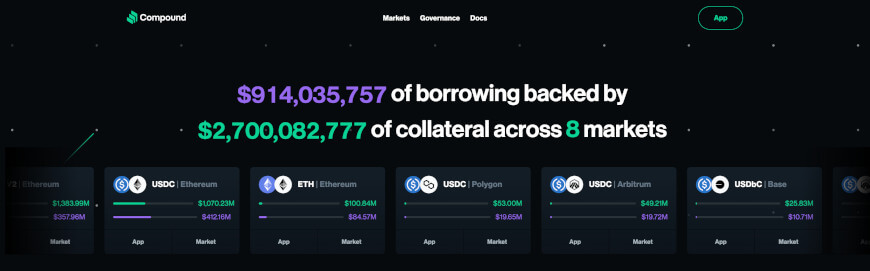

Compound is a decentralized finance (DeFi) protocol that has gained significant attention in the crypto community. It offers an open lending platform that allows users to lend and borrow cryptocurrencies, including BTC, providing them with the opportunity to earn interest on their deposited funds or access liquidity by collateralizing their assets.

But there’s more to than just lending and borrowing. In this comprehensive guide, we will dive deep into the functionality, market analysis, and the future of the company, including its highly anticipated launch of its mainnet in September 2018.

So, let’s get started and unravel the world of Compound crypto!

What is Compound Finance and how does it work?

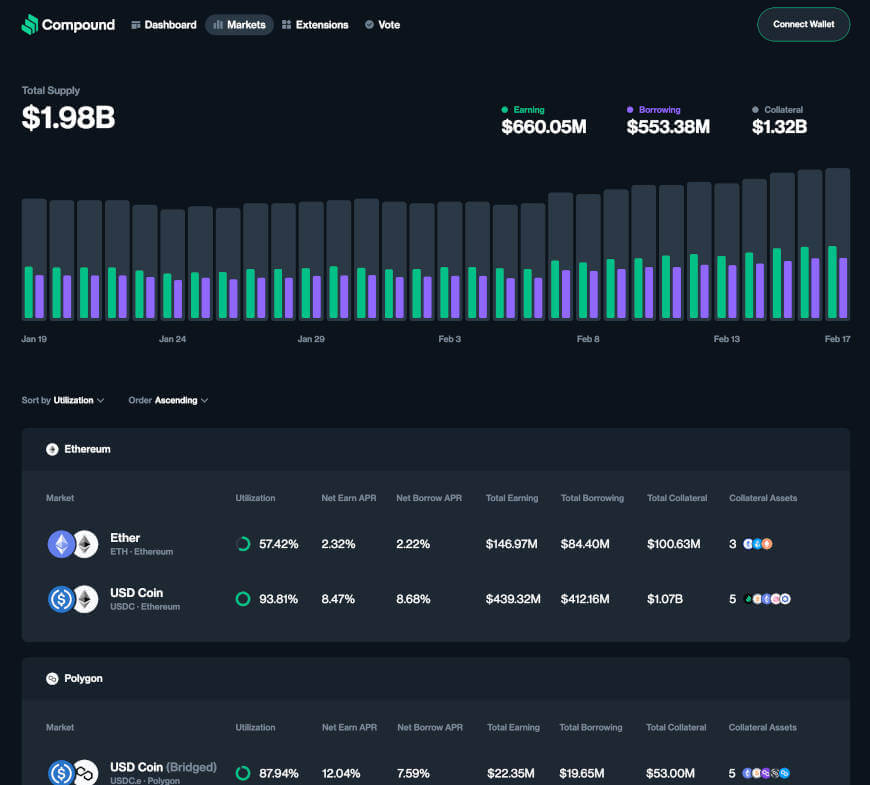

Compound finance is a DeFi protocol built on the Ethereum blockchain. It allows users to lend and borrow cryptocurrencies for investments, earning interest on their deposits and paying interest on their loans. It uses an algorithm to determine interest rates based on supply and demand for each asset.

Share this Image on Your Site:

Compounds’ DeFi Protocol

The Compound protocol operates as an open lending platform, facilitating the exchange of cryptocurrencies within a decentralized finance (DeFi) ecosystem. It allows users to supply collateral, mint cTokens (representing their share of the collateral), and borrow other cryptocurrencies against their collateral.

