The crypto market is always changing. Recently, a new kind of investment called a Bitcoin ETF was approved, and now people are looking at other cryptocurrencies that might be important.

Ethereum (ETH), another cryptocurrency, has been getting a lot of attention because its price is going up and there might be a special investment product for it called an Ether ETF. In this blog, we talk about what’s happening in the crypto market right now and why big companies like Blackrock are interested in Ether ETFs (Exchange-Traded Funds). We compare how investments in Bitcoin and Ethereum have done so far and guess how Ethereum ETFs might do if they get approved. We also look at other cryptocurrencies that might become popular like Ethereum, especially with these new ETFs coming out in London.

This is a good time to learn more about where the crypto market is going and if investing in an Ether ETF could be better than investing in Bitcoin directly.

- 1. What is an Ether ETF?

- 2. Will Ether ETFs help Ethereum to grow?

- 3. The Reasons for ETH’s Rising Price

- 4. The Role of Asset Management Firms in the Crypto Market

- 5. The Possibility of an Ether ETF

- 6. Comparing Tokens: Bitcoin ETFs vs. Ethereum ETFs

- 7. Future of Altcoins in Light of ETH ETF Approval

- 8. Could Ethereum ETFs become more successful than Bitcoin ETFs?

- 9. Conclusion

- 10. FAQ

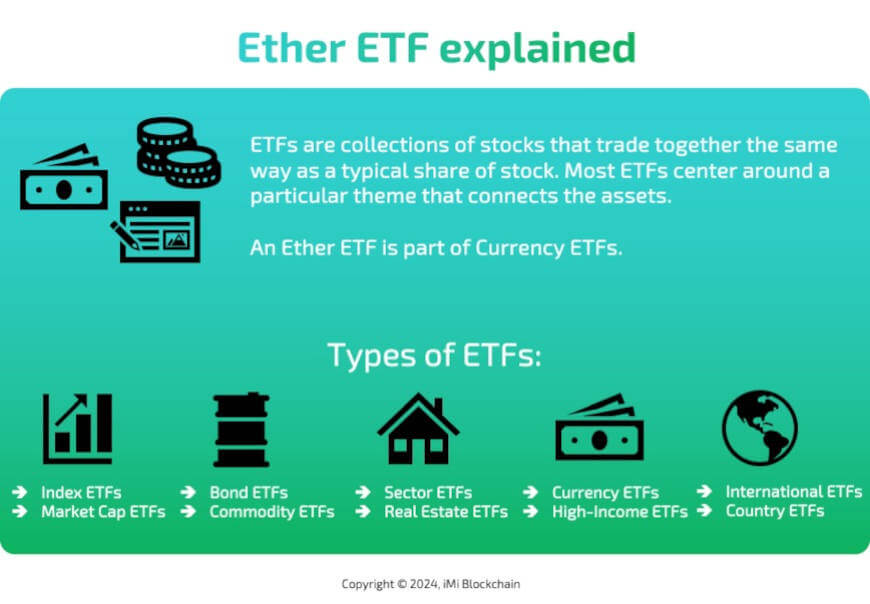

What is an Ether ETF?

An Ether ETF, or Exchange-Traded Fund, is a type of investment fund that allows investors to buy and sell shares that represent ownership in a pool of Ether.

Ether is the cryptocurrency that powers the Ethereum blockchain network. Now, an Ether ETF provides a way for investors to gain exposure to ETH without having to directly own and manage the cryptocurrency themselves. The ETF holds Ether on behalf of its investors and issues shares that can be bought and sold on a stock exchange.

Investing in an Ether ETF can offer several potential benefits, including diversification, liquidity, and ease of trading. It allows investors to participate in the potential growth of the cryptocurrency market without the complexities and risks associated with directly owning and managing digital assets.

It’s important to note that availability and regulations surrounding Ether ETFs may vary depending on your jurisdiction. It’s advisable to consult with a financial advisor or conduct thorough research before considering any investments in cryptocurrencies or related financial products.

Share this Image on Your Site:

Will Ether ETFs help Ethereum to grow?

The price of Ethereum has already risen. Ether ETFs (Exchange-Traded Funds) and Bitcoin ETFs are important for a few reasons, especially for people who are interested in investing in cryptocurrencies but in a more familiar way.

