Welcome to the exciting world of cryptocurrencies! This is a place where digital money and new kinds of finance are changing how we think about money. Today, we’re going to talk about something really interesting called “crypto bubbles.” This is a term for when the value of cryptocurrencies like Bitcoin goes up really quickly and then might drop down just as fast.

In this blog, we’re going to learn all about crypto bubbles. We’ll look at why they happen, what causes them, and if people can make money from these ups and downs. Also, we’ll see how crypto bubbles are different from the bubbles we sometimes see in the regular money world.

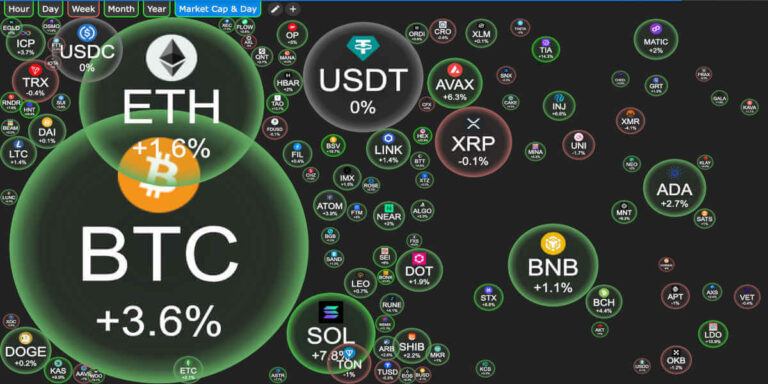

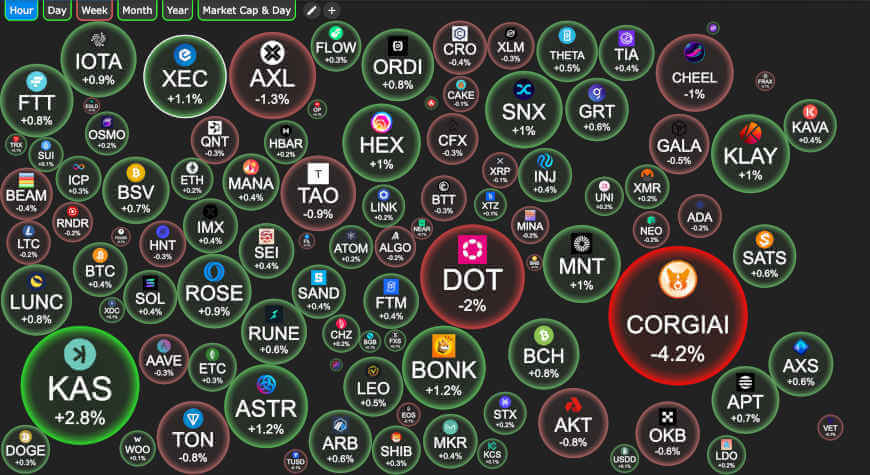

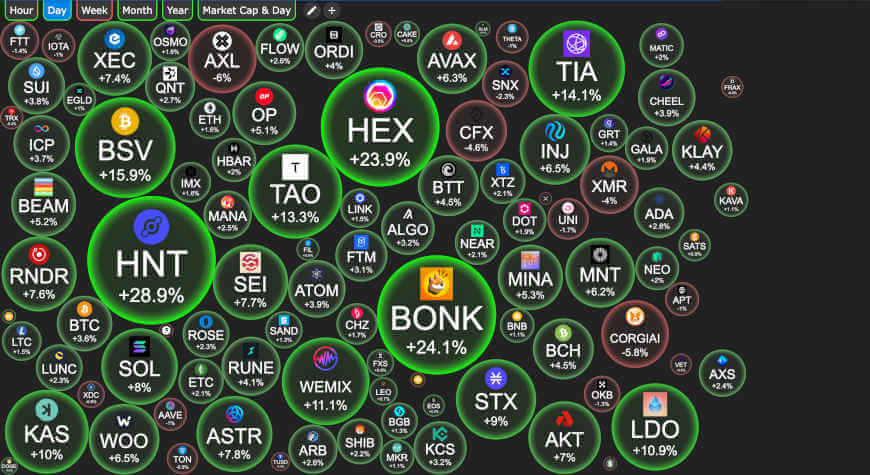

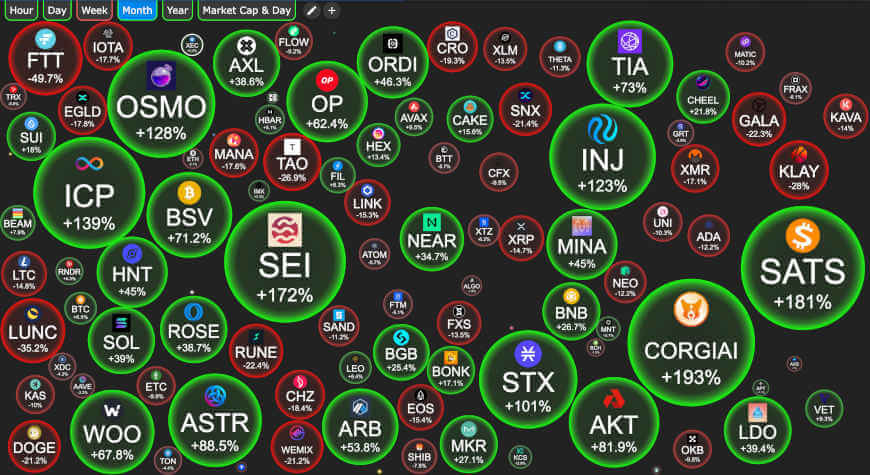

We’ll also check out a website called Cryptobubbles.net. This site helps people who are investing in cryptocurrencies to understand and deal with the big changes in value that can happen.

So, get ready for an adventure as we dive into the world of cryptocurrency markets!

Understanding Crypto Bubbles

When we talk about crypto bubbles, we’re looking at a special situation in the world of cryptocurrencies. Think of a crypto bubble like a balloon that gets too big too fast. It happens when a lot of people invest in the best cryptocurrency and its price goes up.

Let’s say a lot of people are trading Bitcoin or Ethereum and buying or selling crypto, and then the bubble shoots up quickly because lots of people are excited and trading them, but the prices are higher than their actual value. This can be risky, especially for people who are new to investing, because the bubble can pop – meaning the prices can drop suddenly, and people can lose money.

In recent years, the popularity of crypto exchanges has skyrocketed, with platforms like Coinbase gaining significant attention. These exchanges provide a marketplace for buying and selling cryptocurrencies, allowing investors to participate in the phenomenon of crypto bubbles and experience the volatility and potential gains associated with different asset classes, including the Bitcoin network.

It’s important to know the signs of a crypto bubble so you can make smart choices and be careful with your money. Let’s learn more about what a crypto bubble is and why it’s important to understand it.

What is a Crypto Bubble?

A crypto bubble is like a wild roller coaster ride in the world of digital money, called cryptocurrency. Imagine a lot of people suddenly wanting to buy a certain type of digital money, making its price shoot up really fast. This is because people hear about it on social media or just get really excited, thinking they can make a lot of money quickly. But just as quickly as the price goes up, it can fall down, leaving some people with less money than they started with.

