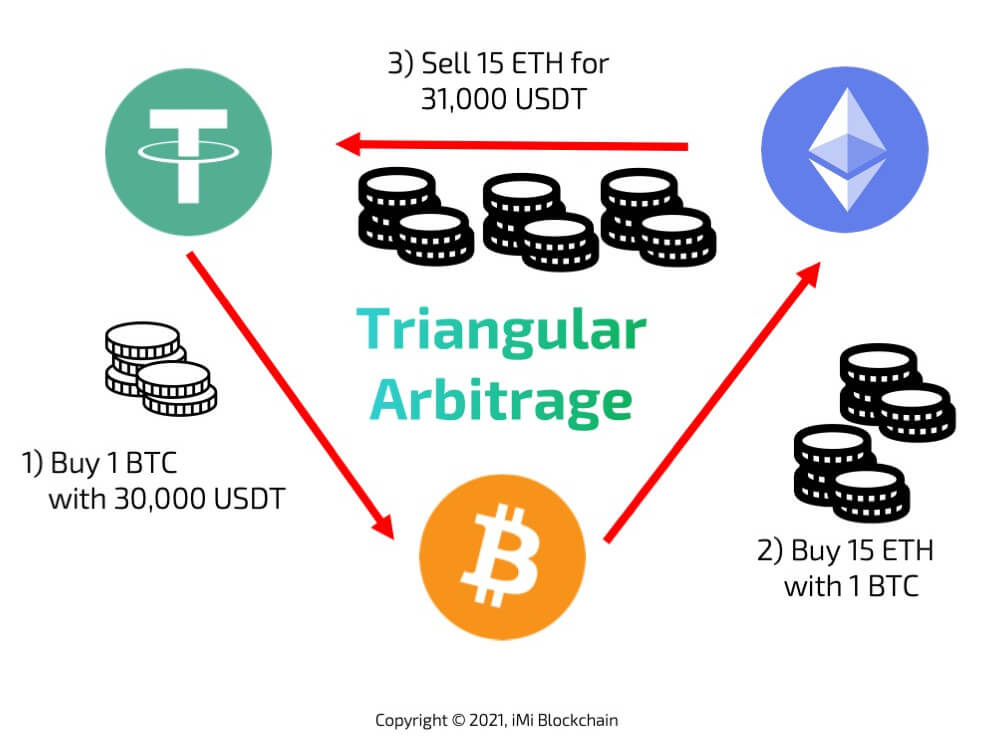

Triangular Arbitrage: An In-depth Analysis

Let’s jump into the exciting world of triangular arbitrage in crypto! This one’s a bit trickier. Imagine you have three types of coins, and you figure out a way to trade them in a circle so that you end up with more than you started. You might trade Coin A for Coin B, then Coin B for Coin C, and finally Coin C back for more of Coin A.

Share this Image on Your Site:

This is a way to make money by taking advantage of price differences in different digital currencies. Here’s what you’ll learn:

- Understanding Triangular Arbitrage: Imagine you have three different cryptocurrencies. In triangular arbitrage, you trade these in a circle – buy one, trade it for the second, then trade that for the third, and finally trade back to the first one. If done right, you end up with more of the first cryptocurrency than you started with!

- The Order Book and Market Volatility: The order book is like a list showing the prices people are willing to buy and sell cryptocurrencies for. Market volatility means how much and how quickly these prices change. In triangular arbitrage, you need to understand these to make smart trades.

- Spotting Profit Opportunities: You’ll learn how to find chances to make money. This involves looking at different cryptocurrencies and seeing where the price differences can work in your favor.

- Costs and Risks: Every trade costs a bit in fees, and there are risks like prices changing quickly or not being able to complete your trades fast enough. We’ll talk about how to consider these in your trading plans.

- Using Trading Bots: These are computer programs that can do trades for you automatically. They can be really helpful in triangular arbitrage because they can make trades faster than a human can.

By understanding these points, you’ll see how traders use triangular arbitrage to buy low and sell high on different exchanges. It’s a cool way to try and make money, but like all trading, it comes with risks. Ready to dive in and learn more? Let’s go!

