Are you curious about cryptocurrency and interested in learning about stablecoins? Look no further! We explain to you, what is Tether USDT, the leading stablecoin. In this article, we will delve into Tether’s history, its unique characteristics, and how it stacks up against other cryptocurrencies such as Bitcoin and Ethereum.

We will also cover the fundamentals of how Tether operates, its position in the market, and the pros and cons of investing in USDT. For those intrigued by mining or staking it, we’ve got you covered with all the necessary information. If you’re ready to purchase or transfer crypto, we will provide guidance on selecting a wallet and managing transactions.

Join us in exploring what is Tether USDT and why it plays a significant role in the world of cryptocurrency, including its controversial past related to allegations of price manipulation in the Bitcoin market.

- 1. What is a Stablecoin?

- 2. What is Tether USDT?

- 3. The History of Tether

- 4. Understanding the Basics of Tether (USDT)

- 5. How does Tether Work?

- 6. Tether vs. Bitcoin (BTC) vs. Ethereum (ETH)

- 7. Navigating Tether Transactions

- 8. Tether’s Position in the Cryptocurrency Market

- 9. The Advantages and Disadvantages of Tether

- 10. How to Mine / Stake USDT?

- 11. Is Tether a Good Investment?

- 12. Conclusion

- 13. FAQ

What is a Stablecoin?

A stablecoin, like USDT or USDC, is an altcoin made to keep its value steady. It stays dependable even when the cryptocurrency market is unpredictable because it’s tied to regular currencies or things of value, also known as the underlying asset. Stablecoins, such as Tether, are becoming more and more popular as digital substitutes for regular money.

What is Tether USDT?

So what is Tether USDT exactly? Well, first you really have to understand what is a stablecoin. It is a special type of cryptocurrency called a stablecoin, and its main purpose is to have a consistent value, which is typically tied to the U.S. dollar. This makes it useful for people who trade cryptocurrencies because they can use it instead of regular money on cryptocurrency exchanges.

Tether operates on something called blockchain technology, which is like a secure digital ledger that records all transactions. This means that every transaction can be seen by anyone who wants to check it, making it very transparent.

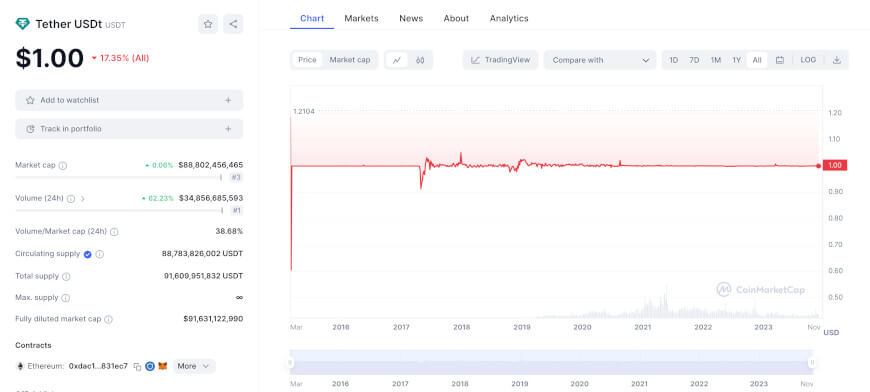

Because of its stability and reliability, Tether has become the biggest stablecoin in the cryptocurrency world. In fact, it makes up about 53% of all the stablecoins out there and is worth a whopping $83.6 billion. That’s a lot of money! But when we’re asking what is Tether USDT, there is much more to discover.

The History of Tether

To understand what is Tether USDT, we also have to look at its fascinating history that spans several years. It was founded in 2015-2016, and during its early years, it experienced a lot of innovation and growth. Back then, it became well-known in the cryptocurrency world for providing stability and reliability by pegging its value to traditional currencies.

From April 2017 up to the present day, Tether continued to change and adapt to the evolving crypto landscape. Along the way, it encountered challenges and controversies, including legal investigations by the New York Attorney General James’s office. Despite these difficulties, Tether managed to endure and remained an important player in the market, acting as a link between digital tokens and regular currencies.

Unlock Your Crypto Potential: Become a Market Maverick with Expert Coaching!

Are you ready to dive into cryptocurrency but need some advice? With our personalized 1:1 coaching, you’ll learn to:

Understand – the fundamentals of cryptos and how they impact value.

Navigate – through the volatile crypto market with confidence.

Identify – new lucrative opportunities that maximize returns.

Manage – exchanges and risk to protect your investments.