Cryptocurrencies are different from regular money because they don’t have one big bank controlling them. Instead, they work on a system that lets people send money directly to each other over the internet. This new way of dealing with money is changing how we think about finance, offering a digital option instead of traditional banking. However, it is important to note that central bank money plays a crucial role in the stability of the payment system. By ensuring that the role of central bank money as the anchor of the payment system is preserved for both retail and wholesale transactions, central banks will safeguard the trust on which private forms of money ultimately depend.

The oversight framework for payment instruments, schemes, and arrangements – the PISA framework – that was launched last year addresses the risks of stablecoins and other crypto-assets for payment systems in various financial centers such as New York.

For people who are part of this market in the United States, understanding these ups and downs is really important. It helps them make smarter choices and be careful, especially since this area of money can be tricky and change a lot. Knowing about these crypto bubbles, especially when you are into crypto arbitrage trading, means being better prepared for the unexpected turns in the world of digital money.

Share this Image on Your Site:

How do Crypto Bubbles Form?

Crypto bubbles usually start when a lot of people get really excited about the price of cryptocurrencies going up. This excitement is often caused by people talking about it on social media and the news. When a certain cryptocurrency gets a lot of attention, people start buying it because they don’t want to miss out on making money.

During a bubble, people get too excited and stop thinking about whether the price makes sense. They just buy because the price is going up and everyone else is buying. Sometimes, they don’t really understand how cryptocurrencies work or they’re new to trading. They just want to make quick money because everyone seems to be doing it.

When prices go really high, people get scared of losing the chance to make money, so they start buying more and more. But when something changes and prices start to fall, everyone panics and sells their cryptocurrencies quickly. This makes the prices of cryptocurrency prices fall even faster. This kind of behavior, where everyone does the same thing, can make the market very unstable and can make the bubble get bigger and then burst.