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWRole of Trading Bots in Cryptocurrency Arbitrage

Are you curious about how trading bots help in crypto arbitrage? Arbitrage in crypto is when you make money by buying and selling cryptocurrencies at different prices on various exchanges. It’s like finding a toy cheaper at one store and selling it for more at another.

Trading bots are super helpful here. They’re like smart computer programs that handle the buying and selling for you, really fast. This speed is important because cryptocurrency prices can change quickly. With these bots, you can grab the best deals before they disappear.

Share this Image on Your Site:

There are many kinds of trading bots, each with special features. Some might be simple, while others are more complex with extra cool tools. It’s important to pick a bot that matches what you need for your crypto trades. This way, you can make the most money from the differences in cryptocurrency prices.

Why Trading Bots Are Essential for Arbitrage Crypto

Trading bots are like super-smart computer programs that keep an eye on different cryptocurrency markets for you. They work really fast, checking out prices on various exchanges to find good deals. When they spot a chance to buy low on one exchange and sell high on another, they can make the trade super quickly. This is way faster and more accurate than if a person was trying to do it all by themselves.

These bots are great because they can reduce mistakes that might happen when people get tired or overwhelmed by too much information. They’re always alert and can react in seconds to any changes in the market, which is crucial in the fast-moving world of cryptocurrency. By using these bots, people who trade arbitrage in crypto can increase their chances of making a profit. It’s important to use these tools to keep up with the constant changes in the cryptocurrency market.

Choosing the Right Crypto Arbitrage Bot

When choosing a crypto arbitrage bot, it’s important to consider several factors. Let’s break it down into easy steps!

- Check Out the Bot’s Features: Just like picking a new app for your phone, look at what the bot can do. Does it have cool features? Can you change the settings to make it work better for you?

- Safety First! Make sure the bot is safe to use. You wouldn’t download a sketchy game, right? It’s the same with these bots. Choose one from a trustworthy company to keep your digital money safe.

- Costs Matter: Just like buying a new game, you need to think about the cost. How much does the bot charge for its services? Don’t forget about any extra fees for transactions.

- Performance: You want a bot that works well, like a video game with no glitches. How well does the bot do its job? Read reviews and see what others are saying.

- Match Your Style: Just like choosing your character in a game, pick a bot that fits your trading style. Do you like to take risks, or do you play it safe?

By thinking about these things, you can choose the best crypto arbitrage bot to help you make money in the exciting world of cryptocurrency. Remember, it’s like finding the best strategy in a game to win!

Highlighting Advantages of Crypto Arbitrage Trading

Maximize your potential profit by taking advantage of price discrepancies across different crypto exchanges. With real-time market data, you can identify opportunities and make smart trading decisions. By utilizing bots, you can automate your trading strategy and execute trades at lightning-fast speeds. Diversifying your crypto asset portfolio through arbitrage trading allows you to spread your risk and optimize your returns. With these advantages, crypto trading is an empowering way to navigate the cryptocurrency market and unlock its full potential.

Share this Image on Your Site:

Quick Profits: How Fast Can You Earn?

Are you interested in a cool way to earn some money fast with cryptocurrency? You should try out spatial arbitrage! It’s all about making the most of different prices in different places. Imagine buying something for a lower price in one market and selling it for a higher price in another – that’s how you make a profit!

With this method, you can really take advantage of the ups and downs in the crypto market to make more money in less time. The key is to act quickly! You’ll be buying and selling across different exchanges, so you need to be fast to catch the best deals.

Here’s a pro tip: use what’s called an ‘order book‘ from exchanges. This shows you the best prices available, so you can make smarter choices and earn more. Remember, the goal is to keep your costs low and your profits high.

Ready to give it a try? Spatial arbitrage can be a fun and exciting way to get into the world of crypto trading!

Identifying Opportunities in Arbitrage Crypto Trading

Arbitrage crypto trading is like finding a great deal on a video game in one store and then selling it for a higher price at another store. You make money from the price difference! In the world of digital money, we look for these price differences in different places where you can buy and sell cryptocurrencies (these places are called exchanges).

Here are some neat tricks to spot these opportunities:

- Check Different Prices: Just like comparing prices in different stores, look at the prices of cryptocurrencies on various exchanges. Sometimes, you can find a cheaper price in one place and a higher price in another.

