The digital currency Bitcoin (BTC) has taken a step towards the investment mainstream in the US. The US Securities and Exchange Commission (SEC) has opened the way for BTC exchange-traded funds (ETFs).

The US Securities and Exchange Commission (SEC) has approved numerous applications for so-called spot Bitcoin ETFs – a move that was expected. The decision means that listed funds that invest directly in BTC will be permitted in the USA.

On Tuesday, the SEC’s X account was hacked and misused for a false report. The series of mishaps put the authority in an extremely unfavorable light.

The approvals mean that the mother of all cryptocurrencies, once ridiculed by the traditional financial world, will soon be indirectly tradable on the world’s largest exchanges. Why “indirectly”? This and other burning questions are now to be clarified.

- 1. What is a Bitcoin ETF and how does it differ from the Cryptocurrency itself?

- 2. What is a Spot Bitcoin ETF anyway?

- 3. Why the fuss – why not just buy Bitcoin Crypto?

- 4. Which BTC ETFs have been Approved?

- 5. How much money will now flow into these ETFs – and how will this affect the BTC price?

- 6. What happens next with Bitcoin and other Cryptocurrencies after the SEC Approval?

- 7. You say: advertising offensive for Bitcoin – but whoever buys an ETF doesn’t really buy BTC!

- 8. But aren’t the ETFs a betrayal of the basic idea of Bitcoin?

- 9. Conclusion

- 10. FAQ

What is a Bitcoin ETF and how does it differ from the Cryptocurrency itself?

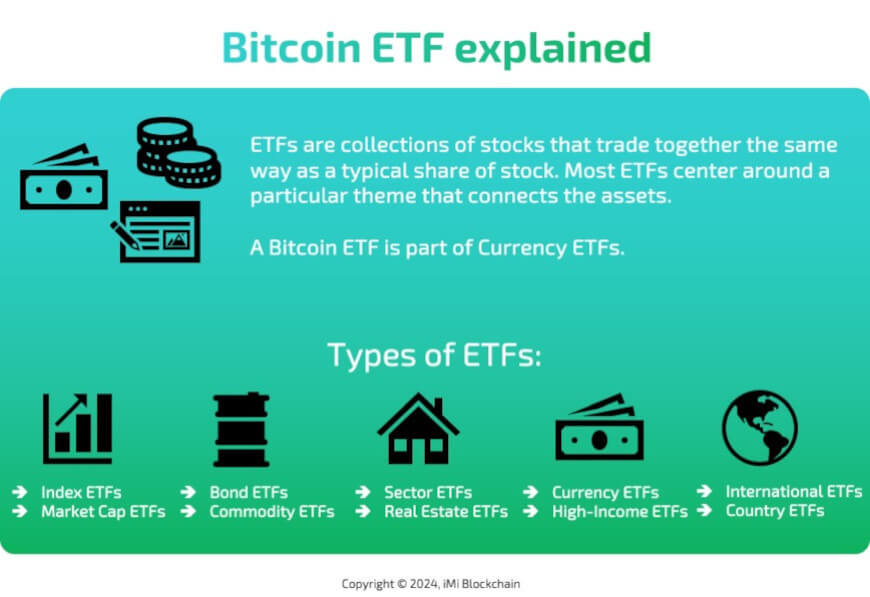

A Bitcoin ETF, or exchange-traded fund, is a type of investment fund that tracks the price of BTC. It allows investors to gain exposure to BTC without actually owning the cryptocurrency. In contrast, owning BTC involves buying and holding the digital currency in a wallet.

Share this Image on Your Site:

What is a Spot Bitcoin ETF anyway?

With a Spot Bitcoin ETF, the fund also issues investment certificates that can be traded like shares on stock exchanges. The price rises and falls with the price of the underlying assets. In the case of a spot BTC ETF, this means with the BTC price. The “spot” in this terrible word means that it is the current value of the commodity. BTC has soared more than 70% in recent months in anticipation of an ETF, and hit its highest level since March 2022 in November, attracting crypto investors.

Share this Image on Your Site:

Why the fuss – why not just buy Bitcoin Crypto?

Buying and managing Bitcoins is easier than many people think, but it’s still not for everyone. Trading ETFs, on the other hand, is a routine matter for many traditional investors.