For example, in the crypto market, a collapse of FTX sent shockwaves through the market and led to a 10% drop in Bitcoin price and a 15% drop in Ether price. It is important to stay informed about the latest developments in the cryptocurrency market, as highlighted by the Financial Times in their article on the first US bitcoin ETF losing a record amount in its initial year.

To really understand how these bubbles happen, it’s important to know about the market, how much the media can influence prices, and how people’s emotions and decisions play a big role. If investors understand these things, they can be more careful and make smarter choices when investing in cryptocurrencies.

Unlock the Secrets of Crypto Trading

Join our Live Online Course today!

Live, interactive online sessions – 1-on-1 sessions from a seasoned crypto trading expert.

Personalized coaching – from a certified crypto expert.

Learning Material – comprehensive learning from basics to advanced strategy.

Flexible Scheduling – to fit your busy life.

ENROLL IN THE BEST CRYPTO TRADING COURSEHow Crypto Bubbles Work

To understand how crypto bubbles work and affect the cryptocurrency market, think about a few key points.

First, there’s something called market capitalization. It’s like a scorecard for a cryptocurrency, showing how much it’s worth overall. You get it by multiplying the current price of the cryptocurrency by how many of them are out there. In a bubble, this number can shoot up because lots of people want to buy the cryptocurrency, and its price goes up a lot.

Second, prices going up is a big sign of a crypto bubble. Sometimes, the price of a cryptocurrency can get really high, but that doesn’t always mean the cryptocurrency itself is worth that much. People might buy it because they don’t want to miss out on making money, not because the cryptocurrency is actually that valuable in market conditions. This rapid increase in price can trick more people into buying, pushing prices even higher, which is a red flag that a crypto bubble may be forming.

It’s also helpful to compare crypto bubbles to other things like the housing market and real estate. Both can have prices that go up and down and are influenced by how many people want to buy or sell. But the crypto market is a bit different because it’s open all the time, anyone around the world can trade, and prices can change really quickly. However, one significant difference between crypto bubbles and traditional financial bubbles is the lack of regulation in the cryptocurrency market. Unlike traditional financial markets, the cryptocurrency market is largely unregulated. This lack of regulation can exacerbate the formation of bubbles as it makes it easier for fraudsters to manipulate prices and deceive investors in the entire cryptocurrency market.

Lastly, understanding how these bubbles work helps people make better choices with their money in the crypto market. By looking at trends, the real value of the cryptocurrency, and how rules and crypto regulations, such as regulatory oversight, might affect it, investors can be smarter about where they put their money. They can try to make the most of good times in the market while being careful not to take on too much risk. It is also important for investors to consider the environmental impact of crypto-assets, as they can have significant social costs. By addressing and internalizing these social risks, authorities can mitigate the negative effects of tax evasion and illicit activities associated with crypto-assets.

Factors Contributing to Crypto Bubbles

Crypto bubbles happen when the prices of cryptocurrencies like Bitcoin go really high and then suddenly drop. This can be caused by a few things:

- Hype: This is when people get very excited about something new, like a new cryptocurrency, and start talking about it a lot. This can make more people want to buy it, which raises its price.

- Irrational Exuberance: This fancy term just means that people get overly excited and optimistic. They think the value of the cryptocurrency will keep going up forever, so they buy a lot of it, which again, pushes the price up.

- Panic Sell-Offs: After a while, something might happen that makes people scared that the price will go down. So, they start selling their cryptocurrency quickly. This rush to sell can make the price drop really fast.

Understanding these factors can help us see why crypto prices go up and down so much. It’s important to know this if you’re interested in the cryptocurrency market.

Hype and Its Impact

Hype is a big reason why crypto bubbles happen. This means when lots of people talk about a cryptocurrency on social media, TV, or when famous people promote it, the price can go really high, really fast. When everyone sees this on places like Twitter or Facebook, even people who don’t know much about investing want to buy it. They feel like they have to join in or they’ll miss out, which is called FOMO (Fear Of Missing Out).

During a bubble, crypto investors might buy crypto just because its price is going up, not because they understand it or think it’s really worth that much. They ignore usual ways to check if it’s a good investment. This can be risky because when the bubble pops, prices fall quickly and people can lose a lot of money.

It’s important to know how hype and getting too excited can affect your choices in the crypto market. By understanding why people act this way, you can be more careful, set reasonable goals, and not get carried away by everyone else’s excitement. This can help you make smarter choices and protect your money.