- Look at Exchange Rates and Fees: Think about how much it costs to buy or sell the cryptocurrencies. These costs can affect whether you’ll actually make money.

- Keep an Eye on the Liquidity Pool: This is a bit like knowing how many of a certain game is available in the store. You want to make sure there’s enough of the cryptocurrency available so you can buy and sell easily.

- Use Smart Trading Tricks: Learn some clever ways to buy and sell. This can help you make the most out of these price differences.

Remember, the goal is to buy low and sell high in different places. By doing this, you can make some cool profits in the crypto world. Just like any other way of making money, it takes some practice and attention to do well. Keep learning and you could get pretty good at it!

Discussing Potential Disadvantages of Crypto Arbitrage

Are you curious about making money with arbitrage in cryptocurrency but worried about the risks? You’re not alone! In this article, we’re going to look at some of the things you should think about before you start.

First off, remember that every time you trade, there are fees. These can eat into your profits, so it’s important to know how much they are. Also, the prices of cryptocurrencies can change really fast, which can be risky. This means you need to be careful and understand what you’re getting into.

Another thing to consider is that different places where you buy and sell cryptocurrencies might have rules on how much money you can use. This could affect your trading plans. Don’t forget about the extra costs like transfer fees when you move your crypto from one place to another.

To do well, you have to be smart about these risks, especially when the market changes quickly. Knowing about these challenges is a big step in becoming a successful trader. Stay informed and cautious to make the most out of your crypto adventure!

Considering Transaction Fees in Your Profit Calculation

When engaging arbitrage in crypto trading, it is crucial to factor in transaction fees. Therefore, let’s talk about something really important: the costs of your trades. When you’re trading in different places (we call them “exchanges”), you’ve got to pay a bit of money each time you make a trade. This is called a transaction fee.

To make sure you’re actually going to make a profit, you need to think about these fees. If the fees are high, they might eat up your profits. So, what can you do? Look for places where the fees are lower – that way, you can keep more of your earnings.

Also, don’t forget about transfer fees. Sometimes, moving your crypto from one place to another costs money too. These fees can add up and affect how much money you make from your trades.

In short, keep an eye on all these different costs. This way, you can figure out the best places to trade and make the most money. Remember, arbitrage in crypto trading, every little bit of money counts!

The Challenge of Limited Withdrawal Options

If you’re into arbitrage in crypto trading, you’ve got to be smart about how you can take out your money and where you can trade. It’s really important to know how much money (or liquidity) is available in different places where you trade (like exchanges) so you can make more profit. Also, you should think about the risks that come with rules on how much money you can take out.

To do well and avoid trouble, like your money getting stuck, you need a good plan that works with the rules of different trading places. Remember to consider how prices change, what fees you have to pay, and the best way to use your digital money and trading bots. These tools can really help you handle these tricky parts of trading.

Why Is Crypto Arbitrage a Low-Risk Trading Strategy?

Arbitrage in crypto might be just what you’re looking for! It’s all about using the price differences in different cryptocurrency markets to your advantage. Here’s how you can do it while keeping risks low:

- Understand Market Changes: Cryptocurrencies can be unpredictable, so it’s important to keep an eye on how they change in price. You want to find those moments when the risks are lower to make your move.

- Use Special Trading Tools: There are tools called ‘trading bots’ that can help you make decisions faster and more efficiently. They can reduce the risks because they work quickly and can track many things at once.

- Mix It Up: Don’t put all your eggs in one basket. Having a variety of cryptocurrencies can help spread out the risk. This way, if one isn’t doing well, the others might balance it out.

- Capitalize on Price Differences: Keep an eye out for price differences in different exchanges. This is where you can make a profit by buying low in one place and selling high in another.

By using these strategies, you can get better at arbitrage in crypto. It’s a cool way to potentially make money in the world of cryptocurrencies!

Share this Image on Your Site:

Understanding Crypto Market Volatility

Understanding the volatility of the crypto market is crucial for successful arbitrage trading. By analyzing market volatility, crypto arbitrageurs can identify potential profit opportunities. They constantly monitor price fluctuations in different cryptocurrencies to spot favorable opportunities.