BOOK EXPERT COACHING NOWFrom RealCoin to Tether: November 2014

Launched as RealCoin in July 2014 the number 1 stablecoin was rebranded as Tether in November 2014, making it one of the oldest stablecoins in the market.

However, thanks to its innovative approach and special features, Tether slowly but steadily gained attention and respect in the cryptocurrency community. This stablecoin has made a significant impact on the wider cryptocurrency market. Its presence and reliability have changed how traders and investors view digital tokens. Despite the competitive nature of the field, Tether has firmly established itself as a major player in the industry.

2015 The Founding of Tether on the Blockchain

In 2015-2016, Tether came into existence and entered the world of cryptocurrency. The folks behind this token had clear goals for this stablecoin, including ensuring transparency and stability in the market. Just like any new project, Tether had its fair share of challenges and important moments during its early days, including its launch in January 2015. and the release of the Paradise Papers in 2017. The use started to grow rapidly on the blockchain, with transactions in US dollars going through banks in Taiwan, which then forwarded them to Wells Fargo. This continued until 2017.

Tether Token Journey from 2017 to Present (EURt)

USDT has undergone significant developments since it was first introduced in 2017. Today, we also have a token based on the Euro, the EURt. Tether’s journey has been filled with moments of growth as well as controversy, with a key focus on how Tether impacts the stability of the cryptocurrency market.

Throughout the years, Tether has been subject to close examination by regulators and legal challenges, especially from New York Attorney General Letitia James.

Despite the challenges, the company has successfully maintained its position as the leading stablecoin by ensuring that its reserves adequately support its value. Today, it remains a prominent presence in the cryptocurrency world, actively engaging in partnerships, and advancements, and keeping up with market trends.

Understanding the Basics of Tether (USDT)

What is Tether USDT should be clear now but there is more. Because the main purpose of this token is to keep its value steady, and it’s tied to regular currencies like the US dollar. It uses blockchain technology, which makes transactions transparent and secure, while also offering the benefit of low fees for USDT users. One great thing about Tether is that it’s easy to turn into cash, making it a handy option for people who trade cryptocurrencies.

When the cryptocurrency market gets crazy and prices are all over the place, Tether stays calm and gives people a stable option. This company is also careful about how it manages its money and gets regular audits, so users can trust that it’s a secure digital coin. This token has changed the game for investors trying to make sense of the constantly shifting cryptocurrency world.

Share this Image on Your Site:

Unique Attributes of Tether U.S. Dollar Crypto

Tether is known for its unique qualities in the stablecoin market. One important thing to note is how versatile it is. It works on various blockchain platforms like Bitcoin, Ethereum (ETH), and Tron, making it easy for people to use and access.

Another interesting feature is that Tether’s reserves are backed by cash equivalents, marketable securities, and other valuable assets, including BTC. This means that for every token in circulation, there’s a corresponding real money reserve to support its value. This commitment to being transparent is made even stronger by regular reports on reserves and audits, which makes Tether different from other stablecoins.

Because of its widespread use and significant market value, USDT has firmly established itself as the top stablecoin.

How does Tether Work?

Tether works by keeping a stash of U.S. dollars for every coin that’s out there. It’s like a coin that’s always worth one U.S. dollar, which you can trade on crypto websites. But some people are worried because they’re not so sure if USDT is really as safe and honest as it claims to be, especially when it comes to having enough money in the bank to back up all the coins in circulation.

Share this Image on Your Site:

How Tether Operates: Transparency & Liquidity

Tether is a digital currency that operates on the Bitcoin blockchain using a protocol called Omni Layer. It helps create, issue, and redeem USDT tokens. Tether Limited manages these tokens and ensures everything runs smoothly. They work with cryptocurrency exchanges to make it easy for people to trade USDT, which adds to the cryptocurrency market’s liquidity.

USDT is like a digital version of traditional currency, such as Bitcoin cash. It plays an important role in the cryptocurrency world by offering stability and being accessible to users. USDT is known for being transparent and secure, and it has become the top choice for many crypto traders and enthusiasts. Its connection to the Bitcoin blockchain and efficient protocol makes it a dependable option in the world of cryptocurrencies, as it operates by being pegged to its matching fiat currency, the US dollar.

What Gives Tether (USDT) Its Value?

Tether (USDT) gets its value from various assets it holds, such as cash equivalents, reserves, and commercial paper. It’s usually worth the same as one U.S. dollar. The value of USDT in the cryptocurrency market is influenced by how much people want it and how much of it is in circulation. Tether Limited’s transparency about its reserves, which helps people trust USDT and its stability and ease of trading make it appealing to traders and investors.