Panic and Sell-Offs

One of the big reasons for ups and downs in cryptocurrency (like Bitcoin) is when people start selling quickly because they’re worried. This can happen when things in the market change fast or when people are trying to avoid losing money. Here’s what you need to know:

- Cryptocurrency bubbles make people want to buy a lot because they don’t want to miss out on making money.

- When prices go really high, more people start buying, which pushes prices even higher. But sometimes, people get too excited and the market can get really shaky.

- If the market changes suddenly, people might start selling a lot and fast. This can make prices drop quickly as everyone tries to sell their crypto.

- When lots of people do the same thing in the market, like buying or selling at the same time, it can make prices change a lot and even make the bubble bigger.

- It’s really important to be smart about risk when there’s a panic sell-off. Investors need to think about how much money they could lose.

- To handle the ups and downs in the crypto market, it’s important to keep an eye on what’s happening, be smart about risks, and have a plan for what to do if prices start to drop a lot. Knowing the warning signs and having a good strategy can help investors make better choices and maybe even take advantage of chances in the market.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWWarning Signs of a Crypto Bubble

When you’re looking at investing in cryptocurrencies, it’s really important to know when there might be a “crypto bubble.” This is like when the prices of a particular cryptocurrency experience rapid, overextended price increases, but it might not last. Knowing this can help you make smarter choices, not take too many risks, and keep you from losing a lot of money.

Let’s learn about the signs that show a crypto bubble and ways to be careful with your investments. One warning sign of a crypto bubble is the lack of intrinsic value. If a cryptocurrency does not have any real-world utility or use case, and its price is driven solely by speculation, it may be a sign of a bubble. In such cases, the price of the cryptocurrency may be far higher than its actual value.

Identifying Risk Indicators

Understanding the signs of risk is really important for people who invest money, especially in things like the stock market or cryptocurrencies. Here are some things to watch out for that can help you make smart choices:

- When the government starts paying more attention and making rules about investments, it might be a warning sign. They do this to keep things fair and safe for everyone.

- If the price of something like Bitcoin goes up really fast just because people are excited about it, but there’s no real reason for the increase, that could mean trouble.

- A lot of attention from the news, social media, or famous people can make everyone want to buy, but this can be risky and might not last.

- If lots of new investors start putting money in because they don’t want to miss out on making money, this can create a risky situation.

- When the total value of a cryptocurrency, how much its price changes, and how much is being traded reach really high levels, it can be a sign that the market is getting too hot and might not be stable.

By keeping an eye on these signs, investors can make better choices, understand what’s happening in the market, and handle the ups and downs of investing in things like cryptocurrencies.

Understanding Market Trends

To understand market trends, especially in the world of cryptocurrencies, it’s like being a detective looking for clues to make smart money choices. Here are some key ideas made simple:

- Market Trends and Cryptocurrency: This is about watching how the prices of digital currencies like Bitcoin go up or down. It’s like keeping an eye on a game score, but instead, it’s about money.

- Why Study Market Trends?: It’s like trying to guess what will happen next in your favorite TV show. By looking at how prices change, you can try to predict if a cryptocurrency will become really popular (and expensive) or if it’s just a passing fad.

- What to Look For: Pay attention to what people are saying about cryptocurrency, how much it’s talked about in the news, and how many people are buying it. It’s like noticing if everyone at school is talking about a new game or gadget.

- Making Smart Choices: By understanding all this, you can make better decisions about where to put your money. It’s like choosing the right player in a video game who has the best chance to win.

- Staying Informed and Adapting: Keep learning and paying attention to what’s happening in the cryptocurrency world. This way, you can change your plans if you need to, just like you might change strategies in a game when things get tough.

Remember, understanding market trends is like being smart with your choices – whether it’s about buying a new phone or investing in digital money!

Cryptocurrency Bubbles vs. Traditional Financial Bubbles

Cryptocurrency bubbles and traditional financial bubbles, like the dot-com bubble or the 2008 housing market crash, have some things in common but also some big differences. Let’s look at what makes them alike and what sets them apart, and see how they both affect the financial world.

- Similarities:

- Both can grow quickly: Just like how a balloon fills up fast, both types of bubbles can get big really quickly.

- Risk of bursting: They can also pop suddenly, causing people to lose money.

- Differences:

- What they’re based on: Traditional bubbles are often about real things like houses or company stocks. Cryptocurrency bubbles are about digital money, which is a newer idea.