- Different Investments: First, it’s like having different flavors of ice cream. Bitcoin and Ether are different cryptocurrencies. Bitcoin is like the original flavor, very popular and well-known. Ether is another flavor, also popular but a bit different. It’s like chocolate and vanilla. Some people might prefer one over the other or want to try both. So, having ETFs for both Bitcoin and Ether gives people more choices.

- Ease of Investment: ETFs make it easier to invest in cryptocurrencies. Think of it like buying a pre-made cake from a store instead of making one from scratch. With ETFs, you don’t have to worry about the complex parts of owning cryptocurrencies, like setting up a digital wallet or dealing with security issues. It’s a simpler way for regular investors to get into the crypto world.

- Regulation and Safety: ETFs are like playing in a playground with safety rules and someone watching over them. They are regulated, which means there are rules and protections in place. This can make people feel safer investing in them, compared to buying cryptocurrencies directly, which can be more like playing in a wild, open field.

- Market Growth: Having both Bitcoin and Ether ETFs shows that the financial world is taking cryptocurrencies seriously. It’s like more stores starting to sell those new, cool electric scooters everyone’s talking about. It means more people might start investing in them, which can help the market grow.

In summary, Ether ETFs, after the approval of Bitcoin ETFs, offer more choices, make it easier and potentially safer to invest in cryptocurrencies, and help the Ethereum blockchain grow. It’s all about providing different options for people who are interested in the world of Ethereum.

Understanding the Recent Bitcoin ETF Approval

The recent approval of the Bitcoin ETF is a big step for the crypto market. It means there are new ways to invest and different strategies to think about. This approval is important because it affects how people decide to invest and changes how the market works, including the prices of cryptocurrencies and how much is traded. Investors need to understand how this ETF approval can make the crypto market more unpredictable. By understanding this, investors can make better choices and take advantage of new chances in the changing world of cryptocurrencies. Gensler said Wednesday after the SEC decision on the ETFs that “Bitcoin, itself, we did not approve”.

Why the Bitcoin Price just dropped?

The Bitcoin price dropped after the SEC approved Bitcoin ETFs because investors had already bought Bitcoin expecting the approval. Once it was approved, they sold their Bitcoin for a profit, which increased the supply of Bitcoin in the market, leading to a decrease in its price.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWThe Reasons for ETH’s Rising Price

Recently, Ethereum’s value has gone up a lot, because everyone expects the approval of EHT EFTs in short. This big change affects how much money investors can make and what might happen in the future. Because of this, investors need to change how they do things. Knowing about these changes helps investors make smart choices, adjust to new market situations, and find more chances to grow their investments and make their portfolios more diverse in dollar value.

After the U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin exchange-traded funds (ETFs) on January 10, the path is now clear for spot Ethereum ETFs to be approved in 2024, according to Bloomberg ETF analyst Eric Balchunas.

The recent increase in Ethereum’s value is making investors look more closely at the market and why things are happening the way they are. This increase is caused by how the market is doing and what’s happening in the industry. Crypto investors need to understand this increase. It makes them think about what could happen if the value keeps going up, which helps them make better investment decisions.

Share this Image on Your Site:

The Role of Asset Management Firms in the Crypto Market

The entry of big Asset Management companies is changing the way the crypto market works, leading to new ways of investing. These firms affect the total value of assets and how people see the industry, which changes how the market behaves. Knowing what these companies do helps investors understand changes in the industry, improve their investment plans, and deal with how these changes affect crypto prices. This knowledge lets investors make smart choices in a market that is changing quickly.

Share this Image on Your Site:

Blackrock’s & VanEck’s Interest in Ether ETFs

Blackrock, VanEck, ARK, and other big investment companies are now focusing on Ether ETFs (a kind of investment linked to cryptocurrency). This is a big deal for the crypto world because it changes how people think about investing and how the industry works. When a company as important as Blackrock shows interest in something like Ether ETFs, it affects how people feel about investing in crypto. This can make the prices of these investments go up and down a lot.

For investors, it’s important to understand what Blackrock’s interest means. Knowing about this can help them guess what might happen next in the crypto industry and change their investment plans to make the most of new chances.

The crypto market is always changing, and big companies have a big effect on the prices of cryptocurrencies. This can make the market go up and down a lot, and it means investors need to change how they invest. If investors understand how these big companies influence the market, they can make better choices and change their plans to deal with new changes in the industry.