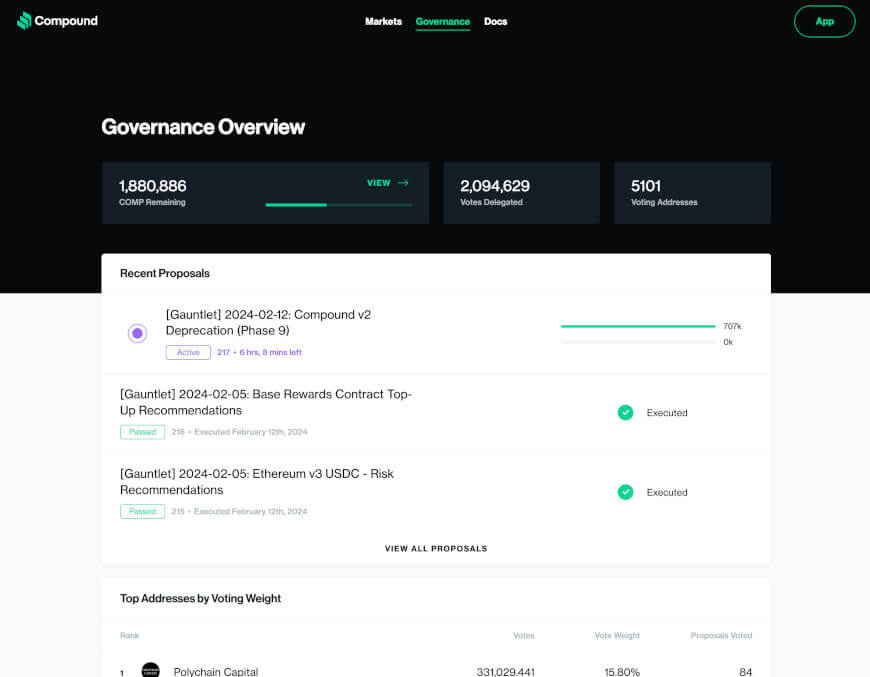

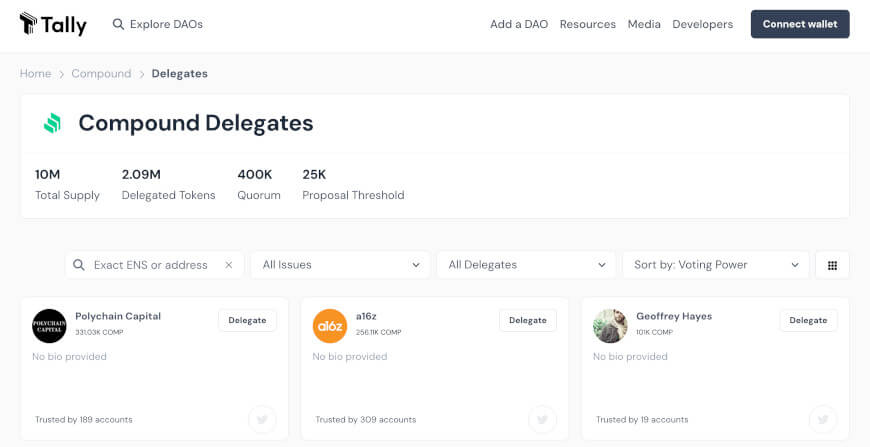

With a minimum maintenance level set for borrowers, the protocol ensures safety net functionality, where borrowers must maintain a minimum collateral ratio to prevent the liquidation of their assets. Key to the protocol is the native governance token, COMP, which holders use to collectively participate in the community governance of this protocol, influencing the development and decision-making process of similar protocols. This token, known as the COMP governance token, allows for a self-governed ecosystem and is a crucial aspect of the rapidly expanding DeFi ecosystem.

The protocol is governed by COMP token holders and their delegates, who have the power to propose and vote on changes to the protocol, including the exchange rate of cTokens to the underlying asset, such as ETH, through community governance of the Compound protocol since the launch of the Compound mainnet in September 2018.

The protocol also supports the borrowing and lending of a specific set of cryptocurrencies, including Dai, Ether, USD Coin, Ox, Tether, Wrapped BTC, Basic Attention Token, Augur, and Sai.

The Functionality of COMP Token

The COMP token holds a significant role in the compound protocol’s community governance. As a governance token, holders are actively involved in the decision-making process of the protocol, contributing to the development and evolution of the platform. The token empowers holders to delegate executive positions, ensuring a decentralized governance structure.

The circulating supply of COMP plays a crucial role in determining the token’s governance significance within the increasingly large ecosystem of decentralized finance. By placing COMP directly into the hands of users of the protocol and applications, the token’s influence on the protocol’s development and the broader community will continue to grow, solidifying its position in the market with good governance.

Securing the Compound Crypto Network

Security is of utmost importance in the decentralized finance ecosystem, and the Compound protocol takes significant measures to ensure the safety of users’ assets. Some of the key security features include:

- Secured Loans: The protocol works like a secured loan platform, where users collateralize their assets before borrowing other cryptocurrencies. This collateralization ensures the safety of the lending process.