- How they start and spread: The way these bubbles begin and spread can be different because of how technology and the internet work with cryptocurrencies.

Understanding these bubbles helps us understand why they matter in the world of money and finance.

Major Differences

Crypto bubbles are different from regular financial bubbles because they happen in a world where there’s no big bank in charge. Let’s look at some of the main differences:

- No Big Bank Boss: In normal money matters, big banks (called central banks) have a lot of power. They can change how much money is worth and decide on rules for money stuff. But cryptocurrencies, like Bitcoin, don’t follow these big bank rules. They’re like a new kind of money that’s trying something different.

- Different Kind of Money: Usually, when there’s a financial bubble, it’s about things like houses getting super expensive or stocks going up like crazy. But crypto bubbles are all about digital money. This digital money is shaking things up and could change how we use money in the future.

- A New Money System: Crypto bubbles show us a new way of dealing with money that doesn’t rely on the usual banks and rules. It’s based on cool tech called blockchain and digital money. Regular financial bubbles happen in the old system where there are lots of rules and people in charge.

It’s really important for people who invest money, for those who make rules (like policymakers), and for everyone who’s part of the market to understand these differences. Knowing what makes crypto bubbles special can help people make smarter choices about their money, especially when dealing with cryptocurrencies and thinking about what might happen next in the market. We should therefore focus on protecting inexperienced investors and preserving the stability of the financial system. The Financial Stability Board (FSB) emphasizes the need for effective regulation and oversight of cryptocurrencies to mitigate the risks they pose to the financial system, including weak accounting systems and risk management.

Similarities and Overlaps

Cryptocurrency bubbles and regular financial bubbles are kind of similar, but also different in some ways. Here’s what you should know:

- Both happen in financial markets, which means the prices of things like stocks or digital currencies can go up a lot and then suddenly drop.

- In both cases, people can get too excited without thinking about what these things are really worth. They just follow what others are doing or the latest price trends.

- Neither crypto nor regular financial bubbles have strong rules to control them. Having rules is important because they keep things stable, protect people who invest, and stop too much wild behavior in the markets.

- Trends in the market and the real value of things are super important in both crypto and regular financial bubbles. They affect how much things cost and how the market behaves.

- Studying the past of economics helps us understand how these bubbles start, burst, and how they impact both the crypto world and the regular financial markets.

Understanding these similarities helps investors learn from the past. They can use this knowledge to better handle both cryptocurrency and regular financial markets. This way, they can reduce risks and make smarter choices about where to put their money.

Can Investors Profit from a Crypto Bubble?

The idea of making money from a crypto bubble (when the prices of cryptocurrencies rise quickly) can be exciting, but it’s really important to know the risks that come with it. In this part, we’re going to talk about the dangers and the possible rewards of putting money into crypto during a bubble. This will help people who want to invest in crypto to make smart choices.

Risks Involved

Investing in cryptocurrencies during a bubble (when prices are super high) can be really risky, and it’s important to be careful. Here’s what you need to know:

- Big Losses: Putting money into crypto bubbles can lead to big losses, especially if you’re new to this and get too excited by the high prices.

- Managing Risks: If you don’t have a good plan for managing risks, you might end up losing a lot of money during a bubble.

- Fewer Rules: The crypto market doesn’t have as many rules as normal financial markets. This means prices can change a lot, and there might not be much protection for your money. There’s also a chance of people messing with the market.

Even though there’s a big risk of losing money and suffering significant losses, you can lower your risks by being smart about it. Learn as much as you can about cryptocurrencies, have a plan for managing risks, and spread your investments across different types. By doing these things, you can make better choices in the crypto market.

Potential Gains

Crypto bubbles are times when the prices of digital money, like Bitcoin, go up really high, really fast. But these bubbles can be risky. However, if you’re smart about it, you can still make money. Here’s how:

- Price jumps: When there’s a crypto bubble, the prices of these digital monies can go up a lot. If you buy them at the right time, you could make money when the prices go up.

- Real value: Some digital monies are actually worth more than others. If you do your homework and figure out which ones are really valuable (and not just popular), you might make money in the long run.

- True worth: It’s important to look past all the excitement and really understand what a certain digital money is worth. This helps you make better choices about which ones to invest in.

The key is to use data and research to guide your choices. Be careful, do your homework, and focus on the real value of the digital money. This way, you can make good investment decisions even when there’s a crypto bubble.