Unlock the Secrets of Crypto Trading

Join our Live Online Course today!

Live, interactive online sessions – 1-on-1 sessions from a seasoned crypto trading expert.

Personalized coaching – from a certified crypto expert.

Learning Material – comprehensive learning from basics to advanced strategy.

Flexible Scheduling – to fit your busy life.

ENROLL IN THE BEST CRYPTO TRADING COURSEThe Possibility of an Ether ETF

The possible approval of an Ether ETF (a type of investment fund) is exciting for people who like cryptocurrency. It means they can invest safely and easily in the digital money market. This big step could help more people use cryptocurrencies in regular money matters. Investors can benefit from the value of Ether, a kind of digital currency, without actually owning it. Also, this might show that more people are starting to trust the future of cryptocurrencies, leading to even better chances to invest and potentially higher investment returns.

The market is excited about the possibility of trading Ethereum futures. People believe this will lead to good results. Everyone in the crypto world is looking forward to Ether ETFs being allowed, as they think it will make investments in futures trading more profitable. There’s a lot of talk about how this could affect the value of crypto investments. The approval of Ether ETFs could open up new chances for investing in cryptocurrencies. Investors are keen to see how this might change how much prices go up and down in the market. Hence, look also into any crypto bubbles before investing.

Share this Image on Your Site:

Market Reactions to Potential Ether ETF

The upcoming decision about whether or not to allow Ether ETFs (Exchange-Traded Funds) is causing a lot of talk, especially about how it might affect the price of Ether. Experts who watch the markets are really interested in this. If these ETFs are approved, a lot of people might invest in them, which could change the value of Ether. The fact that people are so interested in the possibility of Ether ETFs shows that more and more people want to invest in digital currencies like Bitcoin (BTC) and Ethereum (ETH). This is a big moment for the Ethereum market and could mean good things for investing in digital currencies in the future.

Comparing Tokens: Bitcoin ETFs vs. Ethereum ETFs

Comparing Bitcoin and Ethereum Exchange-Traded Funds (ETFs) shows us how different the choices are for investing in digital money like cryptocurrencies. People look at Bitcoin and Ethereum ETFs to see if they can spread out their investments better and why it’s important to know the differences between them to make smart choices. This comparison also helps us understand what people who like investing in cryptocurrencies are looking for, helping them make better choices in the fast-changing world of crypto. All return figures include dividends as of month end.

Share this Image on Your Site:

Advisor: Predicted Performance of Ethereum ETFs

Ethereum ETFs (Exchange Traded Funds) are expected to do really well, and experts think they could bring big profits. This shows that people are getting more confident about investing in digital stuff like cryptocurrencies. The way digital investments are changing is opening up new chances for people to put their money into different kinds of things. Since most people are feeling good about the market, Ethereum ETFs, which invest in Ether futures contracts, could lead to a change in how people invest in crypto. This could be a great chance for investors who want to spread their investments across different areas.

Future of Altcoins in Light of ETH ETF Approval

The decision to allow ETFs (Exchange-Traded Funds) for cryptocurrencies like Ethereum could make it easier for people to invest in these digital currencies. This is exciting news for altcoins, like Ethereum’s Ether, because it could lead to more people wanting to invest in them. If Ethereum ETFs are approved, it might cause a rise in the value of these altcoins and open up new chances for people to invest in the world of digital currencies. This could really change how altcoins are used, giving investors more ways to put their money into the digital currency market, including Fidelity’s spot Ether ETF application.

Several other digital currencies, similar to Ethereum, are expected to do well if certain types of funds, known as ETFs, are approved. These currencies have good features that could help them succeed. Many are watching how Ethereum does, hoping to do the same. People are more hopeful because of the possibility of these new investment options. The excitement is about how these digital currencies might follow in Ethereum’s footsteps and do well in the world of online money investing.

Share this Image on Your Site:

Could Ethereum ETFs become more successful than Bitcoin ETFs?

Speculations about how well Ethereum ETFs might do compared to Bitcoin ETFs show that people’s feelings about investing are changing. When people talk about the future of things to invest in that use digital money, they often compare Ethereum and Bitcoin ETFs. The chance that Ethereum ETFs could do better than Bitcoin shows how the world of investing in cryptocurrencies is changing. This makes the crypto community very excited.