Want to Build Wealth with Cryptocurrency?

Unlock the full potential of crypto investments. We teach you how to:

Manage Crypto Asset – trade, and store digital assets securely.

Minimize Risks – through insights on how to deal with volatility and security risks.

Build Wealth – with customized advice for your individual needs.

BOOK YOUR LIVE SEMINAR NOWTether vs. Bitcoin (BTC) vs. Ethereum (ETH)

Tether, Bitcoin (BTC), and Ethereum (ETH) are three important cryptocurrencies in the world of digital money. They each have their own special roles in the crypto market. This cryptocurrency is unique because it’s a stablecoin, which means its value is meant to stay steady. Bitcoin and Ethereum, on the other hand, don’t have this stability feature.

Another thing that sets them apart is the technology they use. Each cryptocurrency has its own special blockchain, which is like a digital ledger. Think of it as the backbone of the cryptocurrency. USDT is tied to the U.S. dollar, a regular form of money, while Bitcoin and Ethereum aren’t directly connected to any specific traditional currency.

Also, these cryptocurrencies have different things backing them up and different values in the market. They’re designed to meet the different needs of people who trade and invest in cryptocurrencies, offering a variety of advantages and uses. So, they’re not all the same, and it’s important to understand their differences to make smart decisions in the world of crypto.

Share this Image on Your Site:

Selecting a trustworthy Tether wallet is really important to keep your digital money safe and make sure it’s secure. These wallets give you a safe place to keep, send, and get USDT tokens. When you want to buy it, you can use well-known cryptocurrency websites that let you trade it. Because of blockchain technology, moving tokens between wallets or trading platforms is easy and doesn’t take much time.

Additionally, USDT transactions don’t have high fees, so they’re affordable for people. With these features and advantages, anyone can handle these transactions confidently and easily, which allows them to manage their digital money safely and efficiently.

How to Choose a Tether (USDT) Wallet

When you’re picking a Tether wallet, there are a few things you should keep in mind. First, make sure the wallet you choose works with the blockchain platform you prefer, whether it’s Omni layer protocol, Ethereum, or Tron. This will make sure everything works smoothly.

Safety is also crucial. Look for wallets with strong security features like two-factor authentication and encryption to protect your coins.

Ease of use matters too. A user-friendly interface and simple navigation can make managing your tokens a lot easier.

It’s a good idea to check if the wallet you’re interested in works well with popular cryptocurrency exchanges. This can make transferring your Tether tokens simpler.

Lastly, do some research. Read user reviews and check ratings to be sure the wallet you’re considering is reliable and has a good reputation.

How to Buy and Transfer Tether (USDT)

If you want to buy and move USDT, you can start by signing up on a trusted cryptocurrency exchange like Binance or crypto exchange Bitfinex. Once you’re registered, you can deposit regular money like USD or EUR to exchange it for these tokens. After you’ve made your purchase, you can send the tokens to your own wallet or another exchange for trading. These transfers happen through blockchain technology, which ensures transparency, security, and quick processing.

Before you send USDT tokens to anyone, it’s really important to carefully check the recipient’s wallet address. Keep in mind that it’s a stablecoin that makes it easy to carry out smooth transactions within the world of cryptocurrencies. Discover the capabilities of these coins and manage your digital assets with confidence.

How to get Tether (USDT) and transfer immediately?

Explore well-known platforms where you can trade Tether (USDT), sign up for an account, confirm your identity, and protect your digital assets. Buy USDT using regular money or different cryptocurrencies. Move coins to your chosen wallet or exchange. Begin trading, investing, or using the token for different blockchain transactions.

How do I cash out USDT?

If you want to convert your Tether (USDT) into real money or other cryptocurrencies, here’s what you need to do:

- Learn how to turn crypto into regular money or other digital currencies.

- Find cryptocurrency exchanges that allow you to withdraw USDT.

- Think about various ways to cash out, such as trading directly with others or using crypto ATMs.

- Keep in mind the fees and how the market’s value can change.

- Make sure your money stays safe and secure.