The Role of Cryptobubbles.net

In the world of digital money, like Bitcoin and other cryptocurrencies, it’s really important to know what’s happening right now. That’s where Cryptobubbles.net helps a lot. It’s like a special website that helps people who invest in these digital currencies to understand what’s going on in the market. We’re going to talk about how Cryptobubbles.net works and how it helps people spot when a ‘bubble’ is forming. A ‘bubble’ is when the price of something goes really high, but it might not stay that high for long.

How can investors use Cryptobubbles.net to foresee a bubble burst?

Cryptobubbles.net is a website that helps people who invest in digital money, like Bitcoin, make smart choices. It’s like a helpful guide in the tricky world of cryptocurrency. Here’s how it can help you spot when the market might drop suddenly:

- Keeping an Eye on the Market in Real Time: This site shows you what’s happening in the cryptocurrency market as it happens. This means you can see when prices are going up or down really fast. It’s like having a super-fast news update, so you can guess when things might change a lot.

- Smart Guessing with Predictive Analytics: Cryptobubbles.net uses special technology to find patterns in how cryptocurrencies behave. This can help you guess when the market might go down sharply.

- Watching Market Cap Trends: The website lets you track trends in market capitalization, which is a fancy way of saying how much all the cryptocurrencies are worth together. This can give you clues about what might happen next in the market.

- Understanding True Value: Cryptobubbles.net also helps you figure out the real value of a cryptocurrency. This means you can understand if a cryptocurrency is truly valuable or if its price is just inflated.

- Regulation Impact: The platform provides information about rules and regulations in the cryptocurrency world. This helps you understand how these rules can affect the market and possibly lead to big changes in prices.

By using Cryptobubbles.net, you can be more informed and make better decisions when investing in cryptocurrencies. It’s like having a crystal ball that helps you see what might happen next in the cryptocurrency market!

Conclusion

To wrap it up, it’s really important to understand and study crypto bubbles if you want to do well in the cryptocurrency market. Knowing how these bubbles start, what they do, and what causes them helps investors make smart choices. It’s key to spot the warning signs and know the difference between crypto bubbles and regular financial bubbles. Investing in crypto bubbles can be risky, but you might also make a lot of money if you’re careful. At Cryptobubbles.net, we have tools and tips to help investors figure out when bubbles might burst and what to do next.

If you want to keep up with the cryptocurrency market, talk to our experts today. We can help you get through the exciting but unpredictable world of cryptocurrencies.

Learn Cryptocurrency!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Crypto Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

What does crypto bubbles do?

Crypto bubbles study the cryptocurrency market to spot possible price bubbles. They look at market size, price changes, and what investors feel to guide people on when to buy or sell digital money. They also check how these currencies are used, their basic worth, and overall market trends, helping investors smartly deal with the ups and downs of the cryptocurrency world. Some economists and prominent investors, including Berkshire Hathaway board member Warren Buffett and several laureates of the Nobel Memorial Prize in Economic Sciences, central bankers, and investors, have expressed the view that the entire cryptocurrency market constitutes a speculative bubble.

What does it mean when Bitcoin is a bubble?

Bitcoin is like a bubble when its price goes up fast, making it seem more valuable than it really is. This is similar to past bubbles in the internet and housing markets. Experts disagree if Bitcoin is a bubble or a risky, but real investment.

When would the Cryptocurrency bubble burst?

Predicting when a cryptocurrency bubble, like the crypto crash, will pop is tough. Cryptocurrencies like Bitcoin have seen price drops before, like in 2017. Things like market trends, laws, too many similar products, and changes in investor feelings can cause a bubble to burst. Studying markets and the economy helps, but guessing is risky because markets change fast. However, it is important to note that the 2018 cryptocurrency crash serves as a prominent example of how a sudden sell-off of most cryptocurrencies can lead to a significant decline in prices.

Is all cryptocurrency a bubble, or is it just Bitcoin?

Cryptocurrencies are not all bubbles; they can be different. They often change in price and can sometimes form bubbles, but each one is unique. Some are stable and useful in real life, not just for guessing their value. Before investing, it’s important to study each one’s purpose, market behavior, and true worth. The continued adoption of cryptocurrencies and bitcoin for various use cases demonstrates their value in the market. Stablecoin trading volumes and use in crypto trading are important factors to consider when evaluating the worth of cryptocurrencies.

Are we witnessing another Bitcoin bubble?

Yes, it seems we are seeing another Bitcoin bubble. Like previous ones, Bitcoin’s price has risen quickly, attracting a lot of attention. But, just like bubbles in a soda, these sharp rises often burst, causing rapid price drops. It’s a cycle of high excitement followed by sudden drops.