However, ETFs actually have other advantages: they are also of interest to large investors, financial service providers, pension institutions, and crypto advocates. This makes this cryptocurrency an option for investors who previously had no access to it (due to legal requirements) (e.g. pension funds) – or were rather skeptical. ETFs will also improve the image and social acceptance of BTC as an asset class, the mother of all cryptocurrencies. The days when this cryptocurrency was decried as a gaga project by a few cypherpunks are definitely over.

However, there is concern that the broad use of crypto ETFs could put too much risk and volatility into Americans’ retirement accounts – the price of BTC is known to fluctuate wildly, often without warning or explanation. This bridge between traditional finance and the burgeoning world of crypto, as iTrustCapital is pursuing it, is an important development in the investment landscape.

Share this Image on Your Site:

Which BTC ETFs have been Approved?

The SEC (the US Securities and Exchange Commission) received a total of 13 applications for spot BTC ETFs and the SEC approved 11 of them on January 10th, 2024. Rubbing their hands together:

- Grayscale Bitcoin Trust

- Ark/21Shares Bitcoin Trust

- Bitwise Bitcoin ETF Trust

- BlackRock Bitcoin ETF Trust

- VanEck Bitcoin Trust

- WisdomTree Bitcoin Trust

- Valkyrie Bitcoin Fund

- Invesco Galaxy Bitcoin ETF

- Fidelity Wise Origin Bitcoin Trust

- Hashdex Bitcoin ETF

- Franklin Templeton Digital Holdings Trust

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWHow much money will now flow into these ETFs – and how will this affect the BTC price?

Both questions can only be answered with highly speculative forecasts – and these vary widely. Most chroniclers are anticipating a wild rollercoaster ride. Rumor has it that BlackRock alone has over two billion dollars of investor money ready for the ETF. The world’s largest asset manager manages client assets of over ten trillion dollars. Our experts do not want to take part in the short-term speculation about the price of BTC.

Share this Image on Your Site:

What happens next with Bitcoin and other Cryptocurrencies after the SEC Approval?

The 11 ETF providers do not work for charity. For them, the products are first and foremost a business. And like any other product (with competing products), this one has to be advertised, sold, and made palatable to customers.

Experts and industry experts are therefore expecting an advertising offensive right from the start – the likes of which have never been seen before for BTC. The following also applies: first come, first served. First come, first served. The 11 providers therefore endeavored to submit the necessary formalities as quickly as possible. In an interview with FoxBusiness, a representative of VanEck appeared confident. He expects the products to be traded on the stock exchanges as early as Thursday, including Cboe, the largest options exchange in the United States, kicking off a fierce competition for market share.

At the same time, a fee battle has been taking place among the designated ETF issuers in recent days. Even before the first approval, there were massive reductions, so that these fell far below the usual ETF standards. Bitwise came out the cheapest at 0.24 percent, followed by VanEck and Ark (0.25 percent). Ark had originally planned 0.8 percent. BlackRock, one of the issuers, is asking for 0.3 percent. Grayscale received approval to list GBTC to the NYSE, The Block’s Frank Chaparro reported. Issuers also offered waivers to their spot Bitcoin ETF fees ahead of the SEC nod.

Share this Image on Your Site:

You say: advertising offensive for Bitcoin – but whoever buys an ETF doesn’t really buy BTC!