Tether’s Position in the Cryptocurrency Market

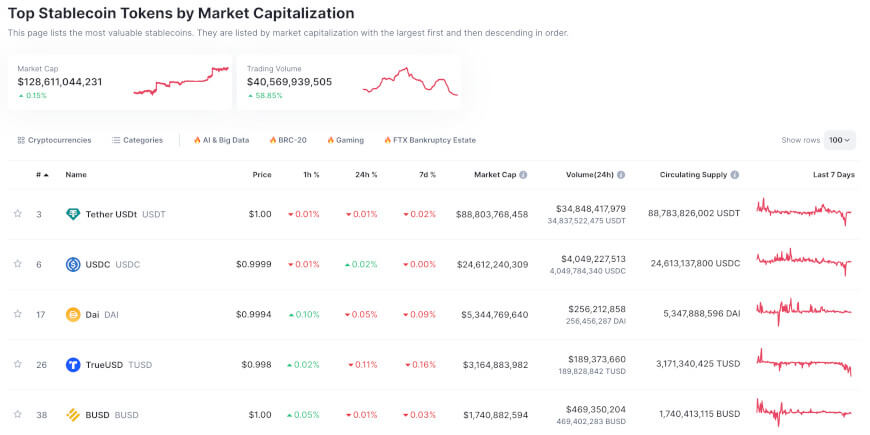

Tether is the top stablecoin in the world of cryptocurrency, and it has managed to stay ahead of its stablecoin competitors by achieving significant market capitalization and valuation. Many traders and investors find this crypto attractive because it maintains a stable value that is tied to traditional currencies. Additionally, its easy availability on various cryptocurrency exchanges has helped it maintain its dominance in the market.

Tether is also committed to being transparent, as evidenced by its reserves, audits, and regular reports, which increase trust and confidence in the cryptocurrency market. In a volatile crypto market, it acts as a reliable digital asset, and it plays a crucial role in crypto trading. Its strong market presence and unique features have kept its position secure.

How USDT Compares to Other Stablecoins

Tether has become the most popular stablecoin, outperforming others like USDC, BUSD, and DAI. One important thing that makes USDT stand out is how transparent it is. Unlike some other stablecoins, it regularly has its reserves checked by auditors, which gives users more confidence in it.

USDT is also well-liked by traders because it’s easy to buy and sell, has a big market value, and is widely accepted. But remember, each stablecoin has its own special features, like what they’re backed by, how they’re created, and the rules they follow. The stablecoin world is always changing, with new tokens that bring new ideas and benefits. One example is TerraUSD (UST), which got a lot of attention in 2022 because of how it affected the cryptocurrency market.

USDT vs USDС (USD Coin)

USDT and USDC are two well-known stablecoins in the world of cryptocurrency. These digital currencies are designed to always have a value equal to one US dollar. Although they share this primary objective, there might be variations in the way they are backed and how transparent they are about their reserves.

Both USDT and USDC are chosen by many traders because they help maintain a steady price, which is especially important in the unpredictable cryptocurrency market. Moreover, these stablecoins are readily available and widely used, which makes them popular among cryptocurrency enthusiasts.

These two stablecoin options are created to meet the diverse needs and preferences of cryptocurrency users. In summary, USDT and USDC serve crucial roles in the crypto ecosystem by providing stability and trustworthiness in contrast to the price fluctuations of other digital tokens.

USDT vs BUSD

USDT and BUSD are types of stablecoins designed to keep their prices stable. These stablecoins are quite popular and widely used in the market. Many traders find them attractive because they can meet the demands of the market effectively. Although both USDT and BUSD aim to provide price stability in the cryptocurrency world, they may have differences when it comes to the assets backing them and how transparent they are about these reserves.

It’s important to take these factors into account when deciding between the two options. By comparing USDT and BUSD, traders can make well-informed choices based on their own preferences and knowledge of the market. Both stablecoins play a vital role in ensuring stability and trustworthiness in the cryptocurrency ecosystem.

Is USDT a Competitor to Bitcoin and Ethereum?

USDT, Bitcoin (BTC), and Ethereum (ETH) have distinct roles in the world of cryptocurrency. Bitcoin and Ethereum are famous for their price fluctuations and advanced blockchain technology. On the other hand, USDT serves a unique function as a stablecoin. Its worth is linked to conventional currencies, ensuring a steady value and acting as a link between cryptocurrencies and regular money. These three cryptocurrencies can peacefully coexist, each serving its own purpose in the market.

The Advantages and Disadvantages of Tether

Tether is a popular choice in the world of cryptocurrencies for several good reasons. First, it offers stability in its price because it’s tied to traditional fiat currencies. This means you don’t have to worry as much about big price swings when you use this token. Second, USDT is easy to buy, sell, and trade because it’s widely accepted and has a lot of people using it. Plus, it makes an effort to be transparent and trustworthy by getting regular audits.