- Safety Net Functionality: The protocol implements a safety net mechanism, where borrowers must maintain a minimum collateral ratio to avoid the liquidation of their assets. This safety net protects both borrowers and lenders in the event of market price fluctuations.

- Smart Contract Security: The protocol is built on smart contract technology, which provides an extra layer of security for users’ funds. The smart contract ensures the secure and transparent exchange of cryptocurrencies, minimizing the risk of unauthorized access or manipulation.

Unlock Your Business Potential with Certified Blockchain Consulting!

Dive into the future of technology with our team of certified blockchain experts. Simply pick the service you need:

Personalized Advice – tailored to your business needs.

Comprehensive Training – for you and your team.

Development Services – innovative solutions from the whitepaper to the finished blockchain.

Programming – with capabilities and tools to succeed.

TALK TO THE EXPERTS TODAYThe unique Features of Compound

Compound crypto stands out from other lending protocols thanks to its unique features and functionalities. Since the launch of its mainnet, the platform has skyrocketed in popularity, with Compound’s price increasing by 8.33% in the past week and currently valued at 93.68% below its all-time high of $915.60.

With a 24-hour trading volume of $35.73M, the current price of COMP is $57.6 per COMP and a market cap of USD 465,059,689. The compound’s price is constantly fluctuating, making it an attractive investment option for traders looking to capitalize on short-term gains. Even a crypto winter could not harm this coin.

So what makes Compound crypto finance unique? Here are 4 key highlights:

1. Open Lending Platform

The platform provides users with an open lending platform, allowing them to lend and borrow cryptocurrencies directly without the need for intermediaries.

2. Ethereum Smart Contracts

The protocol utilizes Ethereum smart contracts, which enable secure and transparent transactions between users, eliminating the need for trust in traditional financial institutions.

3. Collateral Assets

Users can collateralize their assets by minting cTokens, which represent a specific amount of collateral. These cTokens can then be used to borrow other cryptocurrencies.

4. Liquidity Provision

By borrowing and lending, users contribute to the liquidity of the protocol, ensuring the availability of funds for other users and market participants.

Compound Finance and its Crypto Community

Their success is driven by its vibrant community, which actively participates in the protocol’s development and governance. Let’s take a closer look at the social channels and forums where the Compound crypto community congregates, as well as the founders who laid the foundation for the protocol’s growth.

Founders of Compound.finance

Compound.finance was co-founded by Robert Leshner and Geoffrey Hayes, who have played a pivotal role in the development of the decentralized finance ecosystem. Their vision and expertise have propelled the forefront of the DeFi revolution. With their strong support, the protocol has become a prominent player, offering innovative solutions for lending, borrowing, and community governance. Leshner and Hayes also continue to hold executive positions at Compound Labs, Inc, the software development firm behind this protocol. Leshner serves as CEO while Hayes is the CTO.

The founders’ leadership and commitment to decentralized finance, as demonstrated in their previous roles at Postmates – an online food delivery service, have paved the way for the protocol’s success, positioning it as a leading platform in the crypto space.

Social Channels and Forums

Participating in social channels and forums is an excellent way to connect with the Compound crypto community, stay updated with the latest news, and engage in discussions. The compound crypto protocol’s community governance platform provides a space for users to actively contribute their ideas and thoughts, shaping the future of the protocol for informational purposes. Additionally, these channels and forums can also serve as a valuable source of information.

Joining social channels, such as Discord or Telegram, and engaging in forums, like Reddit or the Compound crypto community forum, allows users to gain valuable insights, share knowledge, and collaborate with like-minded individuals within this ecosystem.

How to Use Compound Crypto

Now that we have covered the market analysis, let’s explore how users can actually utilize the protocol. Whether you are looking to buy COMP tokens or utilize them for trading, understanding the steps to use Compound crypto is essential.

Share this Image on Your Site:

Steps to buy COMP with USD

Buying COMP tokens involves a few simple steps. Here’s a step-by-step guide to help you get started:

- Choose a Cryptocurrency Exchange: Select a reputable exchange, such as Coinbase, that supports the trading of COMP tokens.

- Create an Account: Sign up and create an account on the exchange platform, providing the necessary information.

- Set Up a Wallet: Set up a crypto wallet to securely store your COMP tokens. Make sure the wallet supports COMP tokens.

- Deposit Funds: Deposit funds into your exchange account using a fiat currency, such as USD.

- Purchase COMP: Once your account is funded, navigate to the COMP trading pair and execute your purchase order.