Conclusion

In conclusion, there’s a big change happening in the world of cryptocurrency. Recently, a special kind of fund for Bitcoin was approved, and the value of Ethereum, another type of cryptocurrency, has gone up a lot. This has made people wonder if other lesser-known cryptocurrencies might also become more popular, and if Ethereum might get its own special fund like Bitcoin.

Big companies, like Blackrock, are also interested in these Ethereum funds, which can affect the prices of cryptocurrencies. The Bitcoin funds are doing well, and now people are looking forward to seeing how well the Ethereum funds will do. Cryptocurrencies like Ethereum might become as popular as Bitcoin. If you’re curious about all this and want to know more about investing in cryptocurrencies, you can contact us for more information.

Learn Cryptocurrency!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Crypto Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

What is the best ETF for Ethereum?

Some popular options for Ethereum ETFs include the Purpose Ether ETF and the CI Galaxy Ethereum ETF. When considering the best ETF for Ethereum, factors like fees, performance, and investment strategy should be taken into account. Investors need to research and compare different options before making a decision, while also considering the risks associated with cryptocurrency investments.

Will Ethereum ETF be approved?

The approval of an Ethereum ETF remains uncertain. The SEC has previously denied applications, citing concerns over market manipulation and investor protection. However, recent developments in the cryptocurrency industry could increase the likelihood of an approved Ethereum ETF. Stay updated on regulatory changes and consult a financial advisor before investing in any ETFs.

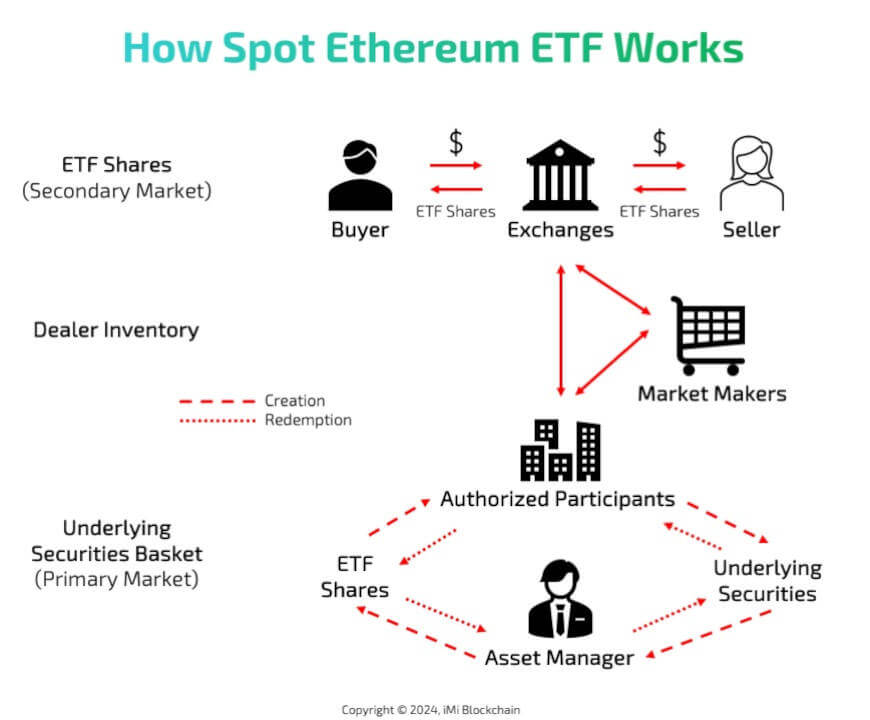

How does investing in an Ether ETF work?

Investing in an Ether ETF involves buying and selling shares of the fund on a stock exchange. The value of the ETF is determined by the performance of the underlying Ether cryptocurrency. Investors need to research and understand the risks before investing.

What are the risks involved with investing in an Ether ETF?

Investing in an Ether ETF comes with risks. Market volatility and regulatory changes can affect the value of the ETF. If the value of the Ether decreases, there is a risk of loss. Before investing, it’s important to research and understand these risks.

What would be the minimum investment in Ethereum ETF?

The minimum investment required for an Ethereum ETF can vary depending on the specific fund and broker. While some Ethereum ETFs may have a minimum investment of $100 or less, others may require a larger initial investment. It is important to thoroughly research different options and consider any associated fees before deciding to invest in an Ethereum ETF. As always, consulting with a financial advisor is recommended.