However, there are some things to be cautious about. Government agencies like the New York Attorney General keep a close eye on Tether, which could lead to regulatory issues. And, like any investment, there are always some risks involved when you deal with cryptocurrencies. It’s important to carefully think about these pros and cons before you decide to use this crypto, especially since the cryptocurrency market is always changing and influenced by many different factors.

Share this Image on Your Site:

The Benefits of Using Tether (USDT)

We know now what is Tether USDT. Its value is always equal to the US dollar, which means you can count on it to stay steady even when other cryptocurrencies are bouncing around. This stability makes it a smart choice for traders and investors.

One of the great things about USDT is how easy it is to use. It lets you make fast and smooth transactions in the crypto world, thanks to its wide availability on different blockchain platforms, exchanges, and wallets.

Tether is also big on transparency. They regularly share reports about their reserves and get audits done, which helps everyone trust that they’re doing things right.

Overall, USDT acts like a bridge between regular money (like the U.S. dollar) and digital currencies. This makes it simpler for people to trade and use cryptocurrencies, opening up lots of exciting possibilities for those who are into crypto.

Are there any Risks Associated with Tether (USDT)?

There are some important things to consider when you know what is Tether USDT and now want to use it. Before you decide to invest in it, you should take a close look at how the market can change rapidly. It’s also a good idea to know what assets support this cryptocurrency and to keep yourself updated on any new rules or trends in the market.

To lower the risks associated with USDT, you can spread your investments across different cryptocurrencies. This way, you can be better prepared for any ups and downs in the market.

How to Mine / Stake USDT?

Tether (USDT) is different from most cryptocurrencies because it can’t be mined or staked. Instead, you can get this crypto by buying or trading it on special websites for digital money. Unlike regular cryptocurrencies, USDT tokens aren’t made by mining.

Is Tether a Good Investment?

Before adding Tether to your crypto investments, think about what is Tether USDT and how the market can change quickly, how easy it is to buy and sell, and the money that backs it up. Think about the good and bad things that might happen if you invest in it.

Talk to experts who know about money and investing for advice. Keep an eye on the latest news about the market and any new rules. Look at what you want to achieve with your investments, how much risk you can handle, and what’s happening in the market before deciding to invest in this cryptocurrency.

Conclusion

So, what is Tether USDT in simple terms? It’s the top stablecoin available, designed to make cryptocurrency easy and steady for users like you. It has some special features and always stays equal to one U.S. dollar, which makes it a reliable digital currency. If you want to use it, whether for transactions, picking a wallet, or understanding its place in the cryptocurrency world, you should think about the good and not-so-good parts. This crypto is fast and easy to use, but there are also risks to think about.

Whether or not you should invest in it depends on what you want and how much risk you can handle. To keep up with the latest news in the crypto world and make smart choices for your money, check out trustworthy websites that offer Tether and get information from sources you can trust.

Don’t miss out on the opportunity to learn from the Swiss experts in blockchain and cryptocurrency. Reach out to iMi Blockchain today!

Learn Cryptocurrency!

Crypto Training in Small Classes

Webinars about Cryptocurrencies

Crypto Courses at University Level

Get our Top Crypto Tips!

Get monthly tips on Crypto investments.

On top, you’ll get our free Blockchain beginners course. Learn how this technology will change our lives.

FAQ

Can You Trust Tether?

Tether is a stable and trusted cryptocurrency that many traders prefer. It’s known for its transparency, strong market value, and easy access. It stays stable because it’s backed by assets like cash. Plus, it follows the rules, which makes it even more reliable.

What Is USDT Backed by?

Tether is a stablecoin that’s backed by cash equivalents, which helps keep its value stable. The company Tether Limited makes sure to regularly check and show its reserves, which are assets like real money, to prove that USDT is trustworthy and reliable.

Is Tether always $1?

Tether’s USDT stablecoin aims to always be worth one dollar by using market strategies and reserves. They work hard to keep its value stable, so it doesn’t change much.

How does Tether make money?

Tether makes money in different ways. It earns interest on the money it holds, which adds to its value and brings in money. They also make money from their investments and fees charged to crypto exchanges that use USDT. Its worth keeps growing because more people want it, use it, and trade it, which adds to its income.

Which Site is Best to Get Tether (USDT)?

If you’re interested in getting Tether, here are some important things to consider: market cap, trading volume, fees, security, and reputation. You should also check user reviews, liquidity, available trading options, how transparent the stablecoin is if it follows regulations, and the quality of customer support. Make sure to pick an exchange that matches what you’re looking for.