- By following these steps, you can acquire COMP tokens and become a part of their ecosystem, opening up opportunities for lending, borrowing, and governance participation.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWUsing COMP for Trading Other Cryptocurrencies

COMP tokens can also be utilized for trading purposes, allowing users to benefit from market price fluctuations. Here are a few things to keep in mind:

- Market Dynamics: Understand the market dynamics and price movements of COMP before initiating any trades. Conduct thorough market research and stay updated with the latest news and trends.

- Volatility: Keep in mind that the crypto market, including COMP, is highly volatile. Be prepared for price fluctuations and assess the potential risk before entering a trade.

- Liquidity: Trading COMP adds liquidity to the market and contributes to the overall ecosystem of decentralized finance. By actively trading COMP, you are participating in the market dynamics and helping to ensure market efficiency.

The Future of Compound Finance

Now, let’s talk about the future and trends for Compound Finance:

- Growing Popularity: More and more people are getting interested in using DeFi protocols like Compound Finance because they offer opportunities to earn interest on their cryptocurrency savings or borrow money without needing a traditional bank.

- Expansion of Services: Compound Finance might start offering new services or features to attract more users. This could include things like supporting more types of cryptocurrencies or adding new ways to earn rewards.

- Regulatory Changes: Governments and regulators are paying more attention to DeFi, which means there might be new rules or crypto regulations coming in the future. This could affect how Compound Finance operates and who can use it.

- Improvements in Technology: As technology keeps advancing, Compound Finance might get faster and more efficient. This could make transactions quicker and cheaper for users.

- Competition: There are other DeFi protocols out there competing with Compound Finance. So, in the future, we might see new innovations from them as they try to attract users and improve their services.

Overall, the future of Compound crypto finance looks promising, with more people likely to use it and improvements expected to make it even better. But, like with any technology, there could be changes and challenges along the way.

Resources for COMP Crypto Users

For users looking to explore Compound crypto further, it’s essential to have access to the right platforms and resources. You can buy COMP and most major exchanges. Let’s discover accessible platforms to buy COMP and the future outlook for this protocol.

What is the future of COMP crypto?

The future outlook for COMP crypto appears promising, considering the growth of the decentralized finance ecosystem and the protocol’s strong market presence. As decentralized finance continues to gain traction, the protocol’s role in the ecosystem is likely to expand, translating into increased adoption, community governance, and market relevance.

However, it’s important to note that the crypto market is highly dynamic and subject to volatility. Individual users should conduct thorough research, analyze market trends, and consider risk mitigation strategies before making investment decisions related to their protocol.

Conclusion

In conclusion, Compound Finance is a promising company that offers unique functionality and has gained significant traction in the market. With its innovative features and a strong community, they have the potential for future growth and performance. If you’re considering investing in COMP, it’s important to do your research and understand the benefits of this cryptocurrency.

While competitor AAVE and Compound have both their merits, it ultimately depends on your investment goals and risk tolerance. Whether you choose to invest in Compound crypto, AAVE, or Bitcoin, remember to diversify your portfolio and make informed decisions.

Make sure you sign up for our newsletter to stay updated with the latest market trends in blockchain technology.

Learn all about Blockchain!

Blockchain Training in Small Classes

Webinars about Blockchain

Courses at University Level

Free Blockchain Tips!

Get monthly Blockchain News.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

Is Compound finance a good investment?

The decision to invest in Compound finance or any other cryptocurrency depends on individual risk tolerance, investment goals, and market research. They have shown strong growth in the past year, making it a popular choice among crypto investors. However, it’s important to conduct thorough research, evaluate market trends, and consult with financial advisors before making any investment decisions.

What are the Benefits of Investing in Compound’s Blockchain?

Investing in Compound finance offers several benefits, including passive income by lending cryptocurrencies on the compound crypto protocol, decentralized peer-to-peer transactions, access to liquidity, and borrowing cryptocurrencies.

Is AAVE or Compound a better crypto investment?

Determining which crypto investment is better, AAVE or COMP, depends on individual investment goals, risk appetite, and market research. Both are decentralized finance protocols that enable the lending and borrowing of cryptocurrencies. They have their own unique features, advantages, and market positions. It’s recommended to conduct thorough research and evaluate the protocol’s functionalities, market dynamics, and market sentiment before making any investment decisions.

Is it better to invest in Compound (COMP) or Bitcoin (BTC)?

If you’re looking for a safer, more stable option, Compound crypto might be the better choice. But if you’re willing to take on more risk in the hopes of bigger returns, Bitcoin could be the way to go. Just remember, it’s important to do your own research and consider your own financial situation before investing in anything.

Can I buy COMP on Coinbase?

Yes, you can buy COMP on Coinbase. Create an account, log in, search for COMP, and buy, sell, or store this crypto on Coinbase.