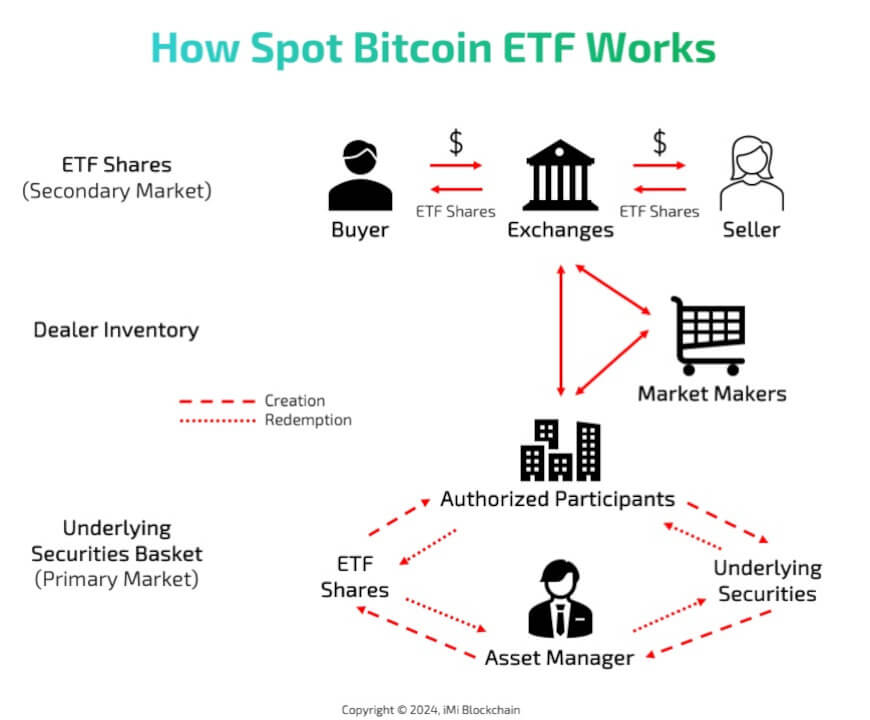

That’s how it is: The buyers of ETF investment certificates do not own BTC, but only profit (or not) from the price movement. However, the situation is different for ETF providers. They have committed to the SEC, including SEC Chair Gary Gensler, to hold BTCs equivalent to the value of the investment certificates. If many investors pump money into the ETFs, it will continue to flow into the stock market, despite the myriad risks associated with this cryptocurrency and products tied to crypto.

As a reminder: the number of Bitcoins is limited to 21 million. A few million (25 to 30 percent) of these have already been lost, never to be seen again. That leaves 15 million – or 0.00184 BTC per person. Less than two million BTCs are currently available for actual purchase.

Share this Image on Your Site:

But aren’t the ETFs a betrayal of the basic idea of Bitcoin?

That is a matter of interpretation. Bitcoin is primarily a booking and payment system that, thanks to its decentralized architecture, enables the management of a digital asset without having to rely on institutions such as banks. It is in the nature of this decentralized architecture that no one is excluded from it. BTC is the first and ultimate Jekami (everyone can participate) of the financial world – and therefore inherently value-free.

It is probably human nature that some BTC supporters try to attach a political orientation to the mother of all cryptocurrencies. Nothing will change as a result. Just as little as when Wall Street discovers this cryptocurrency as an asset to be taken seriously after 15 years. The elegant thing about this system is that you can own as many BTCs as you like – but that doesn’t give you more institutional power. Since its inception, anyone wanting to own one would either have to adopt a digital wallet or open an account at a crypto trading platform like Coinbase or Binance. Cryptocurrency advocates say the development will thrust the once niche and nerdy corner of the internet even further into the financial mainstream.

A person who wants to own BTC due to mistrust, enjoyment of this elegant system, curiosity, or for whatever reason is not well served by an ETF. But for those who – like so many – simply want to profit from the rising price, new worlds of manipulation and opportunity are now opening up in the USA.

Unlock the Secrets of Crypto Trading

Join our Live Online Course today!

Live, interactive online sessions – 1-on-1 sessions from a seasoned crypto trading expert.

Personalized coaching – from a certified crypto expert.

Learning Material – comprehensive learning from basics to advanced strategy.

Flexible Scheduling – to fit your busy life.

ENROLL IN THE BEST CRYPTO TRADING COURSEConclusion

The approval of spot Bitcoin ETFs by the SEC is a significant development in the world of cryptocurrency. With this approval, investors now have more avenues to invest in BTC and participate in its potential growth. However, it is important to understand key facts about BTC ETFs before making any investment decisions. These facts include the potential benefits and risks associated with investing in Bitcoin ETFs, as well as the regulatory framework surrounding them.

By educating yourself on these key facts, you can make informed investment choices that align with your financial goals. If you have any further questions or need guidance regarding Bitcoin ETFs, feel free to contact us. Our team of experts is here to empower you and provide the support you need to navigate the exciting world of cryptocurrency investing.

Learn Cryptocurrency!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Crypto Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

How will the BTC ETFs Work?

Bitcoin ETFs provide a more accessible way for a wider range of investors to participate in the BTC market through the traditional stock exchange, without the need for direct interaction with the complexities of cryptocurrency trading and storage.

Why is a spot BTC ETF different from existing Bitcoin Futures ETFs?

A Bitcoin spot ETF directly involves buying and holding BTC, whereas a Bitcoin futures ETF invests in contracts predicting BTC’s future price. Spot ETFs reflect the real-time price of BTC more accurately than futures ETFs.

Are Bitcoin ETFs good investments?

Bitcoin ETFs, which are funds that invest in BTC, can be good investments for some people. They offer an easy way to invest in BTC without owning it directly. However, they can be risky and their value can change a lot, so it’s important to understand them before investing.