Real-time market analysis helps them mitigate risks associated with sudden market movements. Leveraging order book exchanges allows traders to profit from the price volatility in the crypto markets. It is important to optimize the trading strategy and adapt to changing market conditions in real time. Empower yourself by understanding and navigating the crypto market volatility.

Navigating Sudden and Unfavourable Market Movements

Are you into arbitrage in crypto and want to handle sudden changes in the market without too much risk? It’s super important to have good strategies for managing risk. Here’s how you can do it:

- Keep a close eye on the order book system. This helps you see when prices might not be in your favor.

- Use crypto arbitrage bots. These bots are really quick at responding to market changes as they happen.

- Always work on making your trading strategy better. This way, you can reduce your chances of losing money and increase your chances of making profits.

Remember, the world of crypto trading can be unpredictable. Staying alert, ready to adapt, and proactive is key to doing well in this field.

How Does Crypto Arbitrage Fit Into Your Investment Portfolio?

Adding crypto arbitrage to your investment mix is a clever idea. It spreads out the risk and boosts your chances of making more money. Look at how much you could earn with arbitrage in crypto compared to other investments, and think about how easy it is to buy and sell different cryptocurrencies.

Conclusion

To wrap it up, arbitrage in crypto is a way to make money in the cryptocurrency market that works for both beginners and people who have been doing it for a while. It’s about taking advantage of the different prices for cryptocurrencies on various exchanges. You can do this through different methods, like cross-exchange (using two different exchanges) and intra-exchange (within the same exchange) arbitrage. Using trading bots, which are like automatic helpers, can make this process easier and more efficient.

Even though arbitrage in crypto can lead to quick money and has lots of chances to do so, there are some things to watch out for, like extra costs and sometimes not being able to take your money out easily. In general, though, it’s a pretty safe way to trade that can fit into your plans for investing. If you’re curious about trying arbitrage in crypto, our team is here to help you learn more and give you advice on how to get started.

Learn Cryptocurrency Investment!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Crypto Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

Which crypto arbitrage is best?

Crypto arbitrage is about buying and selling digital currencies on different platforms to profit from price differences. But it’s risky due to fees, changing prices, and rules. Always research and get expert advice before trying it or any investment method.

Can you make a living off crypto arbitrage?

Arbitrage in crypto can be a way to make money by using price differences in different crypto markets. It’s fast-paced and needs good trading skills and access to various exchanges. However, it’s risky due to market volatility, fees, and regulatory changes. Success in crypto arbitrage needs careful planning and staying informed. Consulting experts is recommended for anyone considering it as a main income source.

Is crypto arbitrage profitable in 2024?

Yes, arbitrage in crypto can be profitable in 2024. It’s a way to make money by taking advantage of different prices for cryptocurrencies on various exchanges. However, it’s important to know the risks and to understand how cryptocurrency markets work. Quick changes in prices and fees can affect your profit.

What Are the Dangers of Crypto Arbitrage?

Crypto arbitrage can be risky because cryptocurrency prices change very quickly, and you might not always make a profit. There’s also the chance of losing money if a trading platform has issues or delays. Plus, you need to understand how these trades work and watch out for fees that could eat into your earnings.

Which crypto exchange is best for arbitrage?

The best exchange for arbitrage in crypto depends on your needs, but Binance and Kraken are popular choices. They offer many coin options and have high trading volumes, which is important for quick trades. Remember, always consider fees and transfer times when choosing an exchange for arbitrage.

Which cryptocurrencies are best suited for arbitrage trading?

Cryptocurrencies that are well-suited for arbitrage trading often include popular ones like Bitcoin, Ethereum, and Litecoin. These currencies are widely used, have a lot of trading activity, and are available on multiple exchanges, which can lead to price differences that traders can take advantage of for arbitrage opportunities.

Can a beginner trader engage in cryptocurrency arbitrage?

Yes, a beginner trader can try cryptocurrency arbitrage, but they need to learn how it works first. It involves buying and selling crypto across different exchanges to profit from price differences. However, it’s important for beginners to understand the risks and start with small amounts of practice.